Quantbot Technologies LP purchased a new position in shares of Ashland Inc. (NYSE:ASH - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund purchased 68,179 shares of the basic materials company's stock, valued at approximately $5,930,000. Quantbot Technologies LP owned about 0.14% of Ashland as of its most recent SEC filing.

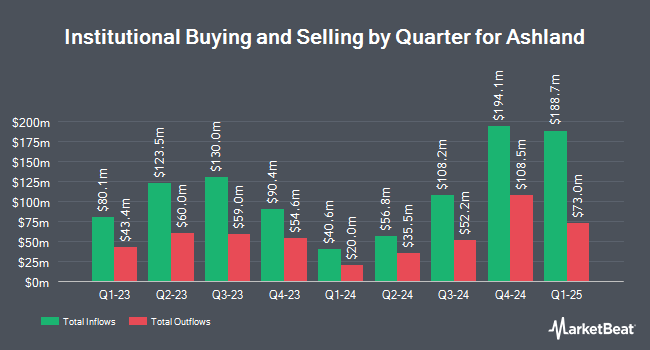

Other hedge funds and other institutional investors have also made changes to their positions in the company. SG Americas Securities LLC purchased a new stake in shares of Ashland in the second quarter valued at $713,000. 1832 Asset Management L.P. lifted its holdings in shares of Ashland by 2.3% during the 2nd quarter. 1832 Asset Management L.P. now owns 671,948 shares of the basic materials company's stock worth $63,492,000 after acquiring an additional 14,938 shares during the period. Boston Partners boosted its position in shares of Ashland by 33.0% in the first quarter. Boston Partners now owns 429,220 shares of the basic materials company's stock worth $41,727,000 after acquiring an additional 106,417 shares during the last quarter. Lighthouse Investment Partners LLC acquired a new stake in shares of Ashland during the 2nd quarter worth $2,442,000. Finally, Tidal Investments LLC raised its position in shares of Ashland by 400.3% in the 1st quarter. Tidal Investments LLC now owns 15,891 shares of the basic materials company's stock worth $1,547,000 after buying an additional 12,715 shares during the period. Institutional investors and hedge funds own 93.95% of the company's stock.

Ashland Stock Up 0.5 %

ASH stock traded up $0.38 during trading on Wednesday, reaching $78.35. The stock had a trading volume of 58,474 shares, compared to its average volume of 418,998. The company has a current ratio of 2.44, a quick ratio of 1.33 and a debt-to-equity ratio of 0.47. The firm has a fifty day moving average price of $83.87 and a 200 day moving average price of $89.91. The company has a market capitalization of $3.69 billion, a P/E ratio of 23.31, a PEG ratio of 1.15 and a beta of 0.88. Ashland Inc. has a 1-year low of $75.04 and a 1-year high of $102.50.

Ashland (NYSE:ASH - Get Free Report) last released its quarterly earnings results on Wednesday, November 6th. The basic materials company reported $1.26 EPS for the quarter, missing the consensus estimate of $1.28 by ($0.02). Ashland had a return on equity of 7.43% and a net margin of 7.95%. The business had revenue of $522.00 million during the quarter, compared to analyst estimates of $524.07 million. During the same quarter last year, the firm posted $0.41 EPS. The company's revenue was up .8% compared to the same quarter last year. On average, equities analysts anticipate that Ashland Inc. will post 4.82 earnings per share for the current year.

Ashland Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Sunday, December 15th. Stockholders of record on Sunday, December 1st will be given a dividend of $0.405 per share. This represents a $1.62 dividend on an annualized basis and a dividend yield of 2.07%. The ex-dividend date of this dividend is Friday, November 29th. Ashland's payout ratio is currently 48.36%.

Insider Buying and Selling

In related news, SVP Robin E. Lampkin sold 868 shares of Ashland stock in a transaction dated Friday, November 15th. The stock was sold at an average price of $77.90, for a total value of $67,617.20. Following the completion of the transaction, the senior vice president now directly owns 2,883 shares in the company, valued at approximately $224,585.70. This trade represents a 23.14 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Insiders own 0.69% of the company's stock.

Wall Street Analyst Weigh In

Several brokerages have commented on ASH. Wells Fargo & Company dropped their price target on Ashland from $112.00 to $100.00 and set an "overweight" rating for the company in a research note on Thursday, August 8th. StockNews.com lowered shares of Ashland from a "buy" rating to a "hold" rating in a report on Friday, September 13th. UBS Group decreased their price objective on shares of Ashland from $116.00 to $107.00 and set a "buy" rating for the company in a research note on Thursday, August 15th. BMO Capital Markets cut their target price on shares of Ashland from $92.00 to $83.00 and set a "market perform" rating on the stock in a research note on Tuesday, November 19th. Finally, JPMorgan Chase & Co. upgraded Ashland from an "underweight" rating to a "neutral" rating and lowered their price target for the company from $90.00 to $89.00 in a report on Thursday, August 8th. Three analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. According to MarketBeat, Ashland presently has a consensus rating of "Moderate Buy" and a consensus price target of $103.29.

Check Out Our Latest Stock Report on Ashland

Ashland Company Profile

(

Free Report)

Ashland Inc provides additives and specialty ingredients in the North and Latin America, Europe, Asia Pacific, and internationally. It operates through Life Sciences, Personal Care, Specialty Additives, and Intermediates segments. The Life Sciences segment offers pharmaceutical solutions, including controlled release polymers, disintegrants, tablet coatings, thickeners, solubilizers, and tablet binders; nutrition solutions, such as thickeners, stabilizers, emulsifiers, and additives; and nutraceutical solutions comprising products for weight management, joint comfort, stomach and intestinal health, sports nutrition, and general wellness, as well as custom formulation, toll processing, and particle engineering solutions.

Read More

Before you consider Ashland, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ashland wasn't on the list.

While Ashland currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.