Quantbot Technologies LP purchased a new position in Horace Mann Educators Co. (NYSE:HMN - Free Report) in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm purchased 16,011 shares of the insurance provider's stock, valued at approximately $560,000.

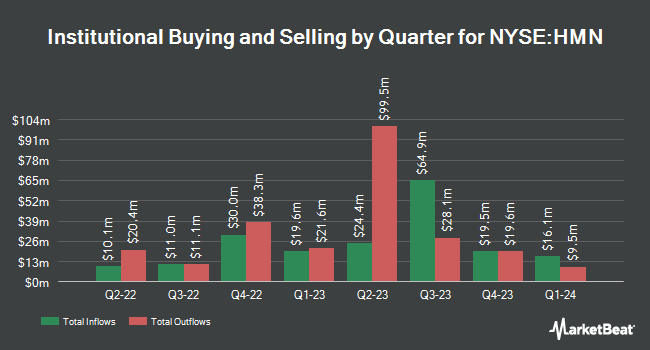

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Harbor Capital Advisors Inc. lifted its position in Horace Mann Educators by 270.1% in the second quarter. Harbor Capital Advisors Inc. now owns 22,305 shares of the insurance provider's stock worth $728,000 after buying an additional 16,278 shares during the last quarter. Principal Financial Group Inc. boosted its position in shares of Horace Mann Educators by 10.6% during the third quarter. Principal Financial Group Inc. now owns 223,512 shares of the insurance provider's stock valued at $7,812,000 after buying an additional 21,430 shares during the period. DekaBank Deutsche Girozentrale purchased a new position in shares of Horace Mann Educators during the second quarter valued at approximately $636,000. Cornercap Investment Counsel Inc. purchased a new stake in shares of Horace Mann Educators in the second quarter worth approximately $508,000. Finally, Hantz Financial Services Inc. bought a new stake in shares of Horace Mann Educators during the 2nd quarter worth approximately $2,037,000. 99.28% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several equities analysts have commented on the company. Keefe, Bruyette & Woods downgraded Horace Mann Educators from an "outperform" rating to a "market perform" rating and upped their price objective for the company from $39.00 to $44.00 in a research report on Tuesday, November 12th. Raymond James began coverage on shares of Horace Mann Educators in a report on Tuesday, August 6th. They set a "strong-buy" rating and a $42.00 price objective on the stock. Finally, Piper Sandler upped their target price on Horace Mann Educators from $36.00 to $42.00 and gave the stock a "neutral" rating in a report on Wednesday, November 6th. Four equities research analysts have rated the stock with a hold rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $42.67.

View Our Latest Stock Report on Horace Mann Educators

Horace Mann Educators Stock Down 0.3 %

HMN traded down $0.13 during trading on Tuesday, hitting $40.99. The stock had a trading volume of 50,263 shares, compared to its average volume of 240,808. The stock has a 50 day simple moving average of $38.17 and a two-hundred day simple moving average of $35.41. The company has a debt-to-equity ratio of 0.42, a quick ratio of 0.09 and a current ratio of 0.09. Horace Mann Educators Co. has a twelve month low of $31.81 and a twelve month high of $43.26. The company has a market capitalization of $1.67 billion, a PE ratio of 16.20 and a beta of 0.30.

Horace Mann Educators (NYSE:HMN - Get Free Report) last posted its quarterly earnings data on Monday, November 4th. The insurance provider reported $0.76 earnings per share for the quarter, topping analysts' consensus estimates of $0.72 by $0.04. Horace Mann Educators had a return on equity of 8.14% and a net margin of 6.55%. The firm had revenue of $412.10 million during the quarter, compared to analysts' expectations of $293.87 million. During the same quarter last year, the firm earned $0.44 EPS. The business's quarterly revenue was up 8.8% on a year-over-year basis. On average, research analysts predict that Horace Mann Educators Co. will post 2.61 earnings per share for the current year.

Insiders Place Their Bets

In related news, Director Beverley J. Mcclure sold 5,634 shares of the stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $42.08, for a total value of $237,078.72. Following the transaction, the director now owns 19,057 shares in the company, valued at approximately $801,918.56. This represents a 22.82 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO Marita Zuraitis sold 4,000 shares of Horace Mann Educators stock in a transaction that occurred on Friday, November 1st. The shares were sold at an average price of $37.24, for a total transaction of $148,960.00. Following the sale, the chief executive officer now owns 292,336 shares of the company's stock, valued at approximately $10,886,592.64. The trade was a 1.35 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders sold 51,751 shares of company stock valued at $1,946,895. Insiders own 3.80% of the company's stock.

Horace Mann Educators Company Profile

(

Free Report)

Horace Mann Educators Corporation, together with its subsidiaries, operates as an insurance holding company in the United States. The company operates through Property & Casualty, Life & Retirement, and Supplemental & Group Benefits segments. Its Property & Casualty segment offers insurance products, including private passenger auto insurance, residential home insurance, and personal umbrella insurance; and provides auto coverages including liability and collision, and property coverage for homeowners and renters.

Featured Articles

Before you consider Horace Mann Educators, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Horace Mann Educators wasn't on the list.

While Horace Mann Educators currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.