Quantbot Technologies LP grew its stake in shares of Perella Weinberg Partners (NASDAQ:PWP - Free Report) by 358.4% during the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 37,516 shares of the company's stock after purchasing an additional 29,332 shares during the quarter. Quantbot Technologies LP's holdings in Perella Weinberg Partners were worth $724,000 at the end of the most recent quarter.

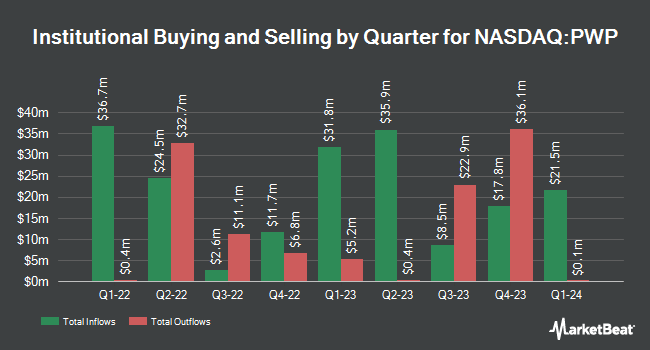

Other institutional investors and hedge funds also recently made changes to their positions in the company. Zurcher Kantonalbank Zurich Cantonalbank lifted its position in shares of Perella Weinberg Partners by 122.7% in the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 9,763 shares of the company's stock valued at $159,000 after buying an additional 5,379 shares during the last quarter. Intech Investment Management LLC acquired a new stake in Perella Weinberg Partners during the 3rd quarter valued at $197,000. Price T Rowe Associates Inc. MD boosted its position in Perella Weinberg Partners by 16.6% during the first quarter. Price T Rowe Associates Inc. MD now owns 12,306 shares of the company's stock worth $174,000 after purchasing an additional 1,753 shares during the period. Arizona State Retirement System increased its holdings in shares of Perella Weinberg Partners by 15.3% in the second quarter. Arizona State Retirement System now owns 13,020 shares of the company's stock valued at $212,000 after purchasing an additional 1,724 shares during the last quarter. Finally, Oppenheimer Asset Management Inc. raised its position in shares of Perella Weinberg Partners by 17.9% in the second quarter. Oppenheimer Asset Management Inc. now owns 16,709 shares of the company's stock valued at $272,000 after purchasing an additional 2,537 shares during the period. Institutional investors own 41.07% of the company's stock.

Insider Activity at Perella Weinberg Partners

In related news, President Dietrich Becker sold 442,889 shares of Perella Weinberg Partners stock in a transaction on Tuesday, November 12th. The shares were sold at an average price of $24.48, for a total transaction of $10,841,922.72. Following the completion of the transaction, the president now owns 379,140 shares of the company's stock, valued at $9,281,347.20. This trade represents a 53.88 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Andrew Bednar sold 300,579 shares of the company's stock in a transaction on Tuesday, November 12th. The shares were sold at an average price of $24.48, for a total transaction of $7,358,173.92. Following the sale, the chief executive officer now directly owns 566,386 shares in the company, valued at $13,865,129.28. This trade represents a 34.67 % decrease in their position. The disclosure for this sale can be found here. 43.53% of the stock is owned by company insiders.

Perella Weinberg Partners Stock Performance

Shares of NASDAQ:PWP traded down $0.30 during trading on Tuesday, reaching $25.49. 240,307 shares of the company traded hands, compared to its average volume of 434,498. Perella Weinberg Partners has a 52 week low of $10.73 and a 52 week high of $26.62. The company's 50 day moving average is $22.22 and its two-hundred day moving average is $18.91.

Perella Weinberg Partners (NASDAQ:PWP - Get Free Report) last released its earnings results on Friday, November 8th. The company reported $0.34 EPS for the quarter, beating the consensus estimate of $0.20 by $0.14. Perella Weinberg Partners had a negative net margin of 11.09% and a negative return on equity of 295.65%. The firm had revenue of $278.20 million for the quarter, compared to analyst estimates of $196.42 million. During the same period last year, the firm earned $0.12 EPS. The business's quarterly revenue was up 100.1% compared to the same quarter last year.

Perella Weinberg Partners Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, December 18th. Stockholders of record on Wednesday, December 4th will be paid a $0.07 dividend. This represents a $0.28 annualized dividend and a dividend yield of 1.10%. The ex-dividend date of this dividend is Wednesday, December 4th. Perella Weinberg Partners's dividend payout ratio is currently -11.81%.

Analysts Set New Price Targets

Separately, JMP Securities increased their price target on shares of Perella Weinberg Partners from $22.00 to $26.00 and gave the company a "market outperform" rating in a report on Wednesday, October 9th.

Read Our Latest Stock Report on PWP

Perella Weinberg Partners Profile

(

Free Report)

Perella Weinberg Partners, an independent investment banking company, provides strategic and financial advice services in the United States and internationally. The company offers advisory services related to strategic and financial decisions, mergers and acquisition execution, shareholder and defense advisory, and financing and capital solutions advice with resources focused on restructuring, liability management, and capital markets advisory, as well as underwriting and research services primarily for the energy and related industries.

Featured Articles

Before you consider Perella Weinberg Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Perella Weinberg Partners wasn't on the list.

While Perella Weinberg Partners currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.