Quantbot Technologies LP bought a new position in Rambus Inc. (NASDAQ:RMBS - Free Report) during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm bought 29,659 shares of the semiconductor company's stock, valued at approximately $1,252,000.

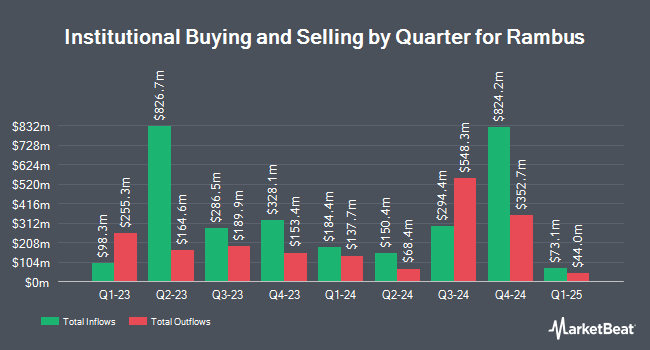

Several other institutional investors and hedge funds have also made changes to their positions in RMBS. Assenagon Asset Management S.A. boosted its holdings in shares of Rambus by 386.3% in the second quarter. Assenagon Asset Management S.A. now owns 288,363 shares of the semiconductor company's stock valued at $16,944,000 after purchasing an additional 229,066 shares during the period. Vaughan Nelson Investment Management L.P. lifted its holdings in shares of Rambus by 32.3% in the 3rd quarter. Vaughan Nelson Investment Management L.P. now owns 1,462,932 shares of the semiconductor company's stock worth $61,765,000 after buying an additional 357,160 shares during the period. Swedbank AB grew its position in shares of Rambus by 56.1% during the 2nd quarter. Swedbank AB now owns 1,549,850 shares of the semiconductor company's stock worth $91,069,000 after buying an additional 556,850 shares in the last quarter. Harbor Capital Advisors Inc. increased its stake in shares of Rambus by 559.4% during the second quarter. Harbor Capital Advisors Inc. now owns 18,939 shares of the semiconductor company's stock valued at $1,113,000 after buying an additional 16,067 shares during the period. Finally, Dynamic Technology Lab Private Ltd purchased a new stake in Rambus in the third quarter worth about $2,077,000. 88.54% of the stock is currently owned by institutional investors.

Rambus Trading Up 1.2 %

Shares of RMBS stock traded up $0.69 during trading hours on Friday, reaching $57.81. 574,108 shares of the company's stock were exchanged, compared to its average volume of 945,433. Rambus Inc. has a fifty-two week low of $37.42 and a fifty-two week high of $76.38. The stock's 50 day moving average is $47.52 and its 200-day moving average is $50.31. The company has a market cap of $6.16 billion, a price-to-earnings ratio of 35.91 and a beta of 1.17.

Wall Street Analysts Forecast Growth

A number of research analysts have commented on the stock. Baird R W raised shares of Rambus to a "strong-buy" rating in a research report on Monday, November 25th. Rosenblatt Securities reissued a "buy" rating and set a $85.00 price objective on shares of Rambus in a report on Tuesday, October 29th. Wells Fargo & Company assumed coverage on Rambus in a report on Wednesday, November 6th. They set an "overweight" rating and a $62.00 target price for the company. Robert W. Baird started coverage on Rambus in a report on Monday, November 25th. They issued an "outperform" rating and a $90.00 price target on the stock. Finally, Loop Capital began coverage on Rambus in a research note on Monday, November 11th. They set a "buy" rating and a $70.00 price objective for the company. Six research analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, the company currently has an average rating of "Buy" and an average target price of $74.67.

Check Out Our Latest Analysis on RMBS

About Rambus

(

Free Report)

Rambus Inc provides semiconductor products in the United States, South Korea, Singapore, and internationally. The company offers DDR memory interface chips, including DDR5 and DDR4 memory interface chips to module manufacturers, OEMs, and hyperscalers; silicon IP, such as interface and security IP solutions that move and protect data in advanced data center, government, and automotive applications; and interface IP solutions for high-speed memory and chip-to-chip digital controller IP.

Featured Articles

Before you consider Rambus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rambus wasn't on the list.

While Rambus currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.