Quantbot Technologies LP trimmed its holdings in shares of InterDigital, Inc. (NASDAQ:IDCC - Free Report) by 95.1% in the third quarter, according to its most recent filing with the SEC. The firm owned 734 shares of the Wireless communications provider's stock after selling 14,399 shares during the period. Quantbot Technologies LP's holdings in InterDigital were worth $104,000 as of its most recent filing with the SEC.

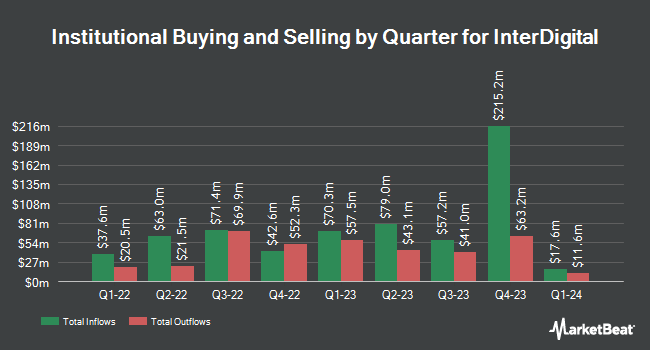

Other institutional investors have also made changes to their positions in the company. Natixis Advisors LLC bought a new stake in InterDigital in the third quarter valued at $1,427,000. Ritholtz Wealth Management increased its position in shares of InterDigital by 16.1% during the 3rd quarter. Ritholtz Wealth Management now owns 24,322 shares of the Wireless communications provider's stock worth $3,445,000 after purchasing an additional 3,381 shares in the last quarter. Olympiad Research LP bought a new position in InterDigital during the 3rd quarter valued at about $475,000. Wealth Enhancement Advisory Services LLC acquired a new position in InterDigital in the third quarter valued at about $568,000. Finally, Capital CS Group LLC bought a new stake in InterDigital during the third quarter worth about $502,000. 99.83% of the stock is currently owned by institutional investors and hedge funds.

InterDigital Trading Up 1.9 %

Shares of NASDAQ:IDCC traded up $3.72 during trading on Friday, hitting $196.83. 263,782 shares of the company's stock were exchanged, compared to its average volume of 320,971. The company has a current ratio of 1.62, a quick ratio of 1.62 and a debt-to-equity ratio of 0.03. The firm has a market cap of $4.99 billion, a P/E ratio of 21.03, a PEG ratio of 0.84 and a beta of 1.44. The firm has a 50-day moving average price of $168.71 and a two-hundred day moving average price of $140.80. InterDigital, Inc. has a 1-year low of $95.33 and a 1-year high of $203.90.

InterDigital Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, January 22nd. Shareholders of record on Wednesday, January 8th will be given a dividend of $0.45 per share. This represents a $1.80 annualized dividend and a dividend yield of 0.91%. The ex-dividend date of this dividend is Wednesday, January 8th. InterDigital's payout ratio is 19.23%.

Insider Activity

In related news, insider Joshua D. Schmidt sold 140 shares of the stock in a transaction that occurred on Tuesday, November 19th. The shares were sold at an average price of $182.19, for a total value of $25,506.60. Following the sale, the insider now directly owns 24,138 shares in the company, valued at $4,397,702.22. This trade represents a 0.58 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, Director John A. Kritzmacher sold 2,500 shares of the business's stock in a transaction that occurred on Friday, September 20th. The shares were sold at an average price of $138.72, for a total transaction of $346,800.00. Following the transaction, the director now owns 20,279 shares of the company's stock, valued at approximately $2,813,102.88. This represents a 10.98 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 3,340 shares of company stock valued at $472,253 in the last 90 days. 2.30% of the stock is owned by company insiders.

Analyst Upgrades and Downgrades

Several analysts have recently commented on the company. StockNews.com cut InterDigital from a "buy" rating to a "hold" rating in a report on Monday, November 4th. Roth Mkm increased their price objective on shares of InterDigital from $146.00 to $160.00 and gave the stock a "buy" rating in a report on Wednesday, September 11th.

View Our Latest Stock Report on IDCC

InterDigital Company Profile

(

Free Report)

InterDigital, Inc operates as a global research and development company with focus primarily on wireless, visual, artificial intelligence (AI), and related technologies. The company engages in the design and development of technologies that enable connected in a range of communications and entertainment products and services, which are licensed to companies providing such products and services, including makers of wireless communications, consumer electronics, IoT devices, and cars and other motor vehicles, as well as providers of cloud-based services, such as video streaming.

See Also

Before you consider InterDigital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and InterDigital wasn't on the list.

While InterDigital currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.