Quantbot Technologies LP trimmed its position in shares of NXP Semiconductors (NASDAQ:NXPI - Free Report) by 84.0% during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 4,581 shares of the semiconductor provider's stock after selling 24,006 shares during the quarter. Quantbot Technologies LP's holdings in NXP Semiconductors were worth $952,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

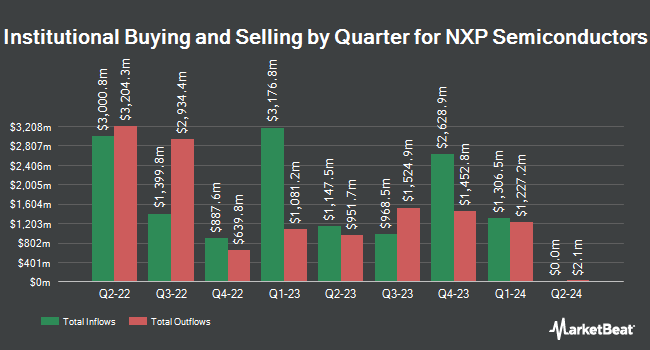

Several other institutional investors have also recently made changes to their positions in NXPI. ORG Wealth Partners LLC grew its position in NXP Semiconductors by 915.4% in the 4th quarter. ORG Wealth Partners LLC now owns 132 shares of the semiconductor provider's stock worth $27,000 after purchasing an additional 119 shares in the last quarter. Sound Income Strategies LLC boosted its stake in shares of NXP Semiconductors by 169.2% in the 4th quarter. Sound Income Strategies LLC now owns 140 shares of the semiconductor provider's stock worth $29,000 after buying an additional 88 shares during the last quarter. Smithfield Trust Co bought a new position in shares of NXP Semiconductors in the fourth quarter valued at approximately $32,000. FSA Wealth Management LLC bought a new stake in NXP Semiconductors during the third quarter worth $33,000. Finally, Brooklyn Investment Group boosted its position in NXP Semiconductors by 69.5% in the fourth quarter. Brooklyn Investment Group now owns 161 shares of the semiconductor provider's stock worth $33,000 after purchasing an additional 66 shares during the last quarter. Institutional investors own 90.54% of the company's stock.

NXP Semiconductors Price Performance

Shares of NASDAQ:NXPI traded down $10.07 during trading on Friday, reaching $189.99. The company had a trading volume of 4,260,658 shares, compared to its average volume of 2,423,696. NXP Semiconductors has a 12 month low of $188.85 and a 12 month high of $296.08. The company has a current ratio of 2.36, a quick ratio of 1.60 and a debt-to-equity ratio of 1.09. The stock has a market capitalization of $48.19 billion, a P/E ratio of 19.53, a price-to-earnings-growth ratio of 3.01 and a beta of 1.47. The company has a fifty day moving average of $214.68 and a two-hundred day moving average of $221.99.

NXP Semiconductors Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, April 9th. Shareholders of record on Wednesday, March 19th will be paid a $1.014 dividend. This represents a $4.06 annualized dividend and a yield of 2.13%. The ex-dividend date of this dividend is Wednesday, March 19th. NXP Semiconductors's dividend payout ratio is currently 41.62%.

Analysts Set New Price Targets

A number of research firms have recently commented on NXPI. Needham & Company LLC lowered their target price on NXP Semiconductors from $250.00 to $230.00 and set a "buy" rating on the stock in a research note on Wednesday, February 5th. The Goldman Sachs Group reissued a "buy" rating on shares of NXP Semiconductors in a research report on Tuesday, February 4th. Stifel Nicolaus lowered their price target on shares of NXP Semiconductors from $231.00 to $210.00 and set a "hold" rating on the stock in a report on Wednesday, February 5th. Susquehanna reduced their price objective on NXP Semiconductors from $235.00 to $225.00 and set a "neutral" rating for the company in a report on Wednesday, February 5th. Finally, StockNews.com lowered NXP Semiconductors from a "buy" rating to a "hold" rating in a research note on Wednesday, January 29th. Four investment analysts have rated the stock with a hold rating, sixteen have given a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat, NXP Semiconductors presently has an average rating of "Moderate Buy" and an average target price of $267.00.

Check Out Our Latest Stock Report on NXPI

Insiders Place Their Bets

In other news, COO Andrew Micallef sold 1,000 shares of NXP Semiconductors stock in a transaction dated Monday, March 17th. The stock was sold at an average price of $204.86, for a total value of $204,860.00. Following the transaction, the chief operating officer now owns 8,828 shares in the company, valued at approximately $1,808,504.08. The trade was a 10.18 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders own 0.11% of the company's stock.

NXP Semiconductors Profile

(

Free Report)

NXP Semiconductors N.V. offers various semiconductor products. The company's product portfolio includes microcontrollers; application processors, including i.MX application processors, and i.MX 8 and 9 family of applications processors; communication processors; wireless connectivity solutions, such as near field communications, ultra-wideband, Bluetooth low-energy, Zigbee, and Wi-Fi and Wi-Fi/Bluetooth integrated SoCs; analog and interface devices; radio frequency power amplifiers; and security controllers, as well as semiconductor-based environmental and inertial sensors, including pressure, inertial, magnetic, and gyroscopic sensors.

Recommended Stories

Before you consider NXP Semiconductors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NXP Semiconductors wasn't on the list.

While NXP Semiconductors currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.