Quantbot Technologies LP decreased its holdings in shares of Atlantica Sustainable Infrastructure plc (NASDAQ:AY - Free Report) by 43.5% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 53,161 shares of the utilities provider's stock after selling 40,899 shares during the quarter. Quantbot Technologies LP's holdings in Atlantica Sustainable Infrastructure were worth $1,168,000 as of its most recent SEC filing.

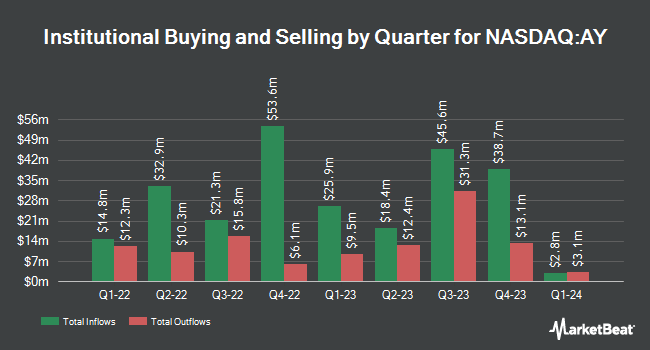

Other hedge funds and other institutional investors have also modified their holdings of the company. Point72 Asia Singapore Pte. Ltd. bought a new stake in Atlantica Sustainable Infrastructure during the second quarter worth approximately $30,000. Private Trust Co. NA lifted its stake in shares of Atlantica Sustainable Infrastructure by 362.1% in the third quarter. Private Trust Co. NA now owns 2,546 shares of the utilities provider's stock worth $56,000 after buying an additional 1,995 shares during the last quarter. Headlands Technologies LLC boosted its holdings in shares of Atlantica Sustainable Infrastructure by 499.4% during the 2nd quarter. Headlands Technologies LLC now owns 4,094 shares of the utilities provider's stock worth $90,000 after buying an additional 3,411 shares during the period. Virtu Financial LLC acquired a new position in Atlantica Sustainable Infrastructure in the 1st quarter valued at $196,000. Finally, Cetera Advisors LLC raised its holdings in Atlantica Sustainable Infrastructure by 58.3% in the 1st quarter. Cetera Advisors LLC now owns 16,775 shares of the utilities provider's stock worth $310,000 after acquiring an additional 6,177 shares during the period. Institutional investors own 40.53% of the company's stock.

Wall Street Analyst Weigh In

Separately, StockNews.com began coverage on Atlantica Sustainable Infrastructure in a report on Saturday. They issued a "sell" rating on the stock. One analyst has rated the stock with a sell rating, five have issued a hold rating and two have given a buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $22.20.

View Our Latest Analysis on AY

Atlantica Sustainable Infrastructure Stock Performance

Shares of AY stock remained flat at $21.94 during trading hours on Friday. The stock had a trading volume of 414,886 shares, compared to its average volume of 1,120,587. Atlantica Sustainable Infrastructure plc has a 52 week low of $16.82 and a 52 week high of $23.47. The company has a debt-to-equity ratio of 3.36, a current ratio of 1.25 and a quick ratio of 1.20. The stock's 50 day moving average is $22.03 and its two-hundred day moving average is $22.09. The company has a market cap of $2.55 billion, a price-to-earnings ratio of 75.66, a price-to-earnings-growth ratio of 2.13 and a beta of 1.03.

Atlantica Sustainable Infrastructure Cuts Dividend

The company also recently declared a quarterly dividend, which will be paid on Thursday, December 12th. Investors of record on Friday, November 29th will be issued a dividend of $0.2225 per share. This represents a $0.89 annualized dividend and a yield of 4.06%. The ex-dividend date is Friday, November 29th. Atlantica Sustainable Infrastructure's dividend payout ratio is currently 613.81%.

Atlantica Sustainable Infrastructure Company Profile

(

Free Report)

Atlantica Sustainable Infrastructure plc owns, manages, and invests in renewable energy, storage, natural gas and heat, electric transmission lines, and water assets in North America, South America, Europe, the Middle East, and Africa. The company was formerly known as Atlantica Yield plc and changed its name to Atlantica Sustainable Infrastructure plc in May 2020.

Featured Articles

Before you consider Atlantica Sustainable Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atlantica Sustainable Infrastructure wasn't on the list.

While Atlantica Sustainable Infrastructure currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.