Quantbot Technologies LP acquired a new position in Ready Capital Co. (NYSE:RC - Free Report) during the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund acquired 131,763 shares of the real estate investment trust's stock, valued at approximately $1,005,000. Quantbot Technologies LP owned 0.08% of Ready Capital at the end of the most recent quarter.

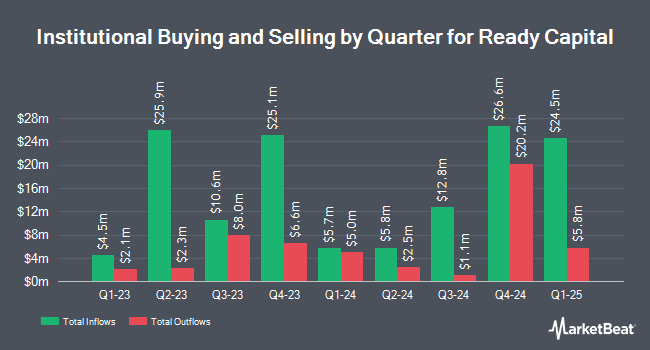

Other hedge funds and other institutional investors also recently modified their holdings of the company. Janus Henderson Group PLC increased its holdings in Ready Capital by 131.0% during the 1st quarter. Janus Henderson Group PLC now owns 168,496 shares of the real estate investment trust's stock valued at $1,539,000 after purchasing an additional 95,562 shares during the period. Clear Harbor Asset Management LLC raised its holdings in shares of Ready Capital by 84.0% during the third quarter. Clear Harbor Asset Management LLC now owns 1,440,250 shares of the real estate investment trust's stock valued at $10,989,000 after acquiring an additional 657,465 shares in the last quarter. Wolverine Asset Management LLC lifted its stake in Ready Capital by 2,902.2% in the third quarter. Wolverine Asset Management LLC now owns 402,291 shares of the real estate investment trust's stock worth $3,069,000 after acquiring an additional 388,891 shares during the period. Spire Wealth Management boosted its holdings in Ready Capital by 1,115.6% in the second quarter. Spire Wealth Management now owns 168,261 shares of the real estate investment trust's stock valued at $1,376,000 after acquiring an additional 154,419 shares in the last quarter. Finally, Intech Investment Management LLC purchased a new stake in shares of Ready Capital in the 3rd quarter worth about $730,000. Institutional investors own 55.87% of the company's stock.

Analyst Ratings Changes

RC has been the topic of a number of research reports. Wedbush restated a "neutral" rating and set a $9.00 target price on shares of Ready Capital in a report on Monday, August 12th. Keefe, Bruyette & Woods lowered their price target on Ready Capital from $8.00 to $7.75 and set an "underperform" rating on the stock in a report on Monday, August 12th. UBS Group reduced their target price on shares of Ready Capital from $8.50 to $7.50 and set a "neutral" rating for the company in a report on Friday, November 15th. Finally, Piper Sandler cut their price objective on shares of Ready Capital from $9.50 to $8.00 and set a "neutral" rating for the company in a research report on Monday, September 16th. One analyst has rated the stock with a sell rating, seven have assigned a hold rating and one has issued a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average price target of $9.04.

View Our Latest Stock Report on Ready Capital

Ready Capital Price Performance

RC stock traded up $0.24 during trading on Monday, reaching $7.61. The company's stock had a trading volume of 1,037,812 shares, compared to its average volume of 1,544,781. The company has a current ratio of 1.67, a quick ratio of 1.67 and a debt-to-equity ratio of 0.54. The company's fifty day moving average is $7.23 and its 200-day moving average is $8.04. Ready Capital Co. has a 1 year low of $6.65 and a 1 year high of $11.67.

Ready Capital Cuts Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, October 31st. Investors of record on Monday, September 30th were paid a $0.25 dividend. The ex-dividend date was Monday, September 30th. This represents a $1.00 annualized dividend and a yield of 13.14%. Ready Capital's dividend payout ratio (DPR) is currently -142.86%.

Ready Capital Company Profile

(

Free Report)

Ready Capital Corporation operates as a real estate finance company in the United States. It operates through two segments: LMM Commercial Real Estate and Small Business Lending. The company originates, acquires, finances, and services lower-to-middle-market (LLM) commercial real estate loans, small business administration (SBA) loans, residential mortgage loans, construction loans, and mortgage-backed securities collateralized primarily by LLM loans, or other real estate-related investments.

Further Reading

Before you consider Ready Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ready Capital wasn't on the list.

While Ready Capital currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.