Quantbot Technologies LP lessened its holdings in shares of ESAB Co. (NYSE:ESAB - Free Report) by 98.3% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 504 shares of the company's stock after selling 28,720 shares during the period. Quantbot Technologies LP's holdings in ESAB were worth $54,000 as of its most recent SEC filing.

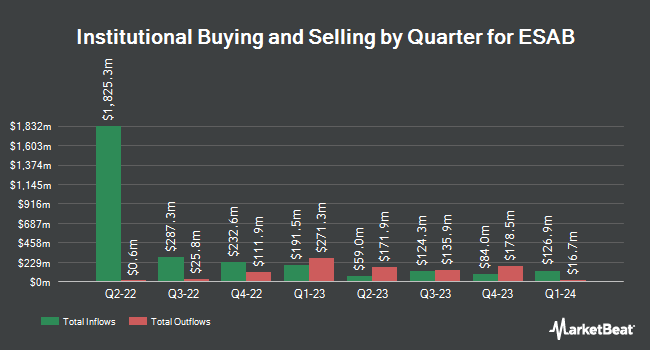

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Cetera Advisors LLC purchased a new stake in shares of ESAB in the first quarter valued at $259,000. Diversified Trust Co grew its stake in shares of ESAB by 117.4% in the second quarter. Diversified Trust Co now owns 8,480 shares of the company's stock valued at $801,000 after buying an additional 4,580 shares in the last quarter. Envestnet Portfolio Solutions Inc. grew its stake in shares of ESAB by 32.3% in the second quarter. Envestnet Portfolio Solutions Inc. now owns 3,599 shares of the company's stock valued at $340,000 after buying an additional 879 shares in the last quarter. Legacy Capital Group California Inc. grew its stake in shares of ESAB by 8.5% in the second quarter. Legacy Capital Group California Inc. now owns 2,139 shares of the company's stock valued at $202,000 after buying an additional 168 shares in the last quarter. Finally, Caldwell Investment Management Ltd. boosted its holdings in ESAB by 168.4% in the second quarter. Caldwell Investment Management Ltd. now owns 10,200 shares of the company's stock valued at $962,000 after purchasing an additional 6,400 shares during the last quarter. Institutional investors and hedge funds own 91.13% of the company's stock.

Insider Activity at ESAB

In other news, CEO Shyam Kambeyanda sold 59,120 shares of ESAB stock in a transaction on Tuesday, October 29th. The stock was sold at an average price of $122.96, for a total transaction of $7,269,395.20. Following the transaction, the chief executive officer now directly owns 53,902 shares in the company, valued at approximately $6,627,789.92. This trade represents a 52.31 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Rhonda L. Jordan sold 4,254 shares of ESAB stock in a transaction on Wednesday, October 30th. The shares were sold at an average price of $125.03, for a total value of $531,877.62. The disclosure for this sale can be found here. Insiders have sold a total of 68,418 shares of company stock worth $8,431,773 in the last three months. 7.00% of the stock is owned by company insiders.

Analysts Set New Price Targets

A number of research firms have commented on ESAB. Loop Capital increased their target price on ESAB from $105.00 to $120.00 and gave the stock a "hold" rating in a report on Wednesday, October 30th. JPMorgan Chase & Co. increased their target price on ESAB from $120.00 to $128.00 and gave the stock an "overweight" rating in a report on Monday, September 30th. Stifel Nicolaus downgraded ESAB from a "buy" rating to a "hold" rating and reduced their target price for the stock from $138.00 to $130.00 in a report on Monday, November 18th. Oppenheimer reaffirmed an "outperform" rating and set a $144.00 target price (up previously from $138.00) on shares of ESAB in a report on Friday, November 8th. Finally, Evercore ISI downgraded ESAB from an "in-line" rating to an "underperform" rating and increased their target price for the stock from $102.00 to $122.00 in a report on Wednesday, November 13th. One investment analyst has rated the stock with a sell rating, two have assigned a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat, the company currently has an average rating of "Hold" and a consensus target price of $129.00.

Read Our Latest Stock Analysis on ESAB

ESAB Stock Performance

Shares of NYSE ESAB traded down $1.91 during mid-day trading on Friday, hitting $128.41. The company had a trading volume of 337,500 shares, compared to its average volume of 264,707. The stock has a market cap of $7.76 billion, a price-to-earnings ratio of 30.07, a PEG ratio of 2.29 and a beta of 1.34. ESAB Co. has a 12 month low of $81.00 and a 12 month high of $135.97. The company has a debt-to-equity ratio of 0.58, a current ratio of 1.92 and a quick ratio of 1.25. The firm's 50 day simple moving average is $119.34 and its two-hundred day simple moving average is $105.77.

ESAB (NYSE:ESAB - Get Free Report) last announced its quarterly earnings results on Tuesday, October 29th. The company reported $1.25 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.12 by $0.13. ESAB had a return on equity of 17.27% and a net margin of 9.47%. The business had revenue of $673.00 million for the quarter, compared to the consensus estimate of $620.50 million. During the same quarter last year, the business posted $1.08 EPS. The business's revenue was down 1.2% on a year-over-year basis. As a group, equities research analysts forecast that ESAB Co. will post 4.94 earnings per share for the current year.

ESAB Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, October 11th. Investors of record on Friday, September 27th were given a $0.08 dividend. This represents a $0.32 annualized dividend and a yield of 0.25%. The ex-dividend date of this dividend was Friday, September 27th. ESAB's dividend payout ratio is currently 7.49%.

About ESAB

(

Free Report)

ESAB Corporation engages in the formulation, development, manufacture, and supply of consumable products and equipment for use in cutting, joining, automated welding, and gas control equipment. Its comprehensive range of welding consumables includes electrodes, cored and solid wires, and fluxes using a range of specialty and other materials; and cutting consumables comprising electrodes, nozzles, shields, and tips.

Further Reading

Before you consider ESAB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ESAB wasn't on the list.

While ESAB currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.