Quantinno Capital Management LP boosted its stake in shares of Jamf Holding Corp. (NASDAQ:JAMF - Free Report) by 97.1% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 292,626 shares of the company's stock after purchasing an additional 144,144 shares during the quarter. Quantinno Capital Management LP owned about 0.23% of Jamf worth $5,077,000 at the end of the most recent reporting period.

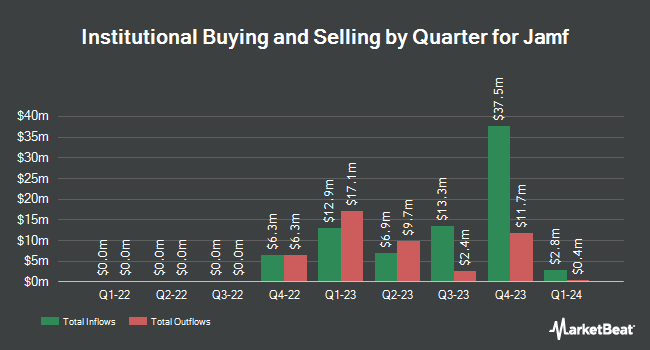

Several other institutional investors and hedge funds have also recently modified their holdings of JAMF. EVR Research LP boosted its holdings in shares of Jamf by 282.9% during the 2nd quarter. EVR Research LP now owns 1,570,000 shares of the company's stock worth $25,905,000 after buying an additional 1,160,000 shares during the period. Marshall Wace LLP boosted its holdings in shares of Jamf by 2,977.5% during the second quarter. Marshall Wace LLP now owns 1,015,770 shares of the company's stock worth $16,760,000 after acquiring an additional 982,764 shares during the period. Principal Financial Group Inc. grew its position in shares of Jamf by 28.2% in the third quarter. Principal Financial Group Inc. now owns 1,394,227 shares of the company's stock valued at $24,190,000 after purchasing an additional 306,558 shares during the last quarter. Crestwood Capital Management L.P. bought a new position in shares of Jamf during the third quarter worth approximately $3,470,000. Finally, Edgestream Partners L.P. acquired a new stake in Jamf during the 2nd quarter worth approximately $2,232,000. 93.81% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of research analysts have commented on the company. Morgan Stanley started coverage on Jamf in a report on Monday, October 14th. They issued an "equal weight" rating and a $20.00 price objective on the stock. The Goldman Sachs Group began coverage on shares of Jamf in a research report on Tuesday, September 3rd. They set a "neutral" rating and a $21.00 price target on the stock. Needham & Company LLC reiterated a "buy" rating and issued a $25.00 price objective on shares of Jamf in a research note on Friday, October 4th. Finally, JMP Securities restated a "market outperform" rating and set a $30.00 target price on shares of Jamf in a research report on Tuesday, October 1st. Three equities research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. According to MarketBeat.com, Jamf has an average rating of "Moderate Buy" and a consensus target price of $22.75.

View Our Latest Analysis on Jamf

Jamf Price Performance

JAMF stock traded down $0.03 during mid-day trading on Friday, hitting $15.42. The stock had a trading volume of 343,650 shares, compared to its average volume of 657,981. The firm has a fifty day simple moving average of $16.10 and a 200 day simple moving average of $16.78. The firm has a market capitalization of $1.97 billion, a P/E ratio of -28.04, a P/E/G ratio of 6.86 and a beta of 0.36. The company has a current ratio of 0.95, a quick ratio of 0.95 and a debt-to-equity ratio of 0.51. Jamf Holding Corp. has a 52 week low of $14.02 and a 52 week high of $21.41.

Insider Buying and Selling

In related news, insider Linh Lam sold 7,702 shares of the company's stock in a transaction on Thursday, October 17th. The stock was sold at an average price of $16.56, for a total transaction of $127,545.12. Following the completion of the sale, the insider now directly owns 187,438 shares in the company, valued at $3,103,973.28. This represents a 3.95 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. 2.30% of the stock is currently owned by company insiders.

Jamf Profile

(

Free Report)

Jamf Holding Corp. offers a cloud software platform for Apple infrastructure and security platform in the Americas, Europe, the Middle East, India, and Africa. Its products include Jamf Pro, an Apple ecosystem management software solution for IT environments; Jamf Now, a pay-as-you-go Apple device management software solution for small-to-medium-sized businesses; Jamf School, an apple mobile device management for schools; and Jamf Connect, a ZTNA solution that replaces legacy conditional access and VPN technology.

Recommended Stories

Before you consider Jamf, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jamf wasn't on the list.

While Jamf currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.