Quantinno Capital Management LP increased its position in Mohawk Industries, Inc. (NYSE:MHK - Free Report) by 36.0% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 31,474 shares of the company's stock after buying an additional 8,327 shares during the quarter. Quantinno Capital Management LP's holdings in Mohawk Industries were worth $5,057,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

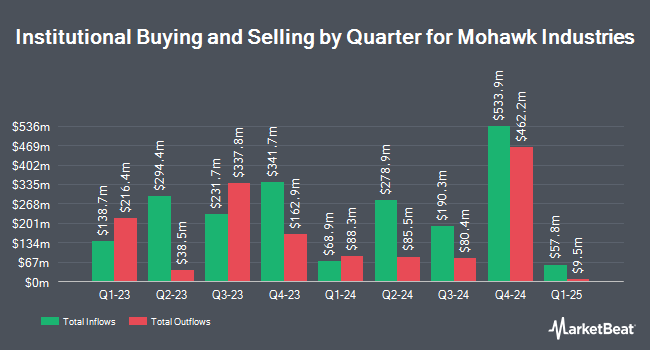

A number of other large investors have also added to or reduced their stakes in the business. Massachusetts Financial Services Co. MA bought a new stake in shares of Mohawk Industries in the second quarter worth $85,997,000. FMR LLC grew its position in shares of Mohawk Industries by 52.3% in the 3rd quarter. FMR LLC now owns 2,179,510 shares of the company's stock valued at $350,204,000 after buying an additional 748,070 shares during the last quarter. Pacer Advisors Inc. increased its stake in shares of Mohawk Industries by 42.9% in the second quarter. Pacer Advisors Inc. now owns 1,200,360 shares of the company's stock valued at $136,349,000 after buying an additional 360,628 shares during the period. Dimensional Fund Advisors LP lifted its stake in shares of Mohawk Industries by 10.7% in the second quarter. Dimensional Fund Advisors LP now owns 3,036,545 shares of the company's stock worth $344,903,000 after acquiring an additional 292,661 shares during the period. Finally, Victory Capital Management Inc. boosted its holdings in Mohawk Industries by 1,464.0% in the second quarter. Victory Capital Management Inc. now owns 227,357 shares of the company's stock valued at $25,825,000 after acquiring an additional 212,820 shares during the last quarter. Institutional investors own 78.98% of the company's stock.

Mohawk Industries Stock Down 0.4 %

Shares of NYSE:MHK traded down $0.51 during midday trading on Friday, hitting $130.92. 1,042,356 shares of the company's stock were exchanged, compared to its average volume of 629,039. The company has a debt-to-equity ratio of 0.22, a current ratio of 2.03 and a quick ratio of 1.09. Mohawk Industries, Inc. has a 12 month low of $90.79 and a 12 month high of $164.29. The company has a market cap of $8.26 billion, a PE ratio of 14.83, a price-to-earnings-growth ratio of 1.45 and a beta of 1.38. The stock has a 50 day moving average price of $145.42 and a 200-day moving average price of $138.39.

Insider Buying and Selling at Mohawk Industries

In other Mohawk Industries news, insider Suzanne L. Helen sold 2,000 shares of Mohawk Industries stock in a transaction on Tuesday, December 3rd. The shares were sold at an average price of $135.48, for a total transaction of $270,960.00. Following the transaction, the insider now directly owns 2,453 shares of the company's stock, valued at $332,332.44. The trade was a 44.91 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Company insiders own 17.10% of the company's stock.

Wall Street Analysts Forecast Growth

MHK has been the subject of several analyst reports. Robert W. Baird upgraded shares of Mohawk Industries from a "neutral" rating to an "overweight" rating and raised their price target for the stock from $160.00 to $196.00 in a report on Monday, October 21st. Wells Fargo & Company raised Mohawk Industries from an "underweight" rating to an "equal weight" rating and lifted their price objective for the stock from $140.00 to $160.00 in a research report on Monday, October 7th. Baird R W raised Mohawk Industries from a "hold" rating to a "strong-buy" rating in a research note on Monday, October 21st. Truist Financial decreased their target price on Mohawk Industries from $184.00 to $155.00 and set a "buy" rating for the company in a research note on Monday, October 28th. Finally, Jefferies Financial Group increased their price target on Mohawk Industries from $150.00 to $160.00 and gave the stock a "hold" rating in a report on Wednesday, October 9th. Five research analysts have rated the stock with a hold rating, seven have issued a buy rating and two have given a strong buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $161.67.

View Our Latest Research Report on MHK

About Mohawk Industries

(

Free Report)

Mohawk Industries, Inc designs, manufactures, sources, distributes, and markets flooring products for residential and commercial remodeling, and new construction channels in the United States, Europe, Latin America, and internationally. It operates through three segments: Global Ceramic, Flooring North America, and Flooring Rest of the World.

Recommended Stories

Before you consider Mohawk Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mohawk Industries wasn't on the list.

While Mohawk Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.