Quantinno Capital Management LP reduced its position in CenterPoint Energy, Inc. (NYSE:CNP - Free Report) by 50.0% during the third quarter, according to its most recent 13F filing with the SEC. The firm owned 18,468 shares of the utilities provider's stock after selling 18,463 shares during the period. Quantinno Capital Management LP's holdings in CenterPoint Energy were worth $543,000 as of its most recent SEC filing.

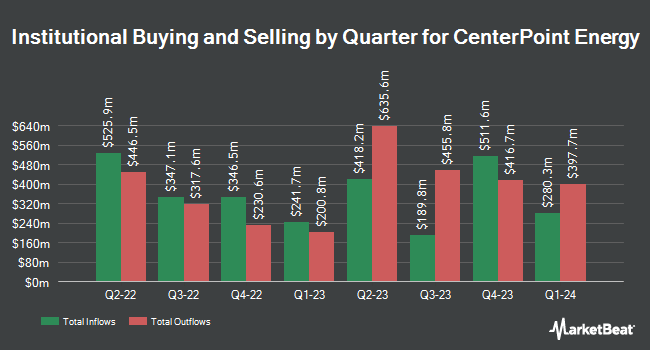

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Rothschild Investment LLC bought a new stake in shares of CenterPoint Energy during the second quarter valued at about $33,000. First Horizon Advisors Inc. increased its position in shares of CenterPoint Energy by 51.3% in the third quarter. First Horizon Advisors Inc. now owns 1,106 shares of the utilities provider's stock worth $33,000 after purchasing an additional 375 shares during the last quarter. Strategic Investment Solutions Inc. IL bought a new position in shares of CenterPoint Energy in the second quarter worth approximately $36,000. Kimelman & Baird LLC bought a new position in shares of CenterPoint Energy in the second quarter worth approximately $43,000. Finally, Blue Trust Inc. increased its position in shares of CenterPoint Energy by 459.0% in the second quarter. Blue Trust Inc. now owns 1,554 shares of the utilities provider's stock worth $44,000 after purchasing an additional 1,276 shares during the last quarter. 91.77% of the stock is currently owned by institutional investors.

CenterPoint Energy Trading Up 0.1 %

Shares of NYSE:CNP traded up $0.03 during trading on Friday, reaching $31.94. 4,760,087 shares of the company traded hands, compared to its average volume of 5,268,520. The firm has a market capitalization of $20.82 billion, a price-to-earnings ratio of 21.15, a P/E/G ratio of 2.72 and a beta of 0.96. CenterPoint Energy, Inc. has a 52-week low of $25.41 and a 52-week high of $33.00. The company has a current ratio of 1.11, a quick ratio of 0.92 and a debt-to-equity ratio of 1.87. The business's fifty day moving average is $30.62 and its 200-day moving average is $29.41.

CenterPoint Energy (NYSE:CNP - Get Free Report) last released its quarterly earnings data on Monday, October 28th. The utilities provider reported $0.31 earnings per share for the quarter, meeting analysts' consensus estimates of $0.31. The firm had revenue of $1.86 billion during the quarter, compared to analyst estimates of $1.88 billion. CenterPoint Energy had a return on equity of 9.73% and a net margin of 11.25%. During the same quarter in the prior year, the firm posted $0.40 earnings per share. As a group, analysts forecast that CenterPoint Energy, Inc. will post 1.62 EPS for the current year.

CenterPoint Energy Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, December 12th. Shareholders of record on Thursday, November 21st were issued a $0.21 dividend. This is an increase from CenterPoint Energy's previous quarterly dividend of $0.20. The ex-dividend date was Thursday, November 21st. This represents a $0.84 dividend on an annualized basis and a yield of 2.63%. CenterPoint Energy's dividend payout ratio is 55.63%.

Analysts Set New Price Targets

CNP has been the topic of several research analyst reports. LADENBURG THALM/SH SH initiated coverage on shares of CenterPoint Energy in a research report on Thursday. They issued a "buy" rating and a $34.50 price objective on the stock. UBS Group upgraded shares of CenterPoint Energy from a "neutral" rating to a "buy" rating and upped their price objective for the stock from $31.00 to $37.00 in a research report on Tuesday, December 3rd. Wells Fargo & Company upped their price objective on shares of CenterPoint Energy from $28.00 to $32.00 and gave the stock an "equal weight" rating in a research report on Wednesday, October 16th. BMO Capital Markets restated a "market perform" rating and issued a $28.00 price objective on shares of CenterPoint Energy in a research report on Monday, August 26th. Finally, Scotiabank raised CenterPoint Energy from a "sector perform" rating to a "sector outperform" rating and upped their target price for the stock from $30.00 to $35.00 in a research note on Thursday. Two equities research analysts have rated the stock with a sell rating, eight have issued a hold rating and four have assigned a buy rating to the stock. Based on data from MarketBeat.com, CenterPoint Energy currently has an average rating of "Hold" and a consensus price target of $31.27.

Read Our Latest Stock Report on CNP

About CenterPoint Energy

(

Free Report)

CenterPoint Energy, Inc operates as a public utility holding company in the United States. The company operates through two segments, Electric and Natural Gas. The Electric segment includes electric transmission and distribution services to electric customers and electric generation assets, as well as optimizes assets in the wholesale power market.

See Also

Before you consider CenterPoint Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CenterPoint Energy wasn't on the list.

While CenterPoint Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.