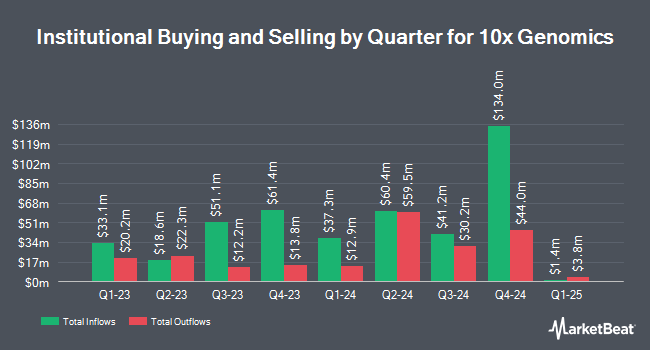

Quantinno Capital Management LP increased its holdings in shares of 10x Genomics, Inc. (NASDAQ:TXG - Free Report) by 380.5% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 235,026 shares of the company's stock after buying an additional 186,111 shares during the quarter. Quantinno Capital Management LP owned 0.19% of 10x Genomics worth $5,307,000 at the end of the most recent reporting period.

Several other large investors have also bought and sold shares of the business. SG Americas Securities LLC boosted its holdings in shares of 10x Genomics by 604.9% during the 2nd quarter. SG Americas Securities LLC now owns 101,344 shares of the company's stock valued at $1,971,000 after acquiring an additional 86,967 shares in the last quarter. SteelPeak Wealth LLC acquired a new stake in shares of 10x Genomics during the second quarter valued at about $413,000. Sumitomo Mitsui Trust Holdings Inc. grew its holdings in shares of 10x Genomics by 69.6% during the second quarter. Sumitomo Mitsui Trust Holdings Inc. now owns 6,143,067 shares of the company's stock worth $119,483,000 after purchasing an additional 2,521,289 shares during the last quarter. First Horizon Advisors Inc. increased its stake in shares of 10x Genomics by 74.1% in the second quarter. First Horizon Advisors Inc. now owns 1,898 shares of the company's stock valued at $37,000 after buying an additional 808 shares during the period. Finally, Slow Capital Inc. raised its holdings in 10x Genomics by 20.2% in the 2nd quarter. Slow Capital Inc. now owns 105,526 shares of the company's stock valued at $2,052,000 after buying an additional 17,761 shares during the last quarter. 84.68% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of equities research analysts have weighed in on TXG shares. Citigroup reduced their target price on shares of 10x Genomics from $35.00 to $23.00 and set a "buy" rating on the stock in a report on Wednesday, October 30th. Morgan Stanley reduced their price objective on shares of 10x Genomics from $50.00 to $46.00 and set an "overweight" rating on the stock in a research note on Tuesday, August 13th. Stephens reaffirmed an "overweight" rating and set a $30.00 target price on shares of 10x Genomics in a research report on Thursday, October 10th. Leerink Partners started coverage on 10x Genomics in a research report on Tuesday, September 3rd. They issued an "outperform" rating and a $35.00 price target on the stock. Finally, JPMorgan Chase & Co. lowered their price objective on 10x Genomics from $20.00 to $14.00 and set a "neutral" rating for the company in a research report on Wednesday, October 30th. One equities research analyst has rated the stock with a sell rating, seven have assigned a hold rating, eight have issued a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $29.19.

Check Out Our Latest Analysis on 10x Genomics

10x Genomics Price Performance

NASDAQ TXG traded up $0.64 during trading hours on Friday, hitting $15.87. The company's stock had a trading volume of 1,301,393 shares, compared to its average volume of 2,022,598. The company's 50-day simple moving average is $16.25 and its two-hundred day simple moving average is $19.23. 10x Genomics, Inc. has a 52 week low of $12.95 and a 52 week high of $57.90.

10x Genomics (NASDAQ:TXG - Get Free Report) last announced its earnings results on Tuesday, October 29th. The company reported ($0.30) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.34) by $0.04. The company had revenue of $151.65 million for the quarter, compared to analysts' expectations of $158.84 million. 10x Genomics had a negative return on equity of 25.07% and a negative net margin of 28.93%. 10x Genomics's quarterly revenue was down 1.3% on a year-over-year basis. During the same quarter in the previous year, the firm earned ($0.51) earnings per share. As a group, research analysts anticipate that 10x Genomics, Inc. will post -1.4 earnings per share for the current fiscal year.

10x Genomics Profile

(

Free Report)

10x Genomics, Inc, a life science technology company, develops and sells instruments, consumables, and software for analyzing biological systems in the America, Europe, the Middle East, Africa, China, and the Asia Pacific. The company provides chromium, chromium connect, and chromium controller instruments, microfluidic chips, slides, reagents, and other consumables products.

Further Reading

Before you consider 10x Genomics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and 10x Genomics wasn't on the list.

While 10x Genomics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.