Quantinno Capital Management LP grew its holdings in shares of Roblox Co. (NYSE:RBLX - Free Report) by 85.8% in the 3rd quarter, according to its most recent disclosure with the SEC. The fund owned 34,316 shares of the company's stock after acquiring an additional 15,846 shares during the period. Quantinno Capital Management LP's holdings in Roblox were worth $1,519,000 as of its most recent SEC filing.

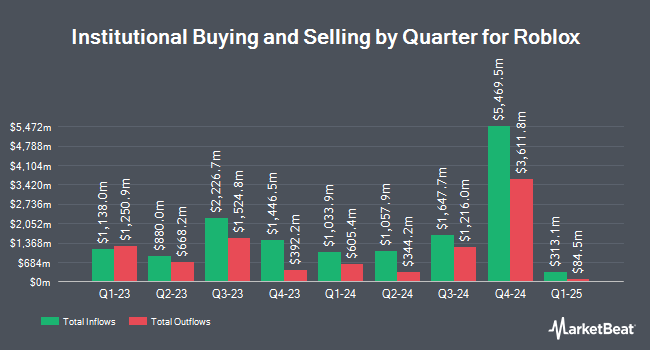

Several other institutional investors also recently modified their holdings of the business. FMR LLC boosted its stake in shares of Roblox by 24.5% in the 3rd quarter. FMR LLC now owns 20,942,691 shares of the company's stock valued at $926,924,000 after purchasing an additional 4,115,286 shares during the last quarter. Dragoneer Investment Group LLC lifted its holdings in Roblox by 26.9% in the second quarter. Dragoneer Investment Group LLC now owns 11,745,203 shares of the company's stock valued at $437,039,000 after buying an additional 2,488,044 shares during the period. Greenvale Capital LLP bought a new stake in Roblox during the second quarter valued at $89,304,000. Marshall Wace LLP acquired a new stake in Roblox during the 2nd quarter worth about $87,543,000. Finally, ARK Investment Management LLC raised its position in shares of Roblox by 12.9% in the 2nd quarter. ARK Investment Management LLC now owns 13,338,829 shares of the company's stock worth $496,338,000 after acquiring an additional 1,519,591 shares in the last quarter. Institutional investors own 91.08% of the company's stock.

Analyst Upgrades and Downgrades

RBLX has been the topic of several recent analyst reports. The Goldman Sachs Group boosted their price target on Roblox from $45.00 to $55.00 and gave the company a "neutral" rating in a research note on Friday, November 1st. Barclays boosted their target price on shares of Roblox from $40.00 to $50.00 and gave the company an "equal weight" rating in a research report on Friday, November 1st. Macquarie raised their price target on shares of Roblox from $50.00 to $58.00 and gave the stock an "outperform" rating in a report on Friday, November 1st. Needham & Company LLC upped their price objective on shares of Roblox from $50.00 to $60.00 and gave the company a "buy" rating in a report on Friday, November 1st. Finally, BMO Capital Markets restated an "outperform" rating and issued a $62.00 target price (up from $56.00) on shares of Roblox in a research note on Friday, November 1st. Seven research analysts have rated the stock with a hold rating, fifteen have assigned a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $55.67.

Read Our Latest Research Report on RBLX

Roblox Stock Down 0.5 %

Shares of NYSE:RBLX traded down $0.28 during midday trading on Thursday, reaching $59.61. The company's stock had a trading volume of 6,487,592 shares, compared to its average volume of 7,670,735. Roblox Co. has a 12-month low of $29.55 and a 12-month high of $61.05. The firm has a market capitalization of $36.22 billion, a P/E ratio of -36.35 and a beta of 1.50. The firm has a 50 day moving average of $48.52 and a 200-day moving average of $42.97. The company has a quick ratio of 0.98, a current ratio of 0.98 and a debt-to-equity ratio of 5.64.

Roblox (NYSE:RBLX - Get Free Report) last released its earnings results on Thursday, October 31st. The company reported ($0.37) EPS for the quarter, topping the consensus estimate of ($0.39) by $0.02. The business had revenue of $919.00 million for the quarter, compared to the consensus estimate of $1.02 billion. Roblox had a negative return on equity of 986.36% and a negative net margin of 30.90%. The company's revenue for the quarter was up 9.5% compared to the same quarter last year. During the same period in the previous year, the company posted ($0.45) earnings per share. On average, research analysts anticipate that Roblox Co. will post -1.56 earnings per share for the current year.

Insider Activity

In related news, CFO Michael Guthrie sold 30,000 shares of the business's stock in a transaction that occurred on Monday, October 7th. The stock was sold at an average price of $41.50, for a total transaction of $1,245,000.00. Following the completion of the transaction, the chief financial officer now directly owns 352,844 shares in the company, valued at approximately $14,643,026. The trade was a 7.84 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, CEO David Baszucki sold 166,666 shares of the company's stock in a transaction that occurred on Wednesday, September 18th. The stock was sold at an average price of $45.56, for a total transaction of $7,593,302.96. Following the completion of the transaction, the chief executive officer now owns 135,755 shares of the company's stock, valued at approximately $6,184,997.80. The trade was a 55.11 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 1,412,379 shares of company stock valued at $71,728,919 over the last ninety days. 22.15% of the stock is currently owned by corporate insiders.

Roblox Company Profile

(

Free Report)

Roblox Corporation develops and operates an online entertainment platform in the United States and internationally. It offers Roblox Studio, a free toolset that allows developers and creators to build, publish, and operate 3D experiences, and other content; Roblox Client, an application that allows users to explore 3D experience; and Roblox Cloud, which provides services and infrastructure that power the platform.

Featured Articles

Before you consider Roblox, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Roblox wasn't on the list.

While Roblox currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.