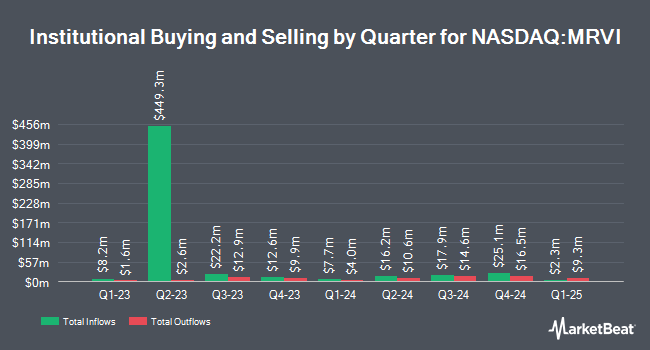

Quantinno Capital Management LP boosted its stake in Maravai LifeSciences Holdings, Inc. (NASDAQ:MRVI - Free Report) by 610.2% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 336,527 shares of the company's stock after acquiring an additional 289,141 shares during the quarter. Quantinno Capital Management LP owned about 0.13% of Maravai LifeSciences worth $2,797,000 at the end of the most recent reporting period.

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. GAMMA Investing LLC increased its holdings in shares of Maravai LifeSciences by 310.2% in the 2nd quarter. GAMMA Investing LLC now owns 3,585 shares of the company's stock valued at $26,000 after acquiring an additional 2,711 shares during the last quarter. Point72 Asia Singapore Pte. Ltd. bought a new stake in Maravai LifeSciences during the second quarter worth approximately $32,000. Venturi Wealth Management LLC acquired a new position in Maravai LifeSciences during the third quarter worth about $47,000. Blue Trust Inc. acquired a new stake in Maravai LifeSciences during the second quarter valued at approximately $44,000. Finally, Custom Index Systems LLC acquired a new stake in shares of Maravai LifeSciences during the third quarter worth $97,000. Hedge funds and other institutional investors own 50.25% of the company's stock.

Wall Street Analysts Forecast Growth

A number of brokerages have recently weighed in on MRVI. Royal Bank of Canada lowered their price target on Maravai LifeSciences from $17.00 to $13.00 and set an "outperform" rating on the stock in a report on Friday, November 8th. The Goldman Sachs Group lowered shares of Maravai LifeSciences from a "neutral" rating to a "sell" rating and cut their target price for the stock from $7.00 to $4.25 in a research report on Thursday, December 5th. Robert W. Baird dropped their target price on shares of Maravai LifeSciences from $10.00 to $9.00 and set an "outperform" rating on the stock in a research report on Friday, November 8th. Wells Fargo & Company initiated coverage on shares of Maravai LifeSciences in a report on Tuesday, August 27th. They set an "overweight" rating and a $10.00 price objective on the stock. Finally, Wolfe Research began coverage on Maravai LifeSciences in a research note on Thursday, November 14th. They set a "peer perform" rating on the stock. One equities research analyst has rated the stock with a sell rating, four have issued a hold rating and six have given a buy rating to the company. Based on data from MarketBeat.com, Maravai LifeSciences currently has a consensus rating of "Hold" and an average price target of $10.03.

View Our Latest Stock Report on Maravai LifeSciences

Insiders Place Their Bets

In other news, insider Carl Hull acquired 175,000 shares of Maravai LifeSciences stock in a transaction dated Monday, November 11th. The stock was bought at an average price of $5.64 per share, for a total transaction of $987,000.00. Following the completion of the acquisition, the insider now directly owns 175,000 shares in the company, valued at approximately $987,000. The trade was a ∞ increase in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Company insiders own 0.63% of the company's stock.

Maravai LifeSciences Stock Up 11.4 %

MRVI traded up $0.62 during trading on Tuesday, hitting $6.05. The company had a trading volume of 1,360,273 shares, compared to its average volume of 2,237,998. The company has a market capitalization of $1.53 billion, a PE ratio of -3.51 and a beta of -0.08. The company has a quick ratio of 9.94, a current ratio of 10.74 and a debt-to-equity ratio of 0.89. Maravai LifeSciences Holdings, Inc. has a one year low of $4.28 and a one year high of $11.56. The firm's 50-day moving average price is $6.69 and its 200 day moving average price is $7.86.

Maravai LifeSciences Profile

(

Free Report)

Maravai LifeSciences Holdings, Inc, a life sciences company, provides products to enable the development of drug therapies, diagnostics, novel vaccines, and support research on human diseases worldwide. The company's products address the key phases of biopharmaceutical development and include nucleic acids for diagnostic and therapeutic applications, antibody-based products to detect impurities during the production of biopharmaceutical products, and products to detect the expression of proteins in tissues of various species.

See Also

Before you consider Maravai LifeSciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Maravai LifeSciences wasn't on the list.

While Maravai LifeSciences currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.