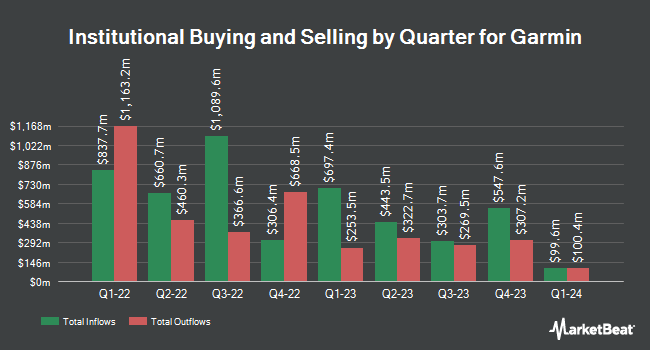

Quantinno Capital Management LP boosted its position in Garmin Ltd. (NYSE:GRMN - Free Report) by 34.1% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 26,461 shares of the scientific and technical instruments company's stock after purchasing an additional 6,734 shares during the quarter. Quantinno Capital Management LP's holdings in Garmin were worth $4,658,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in GRMN. Cetera Advisors LLC boosted its stake in Garmin by 77.0% in the 1st quarter. Cetera Advisors LLC now owns 4,755 shares of the scientific and technical instruments company's stock worth $708,000 after buying an additional 2,068 shares during the last quarter. Park Avenue Securities LLC grew its position in Garmin by 29.7% during the second quarter. Park Avenue Securities LLC now owns 3,843 shares of the scientific and technical instruments company's stock valued at $626,000 after acquiring an additional 881 shares during the period. CWM LLC increased its stake in Garmin by 50.8% during the second quarter. CWM LLC now owns 6,350 shares of the scientific and technical instruments company's stock worth $1,035,000 after acquiring an additional 2,138 shares during the last quarter. Simplicity Wealth LLC raised its holdings in shares of Garmin by 3.2% in the 2nd quarter. Simplicity Wealth LLC now owns 4,707 shares of the scientific and technical instruments company's stock worth $767,000 after purchasing an additional 144 shares during the period. Finally, Czech National Bank lifted its stake in shares of Garmin by 8.7% in the 2nd quarter. Czech National Bank now owns 29,281 shares of the scientific and technical instruments company's stock valued at $4,770,000 after purchasing an additional 2,350 shares in the last quarter. 73.41% of the stock is currently owned by hedge funds and other institutional investors.

Insider Buying and Selling at Garmin

In related news, Director Sean Biddlecombe sold 587 shares of the firm's stock in a transaction that occurred on Thursday, November 7th. The stock was sold at an average price of $210.10, for a total value of $123,328.70. Following the sale, the director now directly owns 6,147 shares in the company, valued at $1,291,484.70. This trade represents a 8.72 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. 19.54% of the stock is currently owned by insiders.

Analysts Set New Price Targets

A number of research analysts have weighed in on the stock. Morgan Stanley cut shares of Garmin from an "equal weight" rating to an "underweight" rating and reduced their price target for the company from $155.00 to $138.00 in a research report on Monday, October 7th. Tigress Financial increased their price objective on shares of Garmin from $210.00 to $215.00 and gave the company a "strong-buy" rating in a research report on Thursday, September 19th. Barclays lifted their price objective on shares of Garmin from $133.00 to $158.00 and gave the company an "underweight" rating in a research note on Friday, November 1st. Finally, StockNews.com downgraded shares of Garmin from a "buy" rating to a "hold" rating in a research note on Thursday, September 12th. Three analysts have rated the stock with a sell rating, three have assigned a hold rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus price target of $162.67.

Get Our Latest Stock Analysis on GRMN

Garmin Stock Up 0.9 %

Shares of GRMN traded up $1.99 during mid-day trading on Friday, hitting $218.58. The stock had a trading volume of 661,073 shares, compared to its average volume of 818,862. Garmin Ltd. has a fifty-two week low of $119.15 and a fifty-two week high of $219.54. The company has a market cap of $41.97 billion, a PE ratio of 27.74, a PEG ratio of 1.42 and a beta of 0.97. The company's fifty day simple moving average is $190.98 and its two-hundred day simple moving average is $177.05.

Garmin (NYSE:GRMN - Get Free Report) last released its earnings results on Wednesday, October 30th. The scientific and technical instruments company reported $1.99 earnings per share for the quarter, beating the consensus estimate of $1.46 by $0.53. Garmin had a net margin of 25.48% and a return on equity of 17.99%. The firm had revenue of $1.59 billion during the quarter, compared to analyst estimates of $1.44 billion. During the same quarter in the previous year, the firm earned $1.41 earnings per share. The firm's revenue for the quarter was up 24.1% compared to the same quarter last year. Equities analysts expect that Garmin Ltd. will post 7.01 earnings per share for the current year.

About Garmin

(

Free Report)

Garmin Ltd. designs, develops, manufactures, markets, and distributes a range of wireless devices worldwide. Its Fitness segment offers running and multi-sport watches; cycling products; smartwatch devices; scales and monitors; and fitness accessories. This segment also provides Garmin Connect and Garmin Connect Mobile, which are web and mobile platforms where users can track and analyze their fitness, activities and workouts, and wellness data; and Connect IQ, an application development platform.

Featured Articles

Before you consider Garmin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Garmin wasn't on the list.

While Garmin currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.