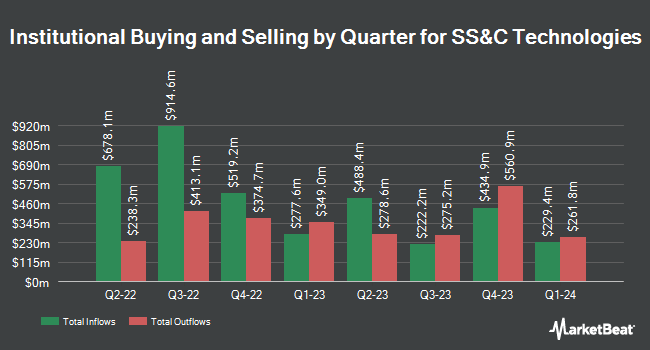

Quantinno Capital Management LP raised its holdings in SS&C Technologies Holdings, Inc. (NASDAQ:SSNC - Free Report) by 27.7% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 77,773 shares of the technology company's stock after buying an additional 16,850 shares during the period. Quantinno Capital Management LP's holdings in SS&C Technologies were worth $5,772,000 at the end of the most recent reporting period.

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in the business. Innealta Capital LLC bought a new stake in shares of SS&C Technologies in the 2nd quarter valued at about $26,000. Ashton Thomas Private Wealth LLC bought a new stake in shares of SS&C Technologies in the 2nd quarter valued at about $35,000. Benjamin Edwards Inc. raised its holdings in shares of SS&C Technologies by 43.3% in the 2nd quarter. Benjamin Edwards Inc. now owns 675 shares of the technology company's stock valued at $42,000 after purchasing an additional 204 shares during the period. 1620 Investment Advisors Inc. bought a new stake in shares of SS&C Technologies in the 2nd quarter valued at about $47,000. Finally, Capital Performance Advisors LLP bought a new stake in shares of SS&C Technologies in the 3rd quarter valued at about $68,000. 96.95% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several research analysts have weighed in on the stock. Needham & Company LLC reissued a "buy" rating and issued a $90.00 price target on shares of SS&C Technologies in a report on Friday, October 25th. Royal Bank of Canada increased their price target on shares of SS&C Technologies from $75.00 to $86.00 and gave the company an "outperform" rating in a report on Thursday, September 19th. StockNews.com cut shares of SS&C Technologies from a "strong-buy" rating to a "buy" rating in a report on Friday, November 15th. DA Davidson reissued a "buy" rating and issued a $92.00 price target on shares of SS&C Technologies in a report on Thursday, October 10th. Finally, Raymond James increased their price target on shares of SS&C Technologies from $79.00 to $85.00 and gave the company a "strong-buy" rating in a report on Friday, October 25th. Two analysts have rated the stock with a hold rating, six have given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, SS&C Technologies has a consensus rating of "Moderate Buy" and an average target price of $77.75.

Read Our Latest Analysis on SSNC

Insider Activity at SS&C Technologies

In related news, Director Michael Jay Zamkow sold 19,000 shares of the stock in a transaction that occurred on Friday, September 20th. The shares were sold at an average price of $75.97, for a total value of $1,443,430.00. Following the completion of the transaction, the director now owns 22,576 shares of the company's stock, valued at $1,715,098.72. This represents a 45.70 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director Normand A. Boulanger sold 130,000 shares of the stock in a transaction that occurred on Monday, September 16th. The shares were sold at an average price of $75.38, for a total transaction of $9,799,400.00. Following the completion of the transaction, the director now directly owns 333,576 shares of the company's stock, valued at approximately $25,144,958.88. The trade was a 28.04 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 218,000 shares of company stock valued at $16,560,660 in the last quarter. Insiders own 15.40% of the company's stock.

SS&C Technologies Price Performance

Shares of NASDAQ SSNC traded down $0.35 during trading hours on Friday, hitting $76.12. 860,859 shares of the stock were exchanged, compared to its average volume of 1,327,861. The company has a debt-to-equity ratio of 1.04, a quick ratio of 1.21 and a current ratio of 1.21. The company has a market cap of $18.85 billion, a PE ratio of 27.28 and a beta of 1.38. The company's fifty day simple moving average is $74.48 and its two-hundred day simple moving average is $70.28. SS&C Technologies Holdings, Inc. has a 1-year low of $56.62 and a 1-year high of $77.69.

SS&C Technologies (NASDAQ:SSNC - Get Free Report) last posted its quarterly earnings results on Thursday, October 24th. The technology company reported $1.29 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.26 by $0.03. The business had revenue of $1.47 billion for the quarter, compared to analyst estimates of $1.44 billion. SS&C Technologies had a net margin of 12.26% and a return on equity of 17.33%. The firm's revenue for the quarter was up 7.3% on a year-over-year basis. During the same quarter last year, the business posted $1.04 EPS. On average, sell-side analysts predict that SS&C Technologies Holdings, Inc. will post 4.62 EPS for the current year.

SS&C Technologies Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Monday, December 2nd will be paid a $0.25 dividend. This represents a $1.00 annualized dividend and a yield of 1.31%. The ex-dividend date is Monday, December 2nd. SS&C Technologies's payout ratio is 35.84%.

About SS&C Technologies

(

Free Report)

SS&C Technologies Holdings, Inc, together with its subsidiaries, provides software products and software-enabled services to financial services and healthcare industries. The company owns and operates technology stack across securities accounting; front-office functions, such as trading and modeling; middle-office functions comprising portfolio management and reporting; back-office functions, such as accounting, performance measurement, reconciliation, reporting, processing and clearing, and compliance and tax reporting; and healthcare solutions consisting of claims adjudication, benefit management, care management, and business intelligence solutions.

Featured Articles

Before you consider SS&C Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SS&C Technologies wasn't on the list.

While SS&C Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.