Quantinno Capital Management LP increased its position in shares of Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN - Free Report) by 59.9% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 7,473 shares of the biopharmaceutical company's stock after purchasing an additional 2,798 shares during the period. Quantinno Capital Management LP's holdings in Regeneron Pharmaceuticals were worth $7,856,000 at the end of the most recent quarter.

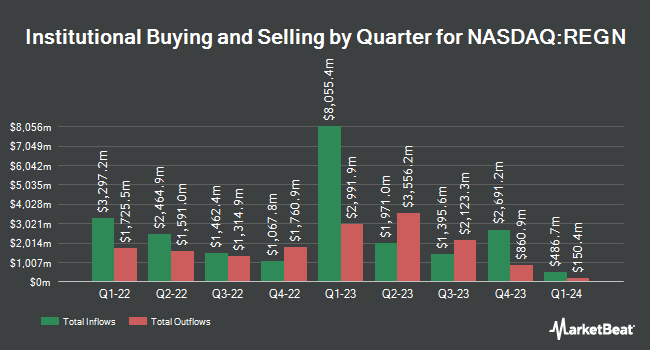

Other institutional investors also recently bought and sold shares of the company. CWM LLC lifted its stake in shares of Regeneron Pharmaceuticals by 2.2% in the 2nd quarter. CWM LLC now owns 2,247 shares of the biopharmaceutical company's stock valued at $2,361,000 after purchasing an additional 49 shares during the last quarter. Czech National Bank lifted its position in Regeneron Pharmaceuticals by 8.7% in the second quarter. Czech National Bank now owns 20,212 shares of the biopharmaceutical company's stock valued at $21,243,000 after buying an additional 1,624 shares during the last quarter. Gibson Capital LLC purchased a new position in Regeneron Pharmaceuticals during the second quarter worth about $284,000. Transform Wealth LLC increased its position in shares of Regeneron Pharmaceuticals by 2.9% during the second quarter. Transform Wealth LLC now owns 9,052 shares of the biopharmaceutical company's stock valued at $9,514,000 after acquiring an additional 258 shares during the last quarter. Finally, Sequoia Financial Advisors LLC raised its stake in shares of Regeneron Pharmaceuticals by 5.0% in the 2nd quarter. Sequoia Financial Advisors LLC now owns 1,522 shares of the biopharmaceutical company's stock valued at $1,600,000 after acquiring an additional 73 shares during the period. 83.31% of the stock is owned by hedge funds and other institutional investors.

Regeneron Pharmaceuticals Stock Up 1.3 %

Regeneron Pharmaceuticals stock traded up $10.10 during mid-day trading on Friday, hitting $778.00. The company had a trading volume of 813,640 shares, compared to its average volume of 547,914. The company has a quick ratio of 4.46, a current ratio of 5.28 and a debt-to-equity ratio of 0.09. Regeneron Pharmaceuticals, Inc. has a 1 year low of $735.95 and a 1 year high of $1,211.20. The business has a fifty day moving average of $882.14 and a 200 day moving average of $1,013.01. The stock has a market cap of $85.49 billion, a price-to-earnings ratio of 19.25, a PEG ratio of 2.89 and a beta of 0.08.

Wall Street Analyst Weigh In

A number of research firms recently weighed in on REGN. Evercore ISI lowered their price objective on shares of Regeneron Pharmaceuticals from $1,250.00 to $1,175.00 and set an "outperform" rating for the company in a research report on Thursday, October 24th. Leerink Partnrs cut Regeneron Pharmaceuticals from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, September 24th. Barclays cut their price objective on Regeneron Pharmaceuticals from $1,080.00 to $1,065.00 and set an "overweight" rating on the stock in a report on Friday, November 1st. Truist Financial lowered their target price on Regeneron Pharmaceuticals from $1,137.00 to $1,126.00 and set a "buy" rating for the company in a report on Friday, November 1st. Finally, Wells Fargo & Company cut their price target on shares of Regeneron Pharmaceuticals from $1,200.00 to $1,050.00 and set an "overweight" rating on the stock in a research note on Tuesday, October 22nd. One equities research analyst has rated the stock with a sell rating, four have issued a hold rating, seventeen have given a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $1,107.29.

Check Out Our Latest Stock Analysis on Regeneron Pharmaceuticals

Regeneron Pharmaceuticals Company Profile

(

Free Report)

Regeneron Pharmaceuticals, Inc discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide. The company's products include EYLEA injection to treat wet age-related macular degeneration and diabetic macular edema; myopic choroidal neovascularization; diabetic retinopathy; neovascular glaucoma; and retinopathy of prematurity.

See Also

Before you consider Regeneron Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regeneron Pharmaceuticals wasn't on the list.

While Regeneron Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.