Quantinno Capital Management LP boosted its holdings in Avantor, Inc. (NYSE:AVTR - Free Report) by 57.5% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 139,901 shares of the company's stock after acquiring an additional 51,075 shares during the quarter. Quantinno Capital Management LP's holdings in Avantor were worth $3,619,000 at the end of the most recent quarter.

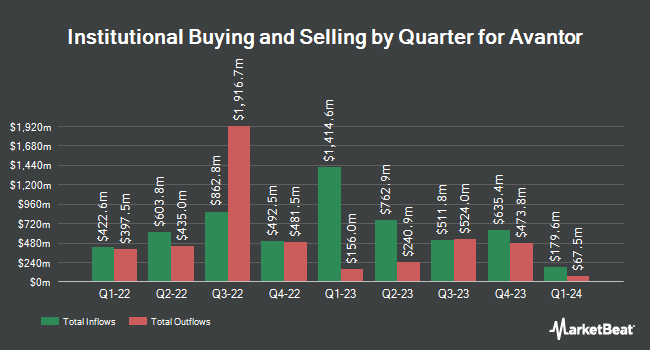

Several other institutional investors and hedge funds also recently modified their holdings of AVTR. Hantz Financial Services Inc. raised its position in shares of Avantor by 2.1% during the 3rd quarter. Hantz Financial Services Inc. now owns 24,900 shares of the company's stock worth $644,000 after buying an additional 503 shares in the last quarter. Intech Investment Management LLC raised its holdings in Avantor by 1.8% during the second quarter. Intech Investment Management LLC now owns 29,068 shares of the company's stock worth $616,000 after purchasing an additional 514 shares in the last quarter. Arizona State Retirement System raised its holdings in Avantor by 0.3% during the second quarter. Arizona State Retirement System now owns 186,567 shares of the company's stock worth $3,955,000 after purchasing an additional 528 shares in the last quarter. Veracity Capital LLC boosted its stake in Avantor by 1.0% during the 3rd quarter. Veracity Capital LLC now owns 52,359 shares of the company's stock valued at $1,355,000 after purchasing an additional 543 shares in the last quarter. Finally, Wealth Enhancement Advisory Services LLC increased its position in shares of Avantor by 2.8% during the 2nd quarter. Wealth Enhancement Advisory Services LLC now owns 26,921 shares of the company's stock valued at $571,000 after purchasing an additional 733 shares during the period. Institutional investors own 95.08% of the company's stock.

Avantor Stock Up 3.3 %

Avantor stock traded up $0.70 during mid-day trading on Monday, hitting $22.09. The company's stock had a trading volume of 6,550,215 shares, compared to its average volume of 6,485,204. Avantor, Inc. has a 52-week low of $19.59 and a 52-week high of $28.00. The company has a market cap of $15.03 billion, a PE ratio of 46.50, a price-to-earnings-growth ratio of 2.59 and a beta of 1.29. The company has a debt-to-equity ratio of 0.84, a current ratio of 1.54 and a quick ratio of 1.06. The firm's 50 day moving average is $22.78 and its 200 day moving average is $23.58.

Wall Street Analysts Forecast Growth

Several brokerages recently weighed in on AVTR. UBS Group decreased their target price on Avantor from $30.00 to $29.00 and set a "buy" rating for the company in a research note on Tuesday, October 8th. Wells Fargo & Company lowered their price objective on shares of Avantor from $30.00 to $28.00 and set an "overweight" rating on the stock in a research note on Monday, October 28th. Robert W. Baird decreased their price target on shares of Avantor from $27.00 to $26.00 and set an "outperform" rating on the stock in a research report on Monday, October 28th. Royal Bank of Canada reiterated an "outperform" rating and set a $34.00 price objective on shares of Avantor in a research report on Thursday, September 26th. Finally, Barclays decreased their target price on Avantor from $28.00 to $25.00 and set an "overweight" rating on the stock in a report on Friday, October 25th. Three investment analysts have rated the stock with a hold rating and eleven have given a buy rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $27.69.

View Our Latest Stock Analysis on Avantor

Avantor Company Profile

(

Free Report)

Avantor, Inc engages in the provision of mission-critical products and services to customers in the biopharma, healthcare, education and government, advanced technologies, and applied materials industries in the Americas, Europe, Asia, the Middle East, and Africa. The company offers materials and consumables, such as purity chemicals and reagents, lab products and supplies, formulated silicone materials, customized excipients, customized single-use assemblies, process chromatography resins and columns, analytical sample prep kits, education and microbiology products, clinical trial kits, peristaltic pumps, and fluid handling tips.

Further Reading

Before you consider Avantor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avantor wasn't on the list.

While Avantor currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.