Quantinno Capital Management LP increased its stake in Atmos Energy Co. (NYSE:ATO - Free Report) by 114.3% during the 3rd quarter, according to its most recent Form 13F filing with the SEC. The fund owned 15,417 shares of the utilities provider's stock after acquiring an additional 8,224 shares during the period. Quantinno Capital Management LP's holdings in Atmos Energy were worth $2,139,000 as of its most recent SEC filing.

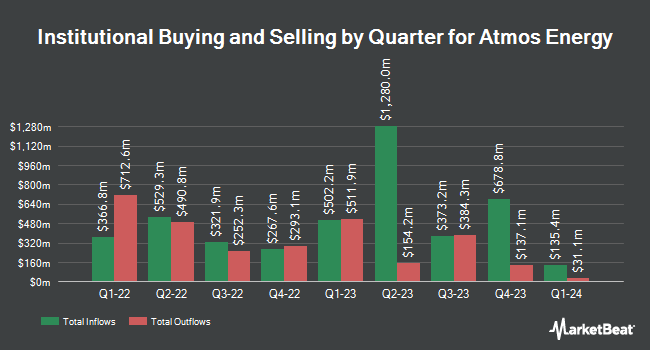

Several other hedge funds have also modified their holdings of ATO. Atria Investments Inc lifted its position in Atmos Energy by 1.3% during the third quarter. Atria Investments Inc now owns 31,399 shares of the utilities provider's stock valued at $4,355,000 after buying an additional 402 shares in the last quarter. Swedbank AB lifted its position in Atmos Energy by 565.3% during the second quarter. Swedbank AB now owns 40,621 shares of the utilities provider's stock valued at $4,738,000 after buying an additional 34,515 shares in the last quarter. Sumitomo Mitsui Trust Holdings Inc. lifted its position in Atmos Energy by 3.6% during the second quarter. Sumitomo Mitsui Trust Holdings Inc. now owns 419,721 shares of the utilities provider's stock valued at $48,960,000 after buying an additional 14,440 shares in the last quarter. Assenagon Asset Management S.A. lifted its position in Atmos Energy by 7.5% during the second quarter. Assenagon Asset Management S.A. now owns 323,614 shares of the utilities provider's stock valued at $37,750,000 after buying an additional 22,531 shares in the last quarter. Finally, Public Sector Pension Investment Board lifted its position in Atmos Energy by 52.2% during the second quarter. Public Sector Pension Investment Board now owns 25,568 shares of the utilities provider's stock valued at $2,983,000 after buying an additional 8,774 shares in the last quarter. 90.17% of the stock is owned by institutional investors and hedge funds.

Atmos Energy Stock Down 0.5 %

ATO traded down $0.70 during trading on Wednesday, hitting $140.41. The company had a trading volume of 247,907 shares, compared to its average volume of 871,001. The company has a market cap of $21.82 billion, a PE ratio of 20.54, a P/E/G ratio of 2.84 and a beta of 0.70. The business has a 50-day moving average of $143.26 and a 200-day moving average of $131.40. The company has a debt-to-equity ratio of 0.65, a current ratio of 0.94 and a quick ratio of 0.80. Atmos Energy Co. has a 1-year low of $110.46 and a 1-year high of $152.65.

Atmos Energy Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, December 9th. Investors of record on Monday, November 25th were issued a $0.87 dividend. The ex-dividend date was Monday, November 25th. This is a boost from Atmos Energy's previous quarterly dividend of $0.81. This represents a $3.48 annualized dividend and a yield of 2.48%. Atmos Energy's dividend payout ratio is currently 50.66%.

Insider Activity at Atmos Energy

In other Atmos Energy news, Director Edward Geiser bought 2,500 shares of the stock in a transaction on Monday, November 11th. The stock was purchased at an average price of $144.89 per share, for a total transaction of $362,225.00. Following the completion of the purchase, the director now directly owns 2,602 shares in the company, valued at approximately $377,003.78. This trade represents a 2,450.98 % increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 0.50% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of research analysts have weighed in on ATO shares. LADENBURG THALM/SH SH lifted their price target on shares of Atmos Energy from $144.00 to $150.50 and gave the company a "buy" rating in a research report on Wednesday, October 2nd. Jefferies Financial Group started coverage on shares of Atmos Energy in a research report on Wednesday, October 2nd. They set a "hold" rating and a $155.00 price target on the stock. Morgan Stanley reduced their target price on shares of Atmos Energy from $145.00 to $143.00 and set an "overweight" rating on the stock in a research report on Friday, November 22nd. JPMorgan Chase & Co. boosted their target price on shares of Atmos Energy from $134.00 to $144.00 and gave the stock an "overweight" rating in a research report on Thursday, August 15th. Finally, Barclays boosted their target price on shares of Atmos Energy from $129.00 to $144.00 and gave the stock an "equal weight" rating in a research report on Monday, October 7th. Four analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat.com, Atmos Energy currently has an average rating of "Moderate Buy" and a consensus target price of $147.69.

Read Our Latest Stock Report on Atmos Energy

Atmos Energy Company Profile

(

Free Report)

Atmos Energy Corporation, together with its subsidiaries, engages in the regulated natural gas distribution, and pipeline and storage businesses in the United States. It operates through two segments, Distribution, and Pipeline and Storage. The Distribution segment is involved in the regulated natural gas distribution and related sales operations in eight states.

Featured Articles

Before you consider Atmos Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atmos Energy wasn't on the list.

While Atmos Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.