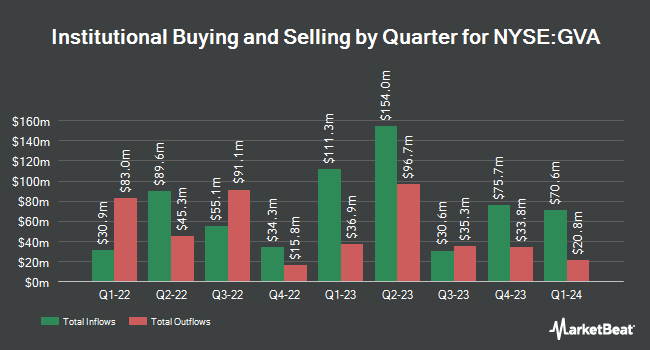

Quest Partners LLC grew its holdings in shares of Granite Construction Incorporated (NYSE:GVA - Free Report) by 2,303,900.0% during the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 23,040 shares of the construction company's stock after buying an additional 23,039 shares during the period. Quest Partners LLC owned approximately 0.05% of Granite Construction worth $1,827,000 as of its most recent filing with the SEC.

Other institutional investors and hedge funds have also recently modified their holdings of the company. Millennium Management LLC lifted its holdings in shares of Granite Construction by 99.3% in the 2nd quarter. Millennium Management LLC now owns 2,569,319 shares of the construction company's stock worth $159,221,000 after purchasing an additional 1,280,288 shares in the last quarter. Hood River Capital Management LLC bought a new position in Granite Construction during the 2nd quarter valued at $29,143,000. Highbridge Capital Management LLC bought a new position in Granite Construction during the 2nd quarter valued at $4,513,000. Aristeia Capital L.L.C. bought a new position in Granite Construction during the 2nd quarter valued at $4,513,000. Finally, Comerica Bank lifted its stake in Granite Construction by 177.6% during the 1st quarter. Comerica Bank now owns 113,514 shares of the construction company's stock valued at $6,485,000 after acquiring an additional 72,621 shares in the last quarter.

Analyst Ratings Changes

Separately, The Goldman Sachs Group raised their price objective on Granite Construction from $61.00 to $70.00 and gave the company a "sell" rating in a research note on Wednesday, October 9th.

Check Out Our Latest Research Report on GVA

Granite Construction Stock Performance

Shares of NYSE:GVA traded up $1.07 during midday trading on Tuesday, reaching $97.52. The company had a trading volume of 524,718 shares, compared to its average volume of 540,497. The company's 50 day moving average price is $83.08 and its 200 day moving average price is $71.40. The company has a current ratio of 1.56, a quick ratio of 1.46 and a debt-to-equity ratio of 0.69. The stock has a market cap of $4.26 billion, a P/E ratio of 44.94 and a beta of 1.39. Granite Construction Incorporated has a 52-week low of $43.92 and a 52-week high of $99.32.

Granite Construction (NYSE:GVA - Get Free Report) last issued its quarterly earnings results on Thursday, October 31st. The construction company reported $2.05 earnings per share for the quarter, missing analysts' consensus estimates of $2.51 by ($0.46). The company had revenue of $1.28 billion during the quarter, compared to analysts' expectations of $1.29 billion. Granite Construction had a return on equity of 19.04% and a net margin of 2.80%. Granite Construction's quarterly revenue was up 14.2% compared to the same quarter last year. During the same period last year, the firm posted $1.69 earnings per share. As a group, sell-side analysts anticipate that Granite Construction Incorporated will post 4.98 EPS for the current fiscal year.

Granite Construction Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, October 15th. Investors of record on Monday, September 30th were paid a $0.13 dividend. This represents a $0.52 dividend on an annualized basis and a yield of 0.53%. The ex-dividend date was Monday, September 30th. Granite Construction's dividend payout ratio is currently 23.85%.

Granite Construction Profile

(

Free Report)

Granite Construction Incorporated operates as an infrastructure contractor in the United States. It operates through two segments: Construction and Materials segments. The Construction segment engages in the construction and rehabilitation of roads, pavement preservation, bridges, rail lines, airports, marine ports, dams, reservoirs, aqueducts, infrastructure, and site development for use by the public and water-related construction for municipal agencies, commercial water suppliers, industrial facilities, and energy companies; and construction of various complex projects, including infrastructure/site development, mining, public safety, tunnel, solar storage, and power related projects.

Read More

Before you consider Granite Construction, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Granite Construction wasn't on the list.

While Granite Construction currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.