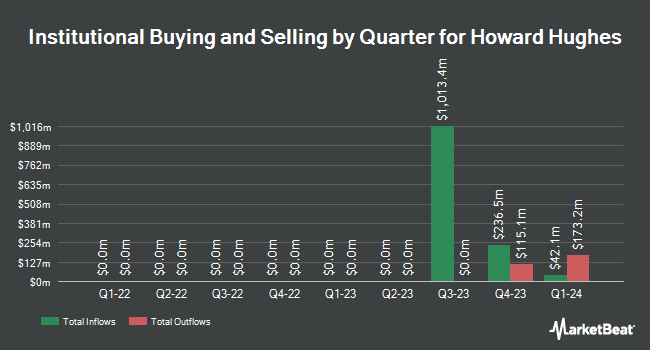

Quest Partners LLC lessened its stake in Howard Hughes Holdings Inc. (NYSE:HHH - Free Report) by 48.3% in the 3rd quarter, according to its most recent filing with the SEC. The firm owned 12,472 shares of the company's stock after selling 11,647 shares during the quarter. Quest Partners LLC's holdings in Howard Hughes were worth $966,000 as of its most recent filing with the SEC.

Other large investors have also recently made changes to their positions in the company. Janney Montgomery Scott LLC purchased a new stake in shares of Howard Hughes in the 1st quarter valued at approximately $294,000. Sei Investments Co. increased its position in shares of Howard Hughes by 6.5% during the first quarter. Sei Investments Co. now owns 47,254 shares of the company's stock worth $3,432,000 after purchasing an additional 2,887 shares in the last quarter. Clearbridge Investments LLC increased its position in Howard Hughes by 2.4% during the first quarter. Clearbridge Investments LLC now owns 326,314 shares of the company's stock worth $23,697,000 after buying an additional 7,500 shares during the period. Keeley Teton Advisors LLC increased its holdings in shares of Howard Hughes by 25.3% in the 1st quarter. Keeley Teton Advisors LLC now owns 8,988 shares of the company's stock valued at $653,000 after acquiring an additional 1,813 shares during the period. Finally, Price T Rowe Associates Inc. MD raised its holdings in shares of Howard Hughes by 1.7% in the first quarter. Price T Rowe Associates Inc. MD now owns 24,210 shares of the company's stock valued at $1,759,000 after buying an additional 398 shares during the last quarter. 93.83% of the stock is currently owned by hedge funds and other institutional investors.

Howard Hughes Stock Performance

Shares of HHH stock traded up $2.41 during midday trading on Thursday, hitting $82.15. The company had a trading volume of 296,564 shares, compared to its average volume of 285,302. The company's 50 day simple moving average is $77.63 and its 200 day simple moving average is $71.81. Howard Hughes Holdings Inc. has a 52-week low of $59.00 and a 52-week high of $86.72. The company has a debt-to-equity ratio of 1.98, a current ratio of 1.08 and a quick ratio of 1.08. The stock has a market cap of $4.12 billion, a price-to-earnings ratio of 54.48 and a beta of 1.46.

Howard Hughes (NYSE:HHH - Get Free Report) last announced its quarterly earnings data on Monday, November 4th. The company reported $1.95 earnings per share for the quarter, beating analysts' consensus estimates of $0.19 by $1.76. The company had revenue of $327.15 million for the quarter, compared to analyst estimates of $261.00 million. Howard Hughes had a return on equity of 3.38% and a net margin of 6.57%. The firm's revenue for the quarter was up 43.2% compared to the same quarter last year. During the same quarter in the previous year, the company earned ($0.26) EPS. Research analysts anticipate that Howard Hughes Holdings Inc. will post 3.28 earnings per share for the current fiscal year.

Howard Hughes Company Profile

(

Free Report)

Howard Hughes Holdings Inc, together with its subsidiaries, operates as a real estate development company in the United States. It operates in four segments: Operating Assets; Master Planned Communities (MPCs); Seaport; and Strategic Developments. The Operating Assets segment consists of developed or acquired retail, office, and multi-family properties along with other retail investments.

Further Reading

Before you consider Howard Hughes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Howard Hughes wasn't on the list.

While Howard Hughes currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.