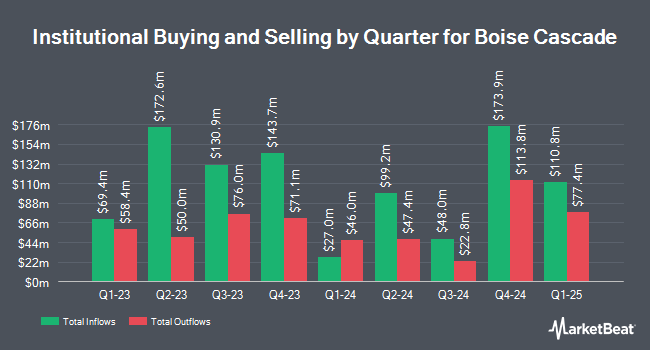

Quest Partners LLC boosted its position in Boise Cascade (NYSE:BCC - Free Report) by 2,173.7% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 7,253 shares of the construction company's stock after acquiring an additional 6,934 shares during the quarter. Quest Partners LLC's holdings in Boise Cascade were worth $1,023,000 at the end of the most recent reporting period.

Several other institutional investors have also added to or reduced their stakes in the company. Chesapeake Capital Corp IL boosted its stake in Boise Cascade by 27.9% in the third quarter. Chesapeake Capital Corp IL now owns 3,948 shares of the construction company's stock valued at $559,000 after buying an additional 862 shares in the last quarter. KBC Group NV raised its holdings in Boise Cascade by 19.0% in the 3rd quarter. KBC Group NV now owns 1,226 shares of the construction company's stock valued at $173,000 after buying an additional 196 shares during the last quarter. United Capital Management of KS Inc. lifted its holdings in Boise Cascade by 2.8% during the 3rd quarter. United Capital Management of KS Inc. now owns 28,976 shares of the construction company's stock worth $4,085,000 after buying an additional 792 shares during the period. Crossmark Global Holdings Inc. lifted its position in shares of Boise Cascade by 13.9% in the 3rd quarter. Crossmark Global Holdings Inc. now owns 3,122 shares of the construction company's stock worth $440,000 after purchasing an additional 381 shares during the period. Finally, Covestor Ltd grew its position in shares of Boise Cascade by 50.1% during the 3rd quarter. Covestor Ltd now owns 689 shares of the construction company's stock worth $97,000 after buying an additional 230 shares during the period. 96.18% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

A number of brokerages have commented on BCC. BMO Capital Markets raised their price objective on Boise Cascade from $130.00 to $136.00 and gave the company a "market perform" rating in a research note on Tuesday, October 22nd. StockNews.com lowered shares of Boise Cascade from a "buy" rating to a "hold" rating in a report on Wednesday, November 6th. Bank of America boosted their price objective on Boise Cascade from $120.00 to $124.00 and gave the stock an "underperform" rating in a report on Thursday, September 12th. Truist Financial lifted their target price on Boise Cascade from $154.00 to $161.00 and gave the company a "buy" rating in a research report on Tuesday, October 15th. Finally, Loop Capital assumed coverage on Boise Cascade in a research report on Friday, November 1st. They issued a "buy" rating and a $155.00 price target for the company. One analyst has rated the stock with a sell rating, three have given a hold rating and two have issued a buy rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average target price of $139.60.

Get Our Latest Stock Report on Boise Cascade

Boise Cascade Stock Performance

NYSE:BCC traded up $3.04 during trading on Thursday, reaching $140.45. The company's stock had a trading volume of 17,054 shares, compared to its average volume of 304,290. Boise Cascade has a 12 month low of $106.38 and a 12 month high of $154.67. The firm has a market cap of $5.39 billion, a price-to-earnings ratio of 13.45 and a beta of 1.53. The firm has a 50 day moving average of $139.00 and a 200-day moving average of $132.90. The company has a debt-to-equity ratio of 0.22, a quick ratio of 1.90 and a current ratio of 3.13.

Boise Cascade (NYSE:BCC - Get Free Report) last issued its earnings results on Monday, November 4th. The construction company reported $2.33 earnings per share for the quarter, missing analysts' consensus estimates of $2.37 by ($0.04). The business had revenue of $1.71 billion for the quarter, compared to the consensus estimate of $1.72 billion. Boise Cascade had a return on equity of 18.24% and a net margin of 5.95%. Boise Cascade's revenue for the quarter was down 6.6% compared to the same quarter last year. During the same quarter in the prior year, the business earned $3.58 EPS. Research analysts expect that Boise Cascade will post 9.57 EPS for the current fiscal year.

Boise Cascade Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, December 18th. Investors of record on Monday, December 2nd will be paid a dividend of $0.21 per share. This represents a $0.84 annualized dividend and a yield of 0.60%. The ex-dividend date is Monday, December 2nd. Boise Cascade's dividend payout ratio is 8.22%.

Boise Cascade Profile

(

Free Report)

Boise Cascade Company engages in manufacture of wood products and distribution of building materials in the United States and Canada. It operates through two segments, Wood Products and Building Materials Distribution. The Wood Products segment manufactures laminated veneer lumber and laminated beams used in headers and beams; I-joists for residential and commercial flooring and roofing systems, and other structural applications; structural, appearance, and industrial plywood panels; and ponderosa pine shop lumber and appearance grade boards.

Featured Stories

Before you consider Boise Cascade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boise Cascade wasn't on the list.

While Boise Cascade currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.