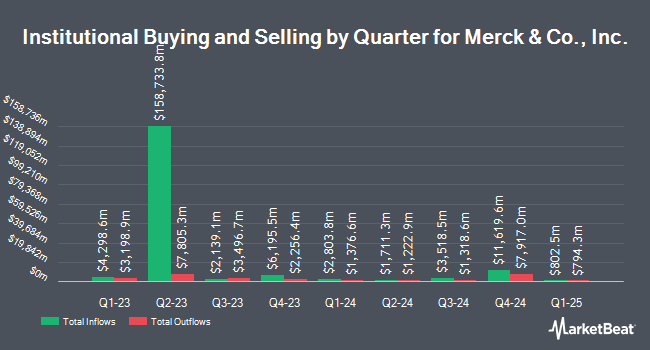

Quest Partners LLC cut its stake in shares of Merck & Co., Inc. (NYSE:MRK - Free Report) by 41.2% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 10,397 shares of the company's stock after selling 7,272 shares during the quarter. Quest Partners LLC's holdings in Merck & Co., Inc. were worth $1,181,000 as of its most recent SEC filing.

Other hedge funds have also recently made changes to their positions in the company. Aljian Capital Management LLC acquired a new stake in shares of Merck & Co., Inc. during the third quarter worth about $695,000. Glass Wealth Management Co LLC increased its stake in shares of Merck & Co., Inc. by 1.9% in the third quarter. Glass Wealth Management Co LLC now owns 33,269 shares of the company's stock worth $3,778,000 after acquiring an additional 613 shares during the period. Clarkston Capital Partners LLC lifted its position in Merck & Co., Inc. by 45.1% during the third quarter. Clarkston Capital Partners LLC now owns 15,929 shares of the company's stock valued at $1,809,000 after purchasing an additional 4,954 shares during the period. Swiss National Bank lifted its position in Merck & Co., Inc. by 0.3% during the third quarter. Swiss National Bank now owns 7,517,951 shares of the company's stock valued at $853,739,000 after purchasing an additional 19,400 shares during the period. Finally, S&CO Inc. boosted its holdings in Merck & Co., Inc. by 1.1% in the third quarter. S&CO Inc. now owns 403,312 shares of the company's stock valued at $45,800,000 after purchasing an additional 4,200 shares during the last quarter. 76.07% of the stock is owned by institutional investors and hedge funds.

Merck & Co., Inc. Stock Up 0.9 %

Merck & Co., Inc. stock traded up $0.89 during midday trading on Wednesday, hitting $97.43. 12,135,486 shares of the company were exchanged, compared to its average volume of 8,966,856. The company has a market cap of $246.46 billion, a PE ratio of 20.52, a price-to-earnings-growth ratio of 1.38 and a beta of 0.40. The company's fifty day moving average price is $108.09 and its 200-day moving average price is $118.39. The company has a debt-to-equity ratio of 0.79, a current ratio of 1.36 and a quick ratio of 1.15. Merck & Co., Inc. has a fifty-two week low of $94.48 and a fifty-two week high of $134.63.

Merck & Co., Inc. (NYSE:MRK - Get Free Report) last released its quarterly earnings results on Thursday, October 31st. The company reported $1.57 EPS for the quarter, topping the consensus estimate of $1.50 by $0.07. The business had revenue of $16.66 billion for the quarter, compared to analysts' expectations of $16.47 billion. Merck & Co., Inc. had a return on equity of 36.42% and a net margin of 19.23%. The company's revenue was up 4.4% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $2.13 earnings per share. On average, research analysts predict that Merck & Co., Inc. will post 7.75 EPS for the current fiscal year.

Merck & Co., Inc. Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, January 8th. Investors of record on Monday, December 16th will be paid a $0.81 dividend. This represents a $3.24 dividend on an annualized basis and a dividend yield of 3.33%. The ex-dividend date is Monday, December 16th. This is a positive change from Merck & Co., Inc.'s previous quarterly dividend of $0.77. Merck & Co., Inc.'s payout ratio is 64.57%.

Analyst Upgrades and Downgrades

A number of research firms have weighed in on MRK. Wells Fargo & Company reduced their price objective on Merck & Co., Inc. from $125.00 to $110.00 and set an "equal weight" rating for the company in a research note on Friday, November 1st. Truist Financial lowered their price objective on Merck & Co., Inc. from $132.00 to $130.00 and set a "buy" rating on the stock in a report on Thursday, November 7th. Cantor Fitzgerald restated an "overweight" rating and set a $155.00 price target on shares of Merck & Co., Inc. in a research report on Thursday, October 3rd. Wolfe Research initiated coverage on Merck & Co., Inc. in a report on Friday, November 15th. They issued a "peer perform" rating for the company. Finally, Guggenheim decreased their price objective on Merck & Co., Inc. from $137.00 to $130.00 and set a "buy" rating on the stock in a report on Wednesday, November 6th. One equities research analyst has rated the stock with a sell rating, six have given a hold rating, ten have issued a buy rating and three have assigned a strong buy rating to the company's stock. According to data from MarketBeat, Merck & Co., Inc. has a consensus rating of "Moderate Buy" and an average price target of $130.86.

Check Out Our Latest Research Report on Merck & Co., Inc.

Merck & Co., Inc. Profile

(

Free Report)

Merck & Co, Inc operates as a healthcare company worldwide. It operates through two segments, Pharmaceutical and Animal Health. The Pharmaceutical segment offers human health pharmaceutical products in the areas of oncology, hospital acute care, immunology, neuroscience, virology, cardiovascular, and diabetes under the Keytruda, Bridion, Adempas, Lagevrio, Belsomra, Simponi, and Januvia brands, as well as vaccine products consisting of preventive pediatric, adolescent, and adult vaccines under the Gardasil/Gardasil 9, ProQuad, M-M-R II, Varivax, RotaTeq, Live Oral, Vaxneuvance, Pneumovax 23, and Vaqta names.

See Also

Before you consider Merck & Co., Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merck & Co., Inc. wasn't on the list.

While Merck & Co., Inc. currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report