Quest Partners LLC increased its holdings in shares of Electronic Arts Inc. (NASDAQ:EA - Free Report) by 9,077.4% in the third quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 15,051 shares of the game software company's stock after purchasing an additional 14,887 shares during the quarter. Quest Partners LLC's holdings in Electronic Arts were worth $2,159,000 as of its most recent filing with the SEC.

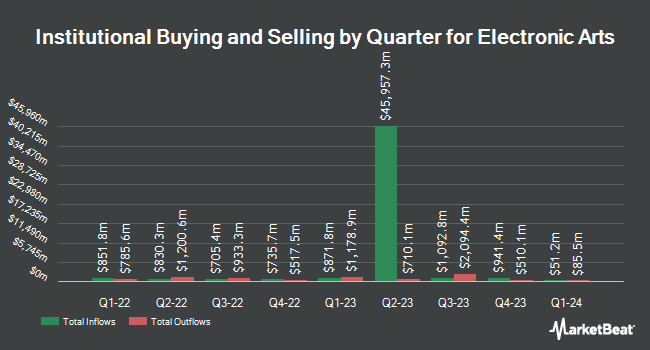

Several other hedge funds have also recently bought and sold shares of the business. Capital International Investors raised its holdings in shares of Electronic Arts by 16.4% during the 1st quarter. Capital International Investors now owns 5,901,257 shares of the game software company's stock valued at $782,920,000 after buying an additional 833,492 shares during the period. Ninety One UK Ltd raised its stake in shares of Electronic Arts by 1.3% during the second quarter. Ninety One UK Ltd now owns 4,283,539 shares of the game software company's stock valued at $596,825,000 after purchasing an additional 53,237 shares during the period. Massachusetts Financial Services Co. MA lifted its position in shares of Electronic Arts by 0.4% during the second quarter. Massachusetts Financial Services Co. MA now owns 4,185,476 shares of the game software company's stock worth $583,162,000 after purchasing an additional 18,376 shares in the last quarter. Legal & General Group Plc boosted its stake in shares of Electronic Arts by 2.1% in the second quarter. Legal & General Group Plc now owns 2,639,691 shares of the game software company's stock valued at $367,789,000 after purchasing an additional 53,800 shares during the period. Finally, Price T Rowe Associates Inc. MD grew its holdings in Electronic Arts by 496.9% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 2,511,250 shares of the game software company's stock valued at $333,169,000 after purchasing an additional 2,090,504 shares in the last quarter. Hedge funds and other institutional investors own 90.23% of the company's stock.

Electronic Arts Stock Performance

EA stock traded up $2.12 on Tuesday, reaching $166.13. The company's stock had a trading volume of 2,163,771 shares, compared to its average volume of 2,055,428. The firm has a fifty day moving average of $147.57 and a two-hundred day moving average of $142.90. The company has a debt-to-equity ratio of 0.25, a current ratio of 1.43 and a quick ratio of 1.43. The company has a market capitalization of $43.57 billion, a P/E ratio of 42.16, a price-to-earnings-growth ratio of 2.11 and a beta of 0.78. Electronic Arts Inc. has a 52 week low of $124.92 and a 52 week high of $166.40.

Electronic Arts Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, December 18th. Investors of record on Wednesday, November 27th will be paid a dividend of $0.19 per share. This represents a $0.76 dividend on an annualized basis and a dividend yield of 0.46%. The ex-dividend date is Wednesday, November 27th. Electronic Arts's dividend payout ratio is currently 19.54%.

Insider Buying and Selling

In other news, CEO Andrew Wilson sold 2,500 shares of the stock in a transaction on Monday, August 26th. The stock was sold at an average price of $148.88, for a total transaction of $372,200.00. Following the completion of the sale, the chief executive officer now owns 56,747 shares in the company, valued at approximately $8,448,493.36. This represents a 4.22 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, insider Vijayanthimala Singh sold 7,384 shares of the business's stock in a transaction on Wednesday, August 28th. The stock was sold at an average price of $149.91, for a total value of $1,106,935.44. Following the sale, the insider now directly owns 31,190 shares in the company, valued at $4,675,692.90. This trade represents a 19.14 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 24,884 shares of company stock valued at $3,699,335 over the last 90 days. 0.22% of the stock is currently owned by company insiders.

Analyst Ratings Changes

Several equities analysts have recently commented on EA shares. JPMorgan Chase & Co. reduced their target price on Electronic Arts from $155.00 to $150.00 and set a "neutral" rating for the company in a research note on Wednesday, October 30th. Bank of America increased their price objective on shares of Electronic Arts from $150.00 to $170.00 and gave the company a "buy" rating in a research note on Wednesday, July 31st. TD Cowen boosted their target price on shares of Electronic Arts from $163.00 to $183.00 and gave the stock a "buy" rating in a research report on Wednesday, July 31st. Deutsche Bank Aktiengesellschaft reaffirmed a "hold" rating and set a $160.00 price target on shares of Electronic Arts in a research report on Wednesday, September 18th. Finally, Wedbush reissued an "outperform" rating and issued a $170.00 price objective on shares of Electronic Arts in a report on Friday, October 25th. Eight analysts have rated the stock with a hold rating, twelve have given a buy rating and two have assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $165.37.

Check Out Our Latest Report on Electronic Arts

About Electronic Arts

(

Free Report)

Electronic Arts Inc develops, markets, publishes, and distributes games, content, and services for game consoles, PCs, mobile phones, and tablets worldwide. It develops and publishes games and services across various genres, such as sports, racing, first-person shooter, action, role-playing, and simulation primarily under the Battlefield, The Sims, Apex Legends, Need for Speed, and license games from others, including FIFA, Madden NFL, UFC, and Star Wars brands.

Further Reading

Before you consider Electronic Arts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Electronic Arts wasn't on the list.

While Electronic Arts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report