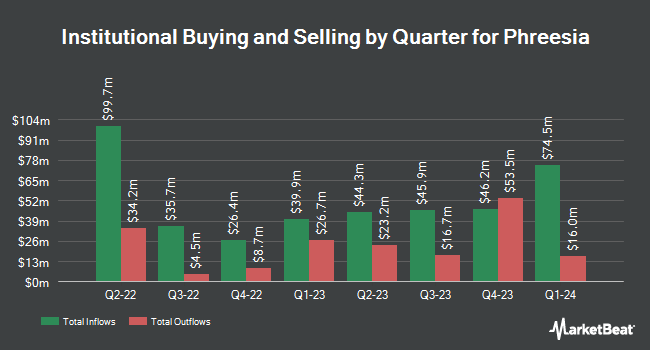

Quest Partners LLC raised its holdings in Phreesia, Inc. (NYSE:PHR - Free Report) by 5,361.8% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 31,296 shares of the company's stock after buying an additional 30,723 shares during the quarter. Quest Partners LLC owned approximately 0.05% of Phreesia worth $713,000 at the end of the most recent quarter.

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the business. GSA Capital Partners LLP grew its holdings in Phreesia by 418.3% in the 3rd quarter. GSA Capital Partners LLP now owns 49,553 shares of the company's stock valued at $1,129,000 after buying an additional 39,993 shares during the period. Versor Investments LP acquired a new position in shares of Phreesia in the 3rd quarter valued at about $694,000. TimesSquare Capital Management LLC lifted its stake in shares of Phreesia by 2.3% in the 3rd quarter. TimesSquare Capital Management LLC now owns 868,409 shares of the company's stock valued at $19,791,000 after purchasing an additional 19,395 shares in the last quarter. Arcadia Investment Management Corp MI lifted its stake in shares of Phreesia by 9.5% in the 3rd quarter. Arcadia Investment Management Corp MI now owns 97,085 shares of the company's stock valued at $2,213,000 after purchasing an additional 8,460 shares in the last quarter. Finally, International Assets Investment Management LLC lifted its stake in shares of Phreesia by 2,179.7% in the 3rd quarter. International Assets Investment Management LLC now owns 1,459 shares of the company's stock valued at $33,000 after purchasing an additional 1,395 shares in the last quarter. Hedge funds and other institutional investors own 92.10% of the company's stock.

Insider Transactions at Phreesia

In other news, COO Evan Roberts sold 3,148 shares of Phreesia stock in a transaction on Tuesday, September 10th. The stock was sold at an average price of $23.25, for a total value of $73,191.00. Following the completion of the sale, the chief operating officer now directly owns 755,719 shares of the company's stock, valued at approximately $17,570,466.75. This trade represents a 0.41 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, insider Yvonne Hui sold 2,791 shares of the firm's stock in a transaction on Tuesday, October 15th. The stock was sold at an average price of $20.92, for a total value of $58,387.72. Following the completion of the transaction, the insider now owns 27,228 shares in the company, valued at $569,609.76. This represents a 9.30 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 44,107 shares of company stock valued at $1,035,226. Corporate insiders own 5.80% of the company's stock.

Phreesia Price Performance

Shares of PHR traded up $0.87 during mid-day trading on Friday, reaching $19.87. The company had a trading volume of 292,863 shares, compared to its average volume of 449,216. Phreesia, Inc. has a twelve month low of $14.55 and a twelve month high of $29.16. The company has a debt-to-equity ratio of 0.03, a current ratio of 1.77 and a quick ratio of 1.77. The company's 50-day moving average is $20.89 and its 200-day moving average is $21.93. The company has a market capitalization of $1.15 billion, a P/E ratio of -11.04 and a beta of 0.94.

Phreesia (NYSE:PHR - Get Free Report) last issued its earnings results on Wednesday, September 4th. The company reported ($0.31) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.37) by $0.06. Phreesia had a negative return on equity of 39.34% and a negative net margin of 25.73%. The business had revenue of $102.12 million during the quarter, compared to analysts' expectations of $101.76 million. On average, equities analysts anticipate that Phreesia, Inc. will post -1.23 EPS for the current year.

Wall Street Analysts Forecast Growth

Several research firms have recently weighed in on PHR. Truist Financial lifted their price objective on Phreesia from $29.00 to $31.00 and gave the company a "buy" rating in a research note on Friday, September 6th. Royal Bank of Canada reissued a "sector perform" rating and set a $23.00 price target on shares of Phreesia in a research report on Friday, September 27th. JPMorgan Chase & Co. boosted their price target on Phreesia from $27.00 to $28.00 and gave the stock an "overweight" rating in a research report on Monday, September 9th. Needham & Company LLC reissued a "buy" rating and set a $29.00 price target on shares of Phreesia in a research report on Thursday, September 5th. Finally, DA Davidson reissued a "buy" rating and set a $32.00 price target on shares of Phreesia in a research report on Thursday, September 5th. One research analyst has rated the stock with a hold rating and eleven have given a buy rating to the company. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $29.42.

Check Out Our Latest Stock Analysis on PHR

Phreesia Profile

(

Free Report)

Phreesia, Inc provides an integrated SaaS-based software and payment platform for the healthcare industry in the United States and Canada. The company offers access solutions that offers appointment scheduling system for online appointments, reminders, and referral tracking management; registration solution to automate patient self-registration; revenue cycle solution, which offer insurance-verification processes, point-of-sale payments applications, post-visit payment collection, and flexible payment options; and network connect solution to deliver clinically relevant content to patients.

Featured Stories

Before you consider Phreesia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Phreesia wasn't on the list.

While Phreesia currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.