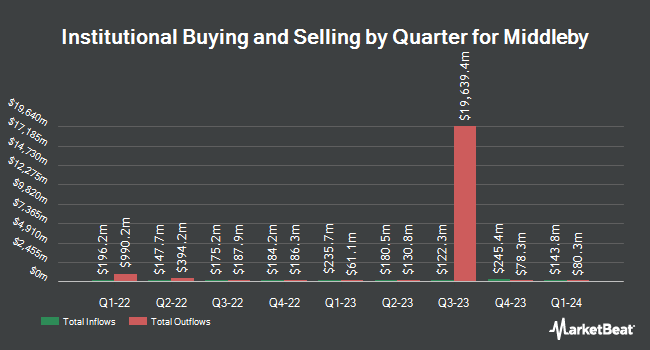

Quest Partners LLC lifted its stake in shares of The Middleby Co. (NASDAQ:MIDD - Free Report) by 142,460.0% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 7,128 shares of the industrial products company's stock after buying an additional 7,123 shares during the quarter. Quest Partners LLC's holdings in Middleby were worth $992,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other hedge funds have also made changes to their positions in MIDD. Epoch Investment Partners Inc. lifted its stake in Middleby by 421.5% in the first quarter. Epoch Investment Partners Inc. now owns 356,714 shares of the industrial products company's stock valued at $57,356,000 after buying an additional 288,314 shares during the last quarter. Tidal Investments LLC boosted its position in Middleby by 278.9% during the 1st quarter. Tidal Investments LLC now owns 9,060 shares of the industrial products company's stock worth $1,457,000 after acquiring an additional 6,669 shares during the period. Vanguard Group Inc. boosted its position in Middleby by 0.3% during the 1st quarter. Vanguard Group Inc. now owns 5,113,286 shares of the industrial products company's stock worth $822,165,000 after acquiring an additional 15,798 shares during the period. Cornercap Investment Counsel Inc. acquired a new stake in shares of Middleby during the 2nd quarter valued at about $500,000. Finally, Addenda Capital Inc. lifted its holdings in shares of Middleby by 8.5% during the 2nd quarter. Addenda Capital Inc. now owns 57,645 shares of the industrial products company's stock valued at $7,068,000 after buying an additional 4,512 shares during the last quarter. Institutional investors and hedge funds own 98.55% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities research analysts have issued reports on the company. JPMorgan Chase & Co. upped their target price on Middleby from $118.00 to $120.00 and gave the stock an "underweight" rating in a research report on Friday, August 2nd. Canaccord Genuity Group restated a "buy" rating and issued a $164.00 target price on shares of Middleby in a research note on Saturday, September 14th. Canaccord Genuity Group cut their target price on Middleby from $164.00 to $155.00 and set a "buy" rating for the company in a research note on Friday, November 1st. StockNews.com upgraded Middleby from a "hold" rating to a "buy" rating in a research note on Monday, November 4th. Finally, Robert W. Baird increased their target price on Middleby from $155.00 to $169.00 and gave the stock an "outperform" rating in a report on Friday, August 2nd. One research analyst has rated the stock with a sell rating, two have assigned a hold rating and six have assigned a buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $154.67.

Check Out Our Latest Stock Analysis on Middleby

Middleby Price Performance

Middleby stock opened at $135.73 on Thursday. The company has a quick ratio of 1.70, a current ratio of 2.81 and a debt-to-equity ratio of 0.66. The Middleby Co. has a 12-month low of $118.41 and a 12-month high of $161.01. The stock has a market cap of $7.30 billion, a price-to-earnings ratio of 18.72 and a beta of 1.58. The business's 50-day simple moving average is $137.32 and its 200 day simple moving average is $133.36.

Middleby (NASDAQ:MIDD - Get Free Report) last issued its earnings results on Thursday, October 31st. The industrial products company reported $2.33 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $2.48 by ($0.15). The company had revenue of $942.81 million for the quarter, compared to the consensus estimate of $996.60 million. Middleby had a return on equity of 14.66% and a net margin of 10.14%. Middleby's quarterly revenue was down 3.9% on a year-over-year basis. During the same quarter last year, the business posted $2.35 EPS. As a group, research analysts anticipate that The Middleby Co. will post 9.2 earnings per share for the current year.

Middleby Profile

(

Free Report)

The Middleby Corporation designs, markets, manufactures, distributes, and services foodservice, food processing, and residential kitchen equipment worldwide. Its Commercial Foodservice Equipment Group segment offers conveyor, combi, convection, baking, proofing, deck, speed cooking, and hydrovection ovens; ranges, fryers, and rethermalizers; steam cooking, food warming, catering, induction cooking, and countertop cooking equipment; heated cabinets, charbroilers, ventless cooking systems, kitchen ventilation, toasters, griddles, charcoal grills, professional mixers, stainless steel fabrication, custom millwork, professional refrigerators, blast chillers, cold rooms, ice machines, and freezers; soft serve ice cream, coffee and beverage dispensing, home and professional craft brewing equipment; and fry dispensers, bottle filling and canning equipment, IoT solutions, and controls development and manufacturing.

See Also

Before you consider Middleby, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Middleby wasn't on the list.

While Middleby currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.