Quest Partners LLC purchased a new position in shares of Vital Energy, Inc. (NYSE:VTLE - Free Report) during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund purchased 25,771 shares of the company's stock, valued at approximately $693,000. Quest Partners LLC owned 0.07% of Vital Energy as of its most recent SEC filing.

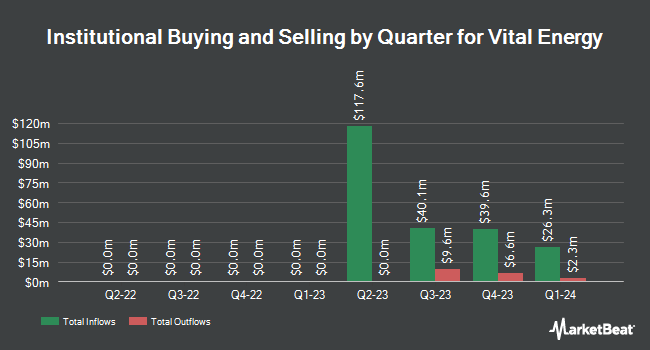

Several other institutional investors also recently added to or reduced their stakes in VTLE. Edgestream Partners L.P. purchased a new position in shares of Vital Energy during the second quarter worth about $4,250,000. Raymond James & Associates grew its stake in shares of Vital Energy by 96.8% in the 3rd quarter. Raymond James & Associates now owns 145,167 shares of the company's stock valued at $3,905,000 after purchasing an additional 71,385 shares during the last quarter. Dimensional Fund Advisors LP increased its holdings in shares of Vital Energy by 19.6% in the second quarter. Dimensional Fund Advisors LP now owns 1,723,075 shares of the company's stock valued at $77,227,000 after purchasing an additional 282,574 shares during the period. Sei Investments Co. raised its stake in shares of Vital Energy by 52.3% during the second quarter. Sei Investments Co. now owns 66,126 shares of the company's stock worth $2,964,000 after purchasing an additional 22,711 shares during the last quarter. Finally, Victory Capital Management Inc. lifted its holdings in shares of Vital Energy by 800.9% during the second quarter. Victory Capital Management Inc. now owns 541,337 shares of the company's stock worth $24,263,000 after purchasing an additional 481,248 shares during the period. Institutional investors and hedge funds own 86.54% of the company's stock.

Insider Activity at Vital Energy

In other news, COO Kathryn Anne Hill sold 2,023 shares of the stock in a transaction dated Tuesday, October 8th. The shares were sold at an average price of $30.22, for a total transaction of $61,135.06. Following the transaction, the chief operating officer now directly owns 29,091 shares in the company, valued at $879,130.02. This represents a 6.50 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, CFO Bryan Lemmerman sold 10,000 shares of the stock in a transaction that occurred on Thursday, October 10th. The stock was sold at an average price of $28.54, for a total transaction of $285,400.00. Following the transaction, the chief financial officer now directly owns 77,516 shares in the company, valued at approximately $2,212,306.64. This represents a 11.43 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 17,168 shares of company stock valued at $502,017 over the last quarter. Insiders own 1.20% of the company's stock.

Wall Street Analyst Weigh In

VTLE has been the subject of a number of analyst reports. Wells Fargo & Company upped their price objective on shares of Vital Energy from $29.00 to $35.00 and gave the stock an "equal weight" rating in a research report on Tuesday. Truist Financial reduced their price objective on shares of Vital Energy from $66.00 to $48.00 and set a "buy" rating for the company in a research report on Monday, September 30th. Mizuho dropped their target price on Vital Energy from $42.00 to $39.00 and set a "neutral" rating on the stock in a research report on Thursday, October 10th. Piper Sandler reduced their price target on Vital Energy from $37.00 to $35.00 and set a "neutral" rating for the company in a report on Monday, November 18th. Finally, BMO Capital Markets decreased their price target on Vital Energy from $48.00 to $40.00 and set a "market perform" rating on the stock in a research note on Friday, October 4th. Three research analysts have rated the stock with a sell rating, five have given a hold rating and three have issued a buy rating to the company. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $47.09.

Check Out Our Latest Research Report on Vital Energy

Vital Energy Price Performance

VTLE traded up $0.08 during midday trading on Friday, reaching $32.88. 474,343 shares of the company's stock were exchanged, compared to its average volume of 845,440. Vital Energy, Inc. has a 1-year low of $25.85 and a 1-year high of $58.30. The stock has a market capitalization of $1.25 billion, a PE ratio of 2.30 and a beta of 3.16. The company has a debt-to-equity ratio of 0.80, a current ratio of 0.67 and a quick ratio of 0.67. The business's 50-day moving average price is $28.97 and its 200 day moving average price is $37.49.

Vital Energy (NYSE:VTLE - Get Free Report) last posted its earnings results on Wednesday, November 6th. The company reported $1.61 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.46 by $0.15. The firm had revenue of $459.23 million for the quarter, compared to analyst estimates of $461.58 million. Vital Energy had a return on equity of 9.05% and a net margin of 25.09%. Vital Energy's revenue was up 5.4% on a year-over-year basis. During the same quarter in the prior year, the company earned $5.16 EPS. As a group, equities analysts anticipate that Vital Energy, Inc. will post 6.9 EPS for the current fiscal year.

Vital Energy Company Profile

(

Free Report)

Vital Energy, Inc, an independent energy company, engages in the acquisition, exploration, and development of oil and natural gas properties in the Permian Basin of West Texas, the United States. The company was formerly known as Laredo Petroleum, Inc and changed its name to Vital Energy, Inc in January 2023.

See Also

Before you consider Vital Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vital Energy wasn't on the list.

While Vital Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.