Quest Partners LLC acquired a new position in shares of Hillenbrand, Inc. (NYSE:HI - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor acquired 50,826 shares of the company's stock, valued at approximately $1,413,000. Quest Partners LLC owned 0.07% of Hillenbrand as of its most recent SEC filing.

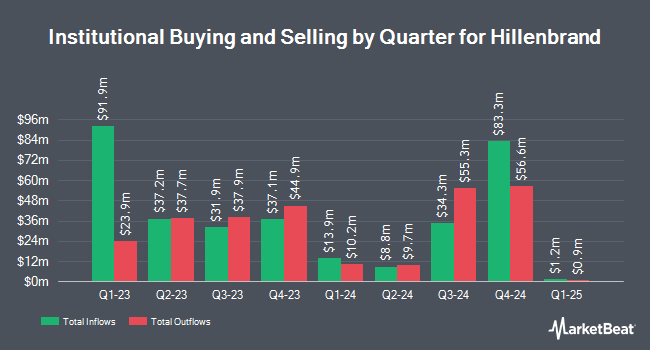

Several other hedge funds have also recently bought and sold shares of HI. O Shaughnessy Asset Management LLC grew its position in Hillenbrand by 2.3% in the first quarter. O Shaughnessy Asset Management LLC now owns 11,530 shares of the company's stock valued at $580,000 after acquiring an additional 259 shares during the last quarter. GAMMA Investing LLC boosted its stake in shares of Hillenbrand by 58.2% during the second quarter. GAMMA Investing LLC now owns 712 shares of the company's stock valued at $28,000 after purchasing an additional 262 shares in the last quarter. GHP Investment Advisors Inc. boosted its stake in shares of Hillenbrand by 0.6% during the second quarter. GHP Investment Advisors Inc. now owns 51,414 shares of the company's stock valued at $2,058,000 after purchasing an additional 320 shares in the last quarter. LRI Investments LLC boosted its stake in shares of Hillenbrand by 15.0% during the second quarter. LRI Investments LLC now owns 2,679 shares of the company's stock valued at $107,000 after purchasing an additional 349 shares in the last quarter. Finally, Arizona State Retirement System boosted its stake in shares of Hillenbrand by 1.9% during the second quarter. Arizona State Retirement System now owns 19,639 shares of the company's stock valued at $786,000 after purchasing an additional 368 shares in the last quarter. 89.09% of the stock is owned by institutional investors.

Hillenbrand Stock Up 1.3 %

Shares of HI traded up $0.41 during trading hours on Wednesday, reaching $31.84. The stock had a trading volume of 459,586 shares, compared to its average volume of 392,538. Hillenbrand, Inc. has a 12 month low of $25.11 and a 12 month high of $50.58. The firm has a 50-day simple moving average of $28.21 and a 200 day simple moving average of $35.86. The company has a current ratio of 1.27, a quick ratio of 0.83 and a debt-to-equity ratio of 1.28. The company has a market capitalization of $2.24 billion, a price-to-earnings ratio of -10.51 and a beta of 1.38.

Hillenbrand (NYSE:HI - Get Free Report) last issued its earnings results on Wednesday, November 13th. The company reported $1.01 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.93 by $0.08. Hillenbrand had a positive return on equity of 14.86% and a negative net margin of 6.63%. The company had revenue of $837.60 million for the quarter, compared to analysts' expectations of $793.38 million. During the same period last year, the business earned $1.13 EPS. Hillenbrand's quarterly revenue was up 9.8% compared to the same quarter last year. Equities research analysts predict that Hillenbrand, Inc. will post 3.05 earnings per share for the current fiscal year.

Hillenbrand Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, September 30th. Shareholders of record on Monday, September 16th were paid a dividend of $0.2225 per share. The ex-dividend date of this dividend was Monday, September 16th. This is a boost from Hillenbrand's previous quarterly dividend of $0.22. This represents a $0.89 annualized dividend and a yield of 2.80%. Hillenbrand's dividend payout ratio (DPR) is -29.77%.

Analysts Set New Price Targets

A number of research firms recently commented on HI. DA Davidson reaffirmed a "neutral" rating and issued a $33.00 price objective on shares of Hillenbrand in a research note on Friday, November 15th. StockNews.com lowered Hillenbrand from a "hold" rating to a "sell" rating in a research note on Thursday, November 14th. Finally, KeyCorp dropped their price target on Hillenbrand from $45.00 to $40.00 and set an "overweight" rating on the stock in a research note on Thursday, November 14th. One research analyst has rated the stock with a sell rating, one has issued a hold rating, one has assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, Hillenbrand currently has an average rating of "Moderate Buy" and a consensus price target of $44.67.

Check Out Our Latest Analysis on HI

Hillenbrand Profile

(

Free Report)

Hillenbrand, Inc operates as an industrial company in the United States and internationally. The company operates through two segments, Advanced Process Solutions and Molding Technology Solutions. The Advanced Process Solutions segment designs, engineers, manufactures, markets, and services process and material handling equipment and systems comprising compounding, extrusion, and material handling equipment, equipment system design services, as well as offers mixing technology, ingredient automation, and portion process; and provides screening and separating equipment for various industries, including plastics, food and pharmaceuticals, chemicals, fertilizers, minerals, energy, wastewater treatment, forest products, and other general industrials.

See Also

Before you consider Hillenbrand, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hillenbrand wasn't on the list.

While Hillenbrand currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.