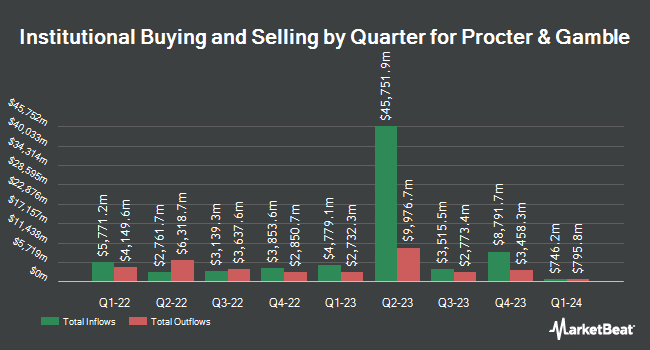

Quest Partners LLC grew its position in The Procter & Gamble Company (NYSE:PG - Free Report) by 3,831.2% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 8,688 shares of the company's stock after buying an additional 8,467 shares during the period. Quest Partners LLC's holdings in Procter & Gamble were worth $1,505,000 at the end of the most recent quarter.

Other institutional investors and hedge funds also recently modified their holdings of the company. Itau Unibanco Holding S.A. bought a new stake in shares of Procter & Gamble in the second quarter worth approximately $28,000. Fairway Wealth LLC purchased a new position in Procter & Gamble in the second quarter worth $29,000. POM Investment Strategies LLC acquired a new stake in Procter & Gamble in the 2nd quarter worth about $34,000. Fairfield Financial Advisors LTD acquired a new position in shares of Procter & Gamble in the 2nd quarter worth approximately $44,000. Finally, Kings Path Partners LLC bought a new stake in shares of Procter & Gamble in the 2nd quarter worth $45,000. 65.77% of the stock is owned by institutional investors.

Analysts Set New Price Targets

PG has been the subject of a number of research analyst reports. Barclays cut Procter & Gamble from an "overweight" rating to an "equal weight" rating and set a $163.00 price target for the company. in a report on Monday, September 30th. Hsbc Global Res upgraded shares of Procter & Gamble to a "strong-buy" rating in a research report on Friday, October 4th. TD Cowen began coverage on shares of Procter & Gamble in a research note on Tuesday, July 23rd. They set a "buy" rating and a $189.00 price objective for the company. JPMorgan Chase & Co. increased their price target on shares of Procter & Gamble from $179.00 to $186.00 and gave the stock an "overweight" rating in a research report on Thursday, September 19th. Finally, Piper Sandler began coverage on shares of Procter & Gamble in a report on Tuesday, September 24th. They set a "neutral" rating and a $174.00 price objective for the company. Nine investment analysts have rated the stock with a hold rating, thirteen have assigned a buy rating and two have assigned a strong buy rating to the stock. According to MarketBeat.com, Procter & Gamble currently has an average rating of "Moderate Buy" and a consensus target price of $177.00.

View Our Latest Report on Procter & Gamble

Insider Transactions at Procter & Gamble

In other news, CEO Ma. Fatima Francisco sold 96,000 shares of the business's stock in a transaction that occurred on Thursday, August 22nd. The stock was sold at an average price of $170.00, for a total value of $16,320,000.00. Following the transaction, the chief executive officer now directly owns 13,721 shares of the company's stock, valued at $2,332,570. The trade was a 87.49 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CFO Andre Schulten sold 13,041 shares of the firm's stock in a transaction that occurred on Monday, August 26th. The stock was sold at an average price of $170.00, for a total transaction of $2,216,970.00. Following the sale, the chief financial officer now owns 37,208 shares of the company's stock, valued at $6,325,360. This trade represents a 25.95 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 270,727 shares of company stock worth $46,014,037. Insiders own 0.18% of the company's stock.

Procter & Gamble Price Performance

NYSE PG traded up $0.13 on Wednesday, reaching $170.89. The company's stock had a trading volume of 7,081,116 shares, compared to its average volume of 6,674,260. The stock has a market cap of $402.45 billion, a PE ratio of 29.37, a PEG ratio of 3.67 and a beta of 0.42. The Procter & Gamble Company has a twelve month low of $142.50 and a twelve month high of $177.94. The company has a debt-to-equity ratio of 0.50, a quick ratio of 0.55 and a current ratio of 0.75. The firm's 50 day moving average is $170.07 and its two-hundred day moving average is $168.49.

Procter & Gamble (NYSE:PG - Get Free Report) last posted its quarterly earnings results on Friday, October 18th. The company reported $1.93 earnings per share for the quarter, topping the consensus estimate of $1.90 by $0.03. Procter & Gamble had a return on equity of 33.25% and a net margin of 17.07%. The firm had revenue of $21.74 billion for the quarter, compared to analyst estimates of $21.99 billion. During the same quarter in the previous year, the firm earned $1.83 EPS. The business's quarterly revenue was down .6% on a year-over-year basis. As a group, sell-side analysts predict that The Procter & Gamble Company will post 6.94 EPS for the current year.

Procter & Gamble Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, November 15th. Shareholders of record on Friday, October 18th were issued a $1.0065 dividend. The ex-dividend date of this dividend was Friday, October 18th. This represents a $4.03 dividend on an annualized basis and a yield of 2.36%. Procter & Gamble's dividend payout ratio is presently 69.48%.

Procter & Gamble Profile

(

Free Report)

The Procter & Gamble Company engages in the provision of branded consumer packaged goods worldwide. The company operates through five segments: Beauty; Grooming; Health Care; Fabric & Home Care; and Baby, Feminine & Family Care. The Beauty segment offers conditioners, shampoos, styling aids, and treatments under the Head & Shoulders, Herbal Essences, Pantene, and Rejoice brands; and antiperspirants and deodorants, personal cleansing, and skin care products under the Olay, Old Spice, Safeguard, Secret, SK-II, and Native brands.

Read More

Before you consider Procter & Gamble, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Procter & Gamble wasn't on the list.

While Procter & Gamble currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.