Quest Partners LLC acquired a new position in Enovis Co. (NYSE:ENOV - Free Report) in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 17,202 shares of the company's stock, valued at approximately $741,000.

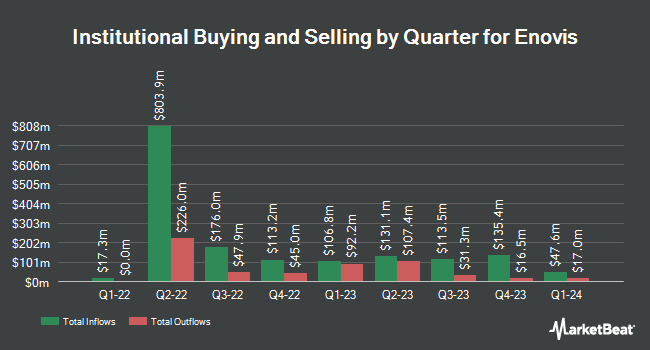

Other large investors have also recently bought and sold shares of the company. Price T Rowe Associates Inc. MD raised its position in Enovis by 88.8% in the first quarter. Price T Rowe Associates Inc. MD now owns 381,118 shares of the company's stock worth $23,802,000 after acquiring an additional 179,276 shares in the last quarter. Janus Henderson Group PLC increased its position in shares of Enovis by 100.6% in the first quarter. Janus Henderson Group PLC now owns 378,020 shares of the company's stock valued at $23,606,000 after buying an additional 189,584 shares in the last quarter. First Eagle Investment Management LLC increased its position in shares of Enovis by 13.3% in the second quarter. First Eagle Investment Management LLC now owns 284,596 shares of the company's stock valued at $12,864,000 after buying an additional 33,300 shares in the last quarter. Sei Investments Co. increased its position in shares of Enovis by 50.9% in the second quarter. Sei Investments Co. now owns 223,358 shares of the company's stock valued at $10,096,000 after buying an additional 75,317 shares in the last quarter. Finally, King Luther Capital Management Corp increased its position in shares of Enovis by 45.2% in the second quarter. King Luther Capital Management Corp now owns 177,862 shares of the company's stock valued at $8,039,000 after buying an additional 55,385 shares in the last quarter. Hedge funds and other institutional investors own 98.45% of the company's stock.

Wall Street Analyst Weigh In

A number of brokerages have recently weighed in on ENOV. JPMorgan Chase & Co. dropped their price target on Enovis from $53.00 to $50.00 and set a "neutral" rating for the company in a research report on Thursday, August 8th. Needham & Company LLC reiterated a "buy" rating and set a $65.00 price objective on shares of Enovis in a research report on Thursday, November 7th. Evercore ISI dropped their price objective on Enovis from $62.00 to $58.00 and set an "outperform" rating for the company in a research report on Tuesday, October 1st. Finally, JMP Securities assumed coverage on Enovis in a research report on Thursday, October 3rd. They set an "outperform" rating and a $62.00 price objective for the company. One equities research analyst has rated the stock with a hold rating and eight have assigned a buy rating to the company. According to MarketBeat.com, Enovis currently has an average rating of "Moderate Buy" and a consensus target price of $67.00.

Read Our Latest Stock Analysis on Enovis

Enovis Trading Up 1.1 %

NYSE:ENOV traded up $0.49 during mid-day trading on Friday, reaching $46.66. The company's stock had a trading volume of 604,677 shares, compared to its average volume of 581,321. The company's fifty day simple moving average is $42.63 and its two-hundred day simple moving average is $45.04. The company has a debt-to-equity ratio of 0.40, a current ratio of 2.27 and a quick ratio of 1.12. Enovis Co. has a twelve month low of $38.27 and a twelve month high of $65.03. The stock has a market cap of $2.61 billion, a P/E ratio of -21.13 and a beta of 1.91.

Enovis (NYSE:ENOV - Get Free Report) last released its quarterly earnings data on Wednesday, November 6th. The company reported $0.73 earnings per share for the quarter, beating the consensus estimate of $0.62 by $0.11. The business had revenue of $505.22 million for the quarter, compared to analyst estimates of $504.44 million. Enovis had a positive return on equity of 4.39% and a negative net margin of 5.95%. The company's revenue was up 21.0% compared to the same quarter last year. During the same period in the previous year, the company posted $0.56 EPS. On average, equities analysts predict that Enovis Co. will post 2.79 EPS for the current year.

Enovis Profile

(

Free Report)

Enovis Corporation operates as a medical technology company focus on developing clinically differentiated solutions worldwide. It also manufactures and distributes medical devices which are used for reconstructive surgery, rehabilitation, pain management, and physical therapy. The company operates through Prevention and Recovery, and Reconstructive segments.

Featured Articles

Before you consider Enovis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enovis wasn't on the list.

While Enovis currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.