Quest Partners LLC raised its holdings in shares of FirstEnergy Corp. (NYSE:FE - Free Report) by 85.5% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 91,590 shares of the utilities provider's stock after buying an additional 42,222 shares during the quarter. FirstEnergy comprises about 0.4% of Quest Partners LLC's portfolio, making the stock its 11th biggest holding. Quest Partners LLC's holdings in FirstEnergy were worth $4,062,000 at the end of the most recent quarter.

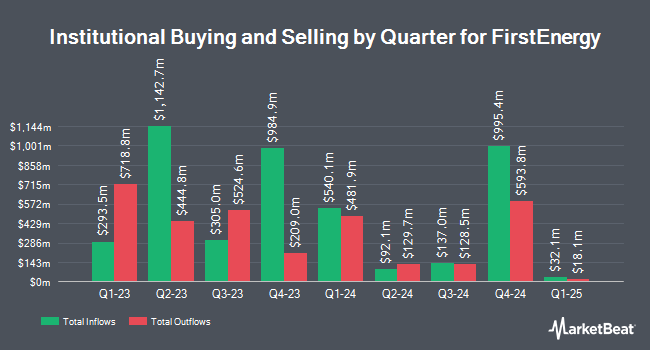

Several other hedge funds and other institutional investors have also recently modified their holdings of FE. Capital World Investors raised its holdings in FirstEnergy by 14.3% in the 1st quarter. Capital World Investors now owns 77,928,914 shares of the utilities provider's stock valued at $3,009,615,000 after buying an additional 9,773,785 shares during the period. Assenagon Asset Management S.A. grew its position in FirstEnergy by 1,417.3% in the 3rd quarter. Assenagon Asset Management S.A. now owns 743,303 shares of the utilities provider's stock valued at $32,965,000 after acquiring an additional 694,313 shares in the last quarter. Allspring Global Investments Holdings LLC lifted its position in shares of FirstEnergy by 5.3% during the third quarter. Allspring Global Investments Holdings LLC now owns 9,098,472 shares of the utilities provider's stock worth $403,517,000 after purchasing an additional 457,231 shares in the last quarter. Point72 Asset Management L.P. acquired a new stake in FirstEnergy during the 2nd quarter worth approximately $14,933,000. Finally, Los Angeles Capital Management LLC increased its position in shares of FirstEnergy by 1,178.5% during the second quarter. Los Angeles Capital Management LLC now owns 286,824 shares of the utilities provider's stock worth $10,977,000 after acquiring an additional 264,389 shares during the period. 89.41% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

FE has been the subject of a number of recent research reports. Bank of America lifted their price target on shares of FirstEnergy from $42.00 to $43.00 and gave the stock an "underperform" rating in a research note on Thursday, August 29th. Scotiabank upped their target price on shares of FirstEnergy from $40.00 to $45.00 and gave the company a "sector perform" rating in a report on Tuesday, August 20th. JPMorgan Chase & Co. raised their price objective on FirstEnergy from $45.00 to $46.00 and gave the stock a "neutral" rating in a report on Friday, October 18th. Morgan Stanley increased their price objective on FirstEnergy from $48.00 to $51.00 and gave the company an "overweight" rating in a report on Wednesday, September 25th. Finally, Argus upgraded shares of FirstEnergy from a "hold" rating to a "buy" rating and set a $50.00 price target for the company in a research report on Friday, September 20th. One analyst has rated the stock with a sell rating, eight have given a hold rating and four have assigned a buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $46.00.

Check Out Our Latest Analysis on FE

FirstEnergy Stock Up 0.4 %

Shares of FE stock traded up $0.18 during trading hours on Monday, hitting $41.69. 2,565,017 shares of the company were exchanged, compared to its average volume of 2,956,812. The company has a debt-to-equity ratio of 1.58, a quick ratio of 0.46 and a current ratio of 0.56. The business's 50-day simple moving average is $43.07 and its two-hundred day simple moving average is $41.38. The stock has a market capitalization of $24.03 billion, a price-to-earnings ratio of 26.90, a P/E/G ratio of 2.23 and a beta of 0.51. FirstEnergy Corp. has a one year low of $35.41 and a one year high of $44.97.

FirstEnergy (NYSE:FE - Get Free Report) last posted its earnings results on Tuesday, October 29th. The utilities provider reported $0.85 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.90 by ($0.05). The company had revenue of $3.73 billion during the quarter, compared to the consensus estimate of $3.96 billion. FirstEnergy had a net margin of 6.64% and a return on equity of 11.38%. The business's quarterly revenue was up 6.9% compared to the same quarter last year. During the same quarter in the previous year, the business posted $0.88 earnings per share. Sell-side analysts predict that FirstEnergy Corp. will post 2.69 EPS for the current fiscal year.

FirstEnergy Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Sunday, December 1st. Investors of record on Thursday, November 7th will be given a $0.425 dividend. The ex-dividend date of this dividend is Thursday, November 7th. This represents a $1.70 dividend on an annualized basis and a yield of 4.08%. FirstEnergy's dividend payout ratio is presently 109.68%.

About FirstEnergy

(

Free Report)

FirstEnergy Corp., through its subsidiaries, generates, transmits, and distributes electricity in the United States. It operates through Regulated Distribution and Regulated Transmission segments. The company owns and operates coal-fired, nuclear, hydroelectric, wind, and solar power generating facilities.

Further Reading

Before you consider FirstEnergy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FirstEnergy wasn't on the list.

While FirstEnergy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.