Quest Partners LLC decreased its position in BILL Holdings, Inc. (NYSE:BILL - Free Report) by 66.9% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 5,486 shares of the company's stock after selling 11,094 shares during the quarter. Quest Partners LLC's holdings in BILL were worth $289,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

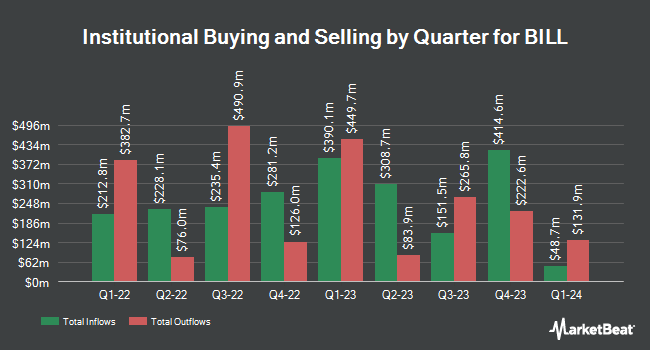

Several other hedge funds and other institutional investors have also bought and sold shares of BILL. UniSuper Management Pty Ltd grew its stake in shares of BILL by 100.0% during the first quarter. UniSuper Management Pty Ltd now owns 1,400 shares of the company's stock valued at $96,000 after buying an additional 700 shares during the last quarter. Advisors Asset Management Inc. grew its position in BILL by 75.0% during the 1st quarter. Advisors Asset Management Inc. now owns 658 shares of the company's stock worth $45,000 after acquiring an additional 282 shares during the last quarter. Levin Capital Strategies L.P. purchased a new position in BILL in the 1st quarter worth approximately $275,000. Plato Investment Management Ltd bought a new stake in BILL in the first quarter valued at approximately $367,000. Finally, DekaBank Deutsche Girozentrale boosted its stake in shares of BILL by 4.0% during the first quarter. DekaBank Deutsche Girozentrale now owns 6,749 shares of the company's stock valued at $449,000 after purchasing an additional 257 shares during the period. Hedge funds and other institutional investors own 97.99% of the company's stock.

Analysts Set New Price Targets

A number of equities research analysts recently commented on BILL shares. BMO Capital Markets lowered their price target on shares of BILL from $75.00 to $57.00 and set a "market perform" rating for the company in a report on Monday, August 26th. Piper Sandler upped their price objective on shares of BILL from $60.00 to $85.00 and gave the company an "overweight" rating in a research note on Friday, November 8th. The Goldman Sachs Group increased their target price on shares of BILL from $60.00 to $77.00 and gave the stock a "neutral" rating in a report on Tuesday, November 12th. BNP Paribas upgraded BILL from a "neutral" rating to an "outperform" rating and set a $90.00 price target on the stock in a report on Thursday, September 12th. Finally, Mizuho lowered their price target on BILL from $60.00 to $52.00 and set a "neutral" rating for the company in a research report on Wednesday, August 28th. One research analyst has rated the stock with a sell rating, nine have assigned a hold rating and ten have given a buy rating to the company's stock. According to MarketBeat, the stock has an average rating of "Hold" and an average price target of $75.78.

Check Out Our Latest Research Report on BILL

Insider Buying and Selling

In other BILL news, Director Alison Wagonfeld sold 519 shares of the stock in a transaction that occurred on Monday, October 21st. The shares were sold at an average price of $57.50, for a total value of $29,842.50. Following the transaction, the director now directly owns 1,038 shares in the company, valued at approximately $59,685. This trade represents a 33.33 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, SVP Germaine Cota sold 803 shares of BILL stock in a transaction on Friday, August 30th. The stock was sold at an average price of $54.75, for a total transaction of $43,964.25. Following the transaction, the senior vice president now owns 6,861 shares in the company, valued at $375,639.75. This represents a 10.48 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 6,112 shares of company stock valued at $398,910 over the last 90 days. Company insiders own 4.20% of the company's stock.

BILL Stock Performance

BILL traded down $0.91 during midday trading on Tuesday, hitting $92.85. 1,384,180 shares of the company traded hands, compared to its average volume of 1,923,020. The company has a quick ratio of 1.53, a current ratio of 1.53 and a debt-to-equity ratio of 0.23. BILL Holdings, Inc. has a 52 week low of $43.11 and a 52 week high of $94.28. The firm has a market capitalization of $9.61 billion, a PE ratio of -281.09 and a beta of 1.59. The company's 50-day moving average is $63.10 and its 200 day moving average is $55.70.

BILL Profile

(

Free Report)

BILL Holdings, Inc provides financial automation software for small and midsize businesses worldwide. The company provides software-as-a-service, cloud-based payments, and spend management products, which allow users to automate accounts payable and accounts receivable transactions, as well as enable users to connect with their suppliers and/or customers to do business, eliminate expense reports, manage cash flows, and improve office efficiency.

Featured Articles

Before you consider BILL, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BILL wasn't on the list.

While BILL currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.