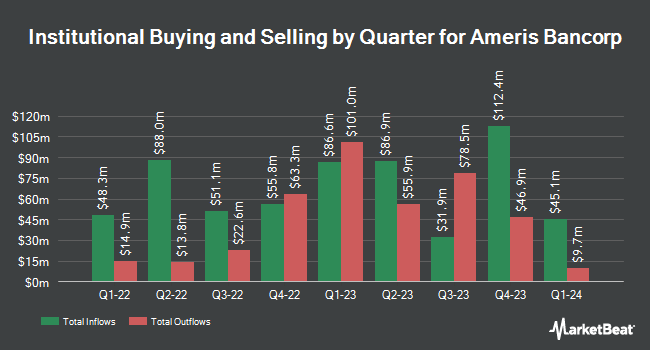

Quest Partners LLC decreased its position in shares of Ameris Bancorp (NASDAQ:ABCB - Free Report) by 82.7% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 9,391 shares of the bank's stock after selling 44,787 shares during the quarter. Quest Partners LLC's holdings in Ameris Bancorp were worth $586,000 at the end of the most recent reporting period.

Several other hedge funds also recently modified their holdings of the company. 1620 Investment Advisors Inc. bought a new position in Ameris Bancorp in the second quarter valued at about $33,000. Blue Trust Inc. raised its holdings in Ameris Bancorp by 249.5% in the 3rd quarter. Blue Trust Inc. now owns 713 shares of the bank's stock valued at $44,000 after buying an additional 509 shares during the last quarter. GAMMA Investing LLC boosted its position in Ameris Bancorp by 66.1% during the 2nd quarter. GAMMA Investing LLC now owns 819 shares of the bank's stock worth $41,000 after buying an additional 326 shares during the period. CWM LLC grew its holdings in Ameris Bancorp by 33.5% during the 2nd quarter. CWM LLC now owns 1,310 shares of the bank's stock worth $66,000 after acquiring an additional 329 shares during the last quarter. Finally, US Bancorp DE increased its position in Ameris Bancorp by 3,396.4% in the 3rd quarter. US Bancorp DE now owns 1,923 shares of the bank's stock valued at $120,000 after acquiring an additional 1,868 shares during the period. Institutional investors and hedge funds own 91.64% of the company's stock.

Analysts Set New Price Targets

ABCB has been the topic of a number of recent research reports. Raymond James upgraded shares of Ameris Bancorp from a "market perform" rating to an "outperform" rating and set a $67.00 price target on the stock in a report on Monday, October 28th. StockNews.com upgraded Ameris Bancorp from a "sell" rating to a "hold" rating in a research report on Thursday, October 31st. Stephens lifted their price objective on Ameris Bancorp from $64.00 to $67.00 and gave the stock an "equal weight" rating in a research note on Monday, October 28th. DA Davidson increased their target price on shares of Ameris Bancorp from $61.00 to $76.00 and gave the company a "buy" rating in a research report on Monday, July 29th. Finally, Keefe, Bruyette & Woods boosted their price target on shares of Ameris Bancorp from $60.00 to $65.00 and gave the stock an "outperform" rating in a research report on Monday, July 29th. Two research analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $66.67.

Check Out Our Latest Stock Report on Ameris Bancorp

Insider Activity at Ameris Bancorp

In other Ameris Bancorp news, Director Robert Dale Ezzell sold 8,000 shares of the firm's stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $69.91, for a total value of $559,280.00. Following the transaction, the director now directly owns 27,444 shares of the company's stock, valued at approximately $1,918,610.04. This trade represents a 22.57 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 5.50% of the stock is currently owned by corporate insiders.

Ameris Bancorp Trading Up 2.9 %

ABCB traded up $2.05 during trading on Friday, hitting $71.79. The company's stock had a trading volume of 417,788 shares, compared to its average volume of 414,888. The firm has a market capitalization of $4.96 billion, a P/E ratio of 14.96 and a beta of 1.01. Ameris Bancorp has a twelve month low of $41.00 and a twelve month high of $72.68. The stock's fifty day moving average price is $64.38 and its 200-day moving average price is $57.56. The company has a quick ratio of 1.01, a current ratio of 1.03 and a debt-to-equity ratio of 0.13.

Ameris Bancorp (NASDAQ:ABCB - Get Free Report) last released its earnings results on Thursday, October 24th. The bank reported $1.38 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.25 by $0.13. The company had revenue of $424.86 million for the quarter, compared to the consensus estimate of $290.60 million. Ameris Bancorp had a net margin of 20.08% and a return on equity of 9.18%. During the same quarter in the previous year, the company earned $1.16 EPS. Analysts anticipate that Ameris Bancorp will post 4.83 EPS for the current year.

Ameris Bancorp Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Monday, October 7th. Stockholders of record on Monday, September 30th were paid a $0.15 dividend. The ex-dividend date of this dividend was Monday, September 30th. This represents a $0.60 annualized dividend and a dividend yield of 0.84%. Ameris Bancorp's dividend payout ratio is presently 12.50%.

Ameris Bancorp Profile

(

Free Report)

Ameris Bancorp operates as the bank holding company for Ameris Bank that provides range of banking services to retail and commercial customers. It operates through five segments: Banking Division, Retail Mortgage Division, Warehouse Lending Division, SBA Division, and Premium Finance Division. The company offers commercial and retail checking, regular interest-bearing savings, money market, individual retirement, and certificates of deposit accounts.

Further Reading

Before you consider Ameris Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ameris Bancorp wasn't on the list.

While Ameris Bancorp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.