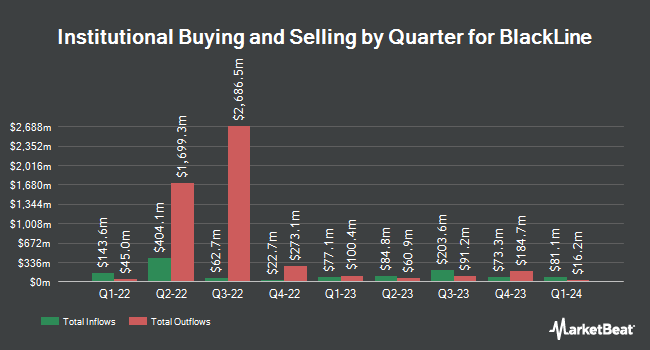

Quest Partners LLC purchased a new position in shares of BlackLine, Inc. (NASDAQ:BL - Free Report) in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 8,792 shares of the technology company's stock, valued at approximately $485,000.

A number of other institutional investors and hedge funds have also bought and sold shares of BL. EntryPoint Capital LLC bought a new position in shares of BlackLine in the first quarter worth $36,000. Quarry LP purchased a new position in shares of BlackLine during the second quarter worth approximately $32,000. 1620 Investment Advisors Inc. purchased a new stake in shares of BlackLine in the 2nd quarter worth about $64,000. Covestor Ltd raised its position in shares of BlackLine by 31.9% in the 3rd quarter. Covestor Ltd now owns 1,392 shares of the technology company's stock worth $77,000 after acquiring an additional 337 shares in the last quarter. Finally, Fifth Third Bancorp boosted its position in shares of BlackLine by 13.0% during the second quarter. Fifth Third Bancorp now owns 2,306 shares of the technology company's stock valued at $112,000 after purchasing an additional 266 shares in the last quarter. 95.13% of the stock is owned by hedge funds and other institutional investors.

Insider Activity

In other news, insider Karole Morgan-Prager sold 10,000 shares of the business's stock in a transaction dated Monday, September 30th. The stock was sold at an average price of $55.00, for a total value of $550,000.00. Following the completion of the transaction, the insider now owns 113,865 shares of the company's stock, valued at $6,262,575. The trade was a 8.07 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, CFO Mark Partin sold 5,648 shares of the company's stock in a transaction dated Friday, September 27th. The stock was sold at an average price of $53.00, for a total value of $299,344.00. Following the completion of the sale, the chief financial officer now owns 226,844 shares in the company, valued at $12,022,732. The trade was a 2.43 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 134,108 shares of company stock worth $7,488,826. Insiders own 9.93% of the company's stock.

Analysts Set New Price Targets

Several equities research analysts recently commented on the stock. Morgan Stanley boosted their price objective on shares of BlackLine from $70.00 to $80.00 and gave the stock an "overweight" rating in a research note on Friday, November 15th. Piper Sandler reissued a "neutral" rating and issued a $60.00 target price on shares of BlackLine in a report on Wednesday. JPMorgan Chase & Co. lifted their target price on shares of BlackLine from $47.00 to $50.00 and gave the stock an "underweight" rating in a report on Friday, October 25th. Robert W. Baird dropped their target price on shares of BlackLine from $72.00 to $65.00 and set an "outperform" rating on the stock in a report on Wednesday, August 7th. Finally, JMP Securities upped their price target on shares of BlackLine from $81.00 to $86.00 and gave the stock a "market outperform" rating in a research report on Friday. Two investment analysts have rated the stock with a sell rating, six have given a hold rating and four have given a buy rating to the stock. According to MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $64.10.

View Our Latest Analysis on BL

BlackLine Stock Up 1.6 %

Shares of NASDAQ:BL traded up $1.01 during trading hours on Friday, hitting $62.70. The company's stock had a trading volume of 576,984 shares, compared to its average volume of 728,996. The firm's fifty day moving average price is $56.26 and its 200 day moving average price is $51.70. BlackLine, Inc. has a 52 week low of $43.37 and a 52 week high of $69.31. The company has a market capitalization of $3.92 billion, a price-to-earnings ratio of 63.98, a P/E/G ratio of 14.48 and a beta of 0.90. The company has a debt-to-equity ratio of 2.42, a current ratio of 2.69 and a quick ratio of 2.69.

About BlackLine

(

Free Report)

BlackLine, Inc provides cloud-based solutions to automate and streamline accounting and finance operations worldwide. It offers financial close management solutions, such as account reconciliations that provides a centralized workspace for users to collaborate on account reconciliations; transaction matching that analyzes and reconciles individual transactions; task management to create and manage processes and task lists; and financial reporting analytics that enables analysis and validation of financial data.

See Also

Before you consider BlackLine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BlackLine wasn't on the list.

While BlackLine currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.