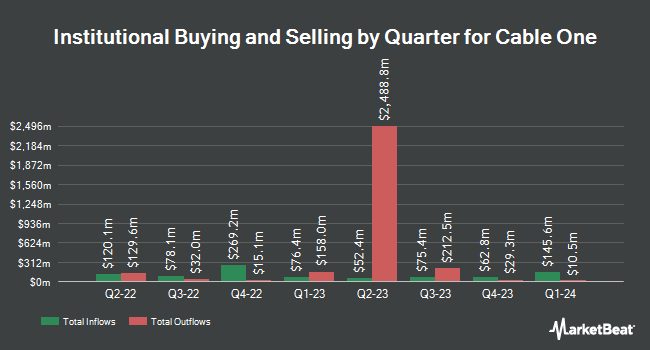

Quinn Opportunity Partners LLC cut its position in shares of Cable One, Inc. (NYSE:CABO - Free Report) by 29.7% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 8,978 shares of the company's stock after selling 3,793 shares during the period. Quinn Opportunity Partners LLC owned 0.16% of Cable One worth $3,251,000 at the end of the most recent quarter.

Several other hedge funds have also bought and sold shares of CABO. Rothschild & Co Wealth Management UK Ltd boosted its stake in shares of Cable One by 1.5% during the 4th quarter. Rothschild & Co Wealth Management UK Ltd now owns 294,400 shares of the company's stock worth $106,608,000 after acquiring an additional 4,352 shares during the period. Geode Capital Management LLC lifted its stake in shares of Cable One by 1.6% during the 3rd quarter. Geode Capital Management LLC now owns 118,170 shares of the company's stock worth $41,342,000 after buying an additional 1,839 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its holdings in shares of Cable One by 8.8% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 86,776 shares of the company's stock worth $31,423,000 after buying an additional 7,055 shares during the period. Raymond James Financial Inc. bought a new position in Cable One in the 4th quarter valued at about $28,129,000. Finally, Bank of New York Mellon Corp lifted its position in Cable One by 3.7% during the fourth quarter. Bank of New York Mellon Corp now owns 73,013 shares of the company's stock worth $26,439,000 after acquiring an additional 2,627 shares during the last quarter. 89.92% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

CABO has been the subject of several research reports. KeyCorp dropped their price target on Cable One from $825.00 to $650.00 and set an "overweight" rating for the company in a report on Friday, February 28th. Wells Fargo & Company dropped their price objective on shares of Cable One from $340.00 to $240.00 and set an "underweight" rating for the company in a research note on Friday, February 28th. Finally, JPMorgan Chase & Co. dropped their price target on shares of Cable One from $420.00 to $325.00 and set a "neutral" rating for the company in a research report on Monday, March 3rd.

Get Our Latest Stock Report on Cable One

Cable One Price Performance

NYSE CABO traded down $8.47 on Wednesday, hitting $250.42. 28,841 shares of the company's stock were exchanged, compared to its average volume of 145,228. The stock has a 50-day moving average of $266.04 and a 200-day moving average of $328.72. The stock has a market cap of $1.41 billion, a price-to-earnings ratio of 5.79 and a beta of 1.07. Cable One, Inc. has a 52 week low of $225.94 and a 52 week high of $436.99. The company has a current ratio of 0.93, a quick ratio of 0.93 and a debt-to-equity ratio of 1.84.

Cable One Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, March 7th. Shareholders of record on Tuesday, February 18th were paid a dividend of $2.95 per share. This represents a $11.80 annualized dividend and a yield of 4.71%. The ex-dividend date of this dividend was Tuesday, February 18th. Cable One's payout ratio is 229.57%.

Insider Transactions at Cable One

In other news, Director Wallace R. Weitz bought 1,000 shares of the stock in a transaction on Tuesday, March 4th. The stock was acquired at an average price of $244.02 per share, with a total value of $244,020.00. Following the acquisition, the director now directly owns 5,584 shares in the company, valued at approximately $1,362,607.68. This trade represents a 21.82 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Company insiders own 0.70% of the company's stock.

Cable One Profile

(

Free Report)

Cable One, Inc, together with its subsidiaries, provides data, video, and voice services in the United States. The company offers residential data services, a service to enhance Wi-Fi signal throughout the home. It also provides various residential video services from basic video service to digital services with access to hundreds of channels; and provides a cloud-based DVR feature that does not require the use of a set-top boxes.

See Also

Before you consider Cable One, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cable One wasn't on the list.

While Cable One currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.