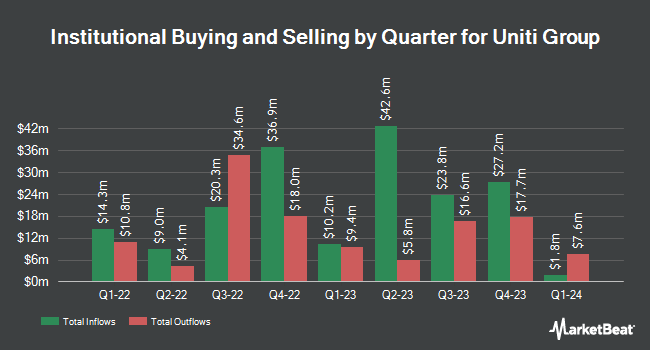

Quinn Opportunity Partners LLC bought a new position in shares of Uniti Group Inc. (NASDAQ:UNIT - Free Report) in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm bought 590,791 shares of the real estate investment trust's stock, valued at approximately $3,249,000. Quinn Opportunity Partners LLC owned about 0.24% of Uniti Group as of its most recent SEC filing.

A number of other institutional investors have also bought and sold shares of the company. Signaturefd LLC grew its stake in Uniti Group by 51.3% during the fourth quarter. Signaturefd LLC now owns 8,460 shares of the real estate investment trust's stock worth $47,000 after purchasing an additional 2,870 shares during the period. Proficio Capital Partners LLC acquired a new stake in shares of Uniti Group during the 4th quarter worth approximately $68,000. Virtu Financial LLC bought a new stake in shares of Uniti Group in the 3rd quarter valued at $70,000. Handelsbanken Fonder AB acquired a new position in shares of Uniti Group during the 4th quarter valued at $71,000. Finally, Diversified Trust Co bought a new position in Uniti Group during the fourth quarter worth $74,000. Institutional investors own 87.51% of the company's stock.

Uniti Group Price Performance

Shares of NASDAQ UNIT traded down $0.11 during mid-day trading on Wednesday, reaching $4.51. 893,421 shares of the company's stock traded hands, compared to its average volume of 2,719,101. The business has a 50-day simple moving average of $5.12 and a 200 day simple moving average of $5.46. The stock has a market cap of $1.10 billion, a P/E ratio of 11.00 and a beta of 1.57. Uniti Group Inc. has a 1-year low of $2.57 and a 1-year high of $6.31.

Uniti Group (NASDAQ:UNIT - Get Free Report) last posted its earnings results on Friday, February 21st. The real estate investment trust reported $0.35 earnings per share for the quarter, beating analysts' consensus estimates of $0.33 by $0.02. Uniti Group had a negative return on equity of 4.12% and a net margin of 8.82%. The company had revenue of $293.32 million for the quarter, compared to analyst estimates of $294.59 million. Equities research analysts anticipate that Uniti Group Inc. will post 1.28 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several brokerages have recently weighed in on UNIT. Royal Bank of Canada upped their price objective on shares of Uniti Group from $5.50 to $6.00 and gave the company a "sector perform" rating in a report on Monday, December 23rd. Raymond James upgraded Uniti Group from an "outperform" rating to a "strong-buy" rating and boosted their price objective for the company from $6.00 to $8.00 in a report on Monday, February 24th.

Get Our Latest Stock Analysis on UNIT

Uniti Group Company Profile

(

Free Report)

Uniti Group, Inc is a real estate investment trust company, which engages in the acquisition, construction, and leasing of properties. It operates through the following business segments: Uniti Leasing, Uniti Fiber, and Corporate. The Uniti Leasing segment involves mission-critical communications assets on exclusive or shared-tenant basis, and dark fiber network.

See Also

Before you consider Uniti Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Uniti Group wasn't on the list.

While Uniti Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.