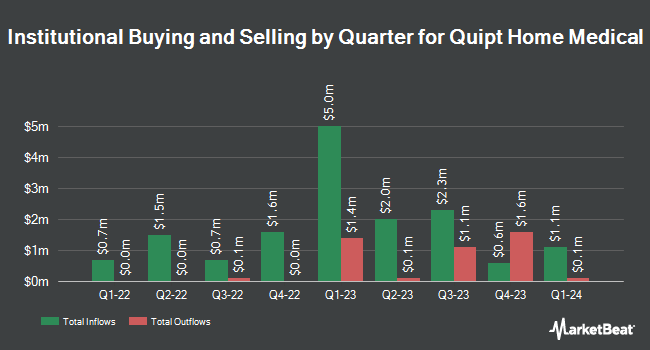

Forager Capital Management LLC grew its holdings in shares of Quipt Home Medical Corp. (NASDAQ:QIPT - Free Report) by 77.7% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 4,192,562 shares of the company's stock after acquiring an additional 1,833,590 shares during the quarter. Quipt Home Medical comprises 4.8% of Forager Capital Management LLC's investment portfolio, making the stock its 10th largest position. Forager Capital Management LLC owned about 9.73% of Quipt Home Medical worth $12,200,000 as of its most recent SEC filing.

Other large investors have also recently modified their holdings of the company. Barclays PLC raised its holdings in shares of Quipt Home Medical by 79.2% during the 3rd quarter. Barclays PLC now owns 87,425 shares of the company's stock valued at $256,000 after buying an additional 38,635 shares in the last quarter. XTX Topco Ltd purchased a new position in shares of Quipt Home Medical during the 3rd quarter valued at about $54,000. Jane Street Group LLC raised its holdings in shares of Quipt Home Medical by 28.5% during the 3rd quarter. Jane Street Group LLC now owns 41,926 shares of the company's stock valued at $122,000 after buying an additional 9,290 shares in the last quarter. State Street Corp raised its holdings in shares of Quipt Home Medical by 1.0% during the 3rd quarter. State Street Corp now owns 621,388 shares of the company's stock valued at $1,814,000 after buying an additional 6,317 shares in the last quarter. Finally, Atom Investors LP purchased a new position in shares of Quipt Home Medical during the 3rd quarter valued at about $51,000. Institutional investors own 42.85% of the company's stock.

Wall Street Analysts Forecast Growth

A number of brokerages recently weighed in on QIPT. Benchmark decreased their price objective on Quipt Home Medical from $9.00 to $7.00 and set a "buy" rating on the stock in a report on Wednesday, August 21st. Canaccord Genuity Group decreased their price target on Quipt Home Medical from $8.00 to $6.00 and set a "buy" rating on the stock in a research note on Friday, August 16th. One investment analyst has rated the stock with a sell rating, three have assigned a buy rating and two have given a strong buy rating to the company. Based on data from MarketBeat.com, the company presently has a consensus rating of "Buy" and an average price target of $6.25.

Check Out Our Latest Analysis on Quipt Home Medical

Quipt Home Medical Trading Down 0.7 %

Quipt Home Medical stock traded down $0.02 during trading hours on Wednesday, reaching $2.80. The company had a trading volume of 29,343 shares, compared to its average volume of 184,287. The company has a debt-to-equity ratio of 0.66, a current ratio of 1.11 and a quick ratio of 0.77. The company has a 50-day moving average price of $2.69 and a 200 day moving average price of $2.97. The firm has a market cap of $120.65 million, a price-to-earnings ratio of -25.64 and a beta of 0.62. Quipt Home Medical Corp. has a 12-month low of $2.34 and a 12-month high of $5.29.

Quipt Home Medical Company Profile

(

Free Report)

Quipt Home Medical Corp., through its subsidiaries, engages in the provision of durable and home medical equipment and supplies in the United States. The company offers nebulizers, oxygen concentrators, and CPAP and BiPAP units; traditional and non-traditional durable medical respiratory equipment and services; non-invasive ventilation equipment, supplies, and services; and engages in the rental of medical equipment.

See Also

Before you consider Quipt Home Medical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Quipt Home Medical wasn't on the list.

While Quipt Home Medical currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.