Quotient Wealth Partners LLC grew its position in shares of Vanguard Russell 1000 Value (NASDAQ:VONV - Free Report) by 87.4% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 8,288 shares of the company's stock after purchasing an additional 3,866 shares during the quarter. Quotient Wealth Partners LLC's holdings in Vanguard Russell 1000 Value were worth $673,000 as of its most recent SEC filing.

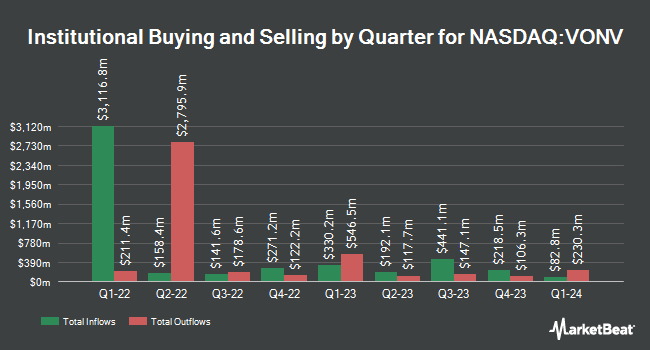

A number of other hedge funds have also recently made changes to their positions in VONV. DAVENPORT & Co LLC boosted its stake in shares of Vanguard Russell 1000 Value by 4,696.6% during the fourth quarter. DAVENPORT & Co LLC now owns 280,460 shares of the company's stock valued at $22,787,000 after purchasing an additional 274,613 shares in the last quarter. LPL Financial LLC raised its position in shares of Vanguard Russell 1000 Value by 18.7% during the third quarter. LPL Financial LLC now owns 1,434,011 shares of the company's stock worth $119,496,000 after acquiring an additional 226,324 shares during the last quarter. Highline Wealth Partners LLC bought a new position in shares of Vanguard Russell 1000 Value during the third quarter worth about $13,274,000. Raymond James & Associates raised its position in shares of Vanguard Russell 1000 Value by 19.8% during the third quarter. Raymond James & Associates now owns 902,596 shares of the company's stock worth $75,213,000 after acquiring an additional 149,035 shares during the last quarter. Finally, Strategic Financial Concepts LLC bought a new position in shares of Vanguard Russell 1000 Value during the fourth quarter worth about $8,272,000.

Vanguard Russell 1000 Value Stock Performance

Shares of VONV traded up $0.78 during mid-day trading on Thursday, reaching $85.52. 432,754 shares of the company were exchanged, compared to its average volume of 788,833. Vanguard Russell 1000 Value has a 52 week low of $72.73 and a 52 week high of $87.97. The stock has a market capitalization of $10.45 billion, a PE ratio of 17.49 and a beta of 0.95. The business has a 50 day simple moving average of $83.49 and a two-hundred day simple moving average of $83.02.

Vanguard Russell 1000 Value Announces Dividend

The business also recently disclosed a dividend, which was paid on Thursday, December 26th. Stockholders of record on Monday, December 23rd were given a dividend of $0.437 per share. The ex-dividend date of this dividend was Monday, December 23rd.

Vanguard Russell 1000 Value Company Profile

(

Free Report)

The Vanguard Russell 1000 Value ETF (VONV) is an exchange-traded fund that is based on the Russell 1000 Value index. The fund tracks an index of value stocks selected from the 1,000 largest US companies. VONV was launched on Sep 20, 2010 and is managed by Vanguard.

Further Reading

Before you consider Vanguard Russell 1000 Value, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vanguard Russell 1000 Value wasn't on the list.

While Vanguard Russell 1000 Value currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.