R Squared Ltd purchased a new position in shares of BHP Group Limited (NYSE:BHP - Free Report) during the 4th quarter, according to its most recent 13F filing with the SEC. The firm purchased 6,490 shares of the mining company's stock, valued at approximately $317,000.

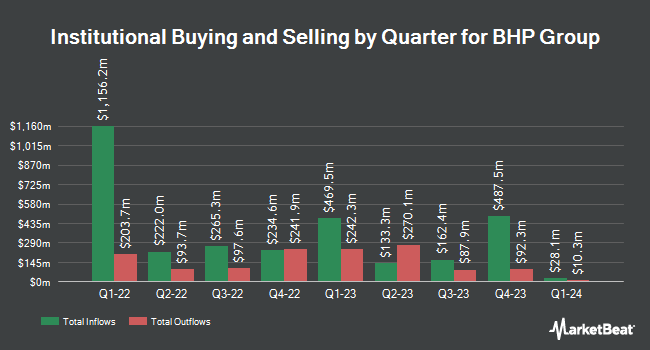

Several other hedge funds also recently made changes to their positions in BHP. Barclays PLC lifted its stake in BHP Group by 93.7% in the third quarter. Barclays PLC now owns 226,083 shares of the mining company's stock worth $14,042,000 after acquiring an additional 109,337 shares during the period. FMR LLC grew its holdings in shares of BHP Group by 10.0% during the third quarter. FMR LLC now owns 1,434,417 shares of the mining company's stock valued at $89,092,000 after buying an additional 129,908 shares during the last quarter. JPMorgan Chase & Co. increased its position in shares of BHP Group by 10.1% during the third quarter. JPMorgan Chase & Co. now owns 600,086 shares of the mining company's stock valued at $37,271,000 after acquiring an additional 55,095 shares in the last quarter. Charles Schwab Investment Management Inc. raised its holdings in shares of BHP Group by 17.4% during the third quarter. Charles Schwab Investment Management Inc. now owns 153,170 shares of the mining company's stock valued at $9,513,000 after purchasing an additional 22,677 shares during the last quarter. Finally, XY Capital Ltd lifted its holdings in shares of BHP Group by 503.6% during the 3rd quarter. XY Capital Ltd now owns 921,666 shares of the mining company's stock valued at $57,245,000 after buying an additional 768,972 shares during the period. 3.79% of the stock is owned by hedge funds and other institutional investors.

BHP Group Stock Down 1.3 %

BHP stock traded down $0.63 during trading on Friday, hitting $49.12. The company had a trading volume of 1,949,405 shares, compared to its average volume of 2,275,983. The company has a current ratio of 1.70, a quick ratio of 1.29 and a debt-to-equity ratio of 0.38. The company has a 50 day simple moving average of $50.28 and a 200-day simple moving average of $53.59. BHP Group Limited has a 52-week low of $48.06 and a 52-week high of $63.21.

Analyst Ratings Changes

Several analysts recently issued reports on BHP shares. StockNews.com lowered shares of BHP Group from a "strong-buy" rating to a "buy" rating in a research report on Friday. Jefferies Financial Group dropped their target price on shares of BHP Group from $57.00 to $53.00 and set a "hold" rating for the company in a research report on Monday, January 6th. Three analysts have rated the stock with a hold rating, three have given a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, BHP Group currently has a consensus rating of "Moderate Buy" and an average price target of $53.00.

Get Our Latest Stock Analysis on BHP

BHP Group Company Profile

(

Free Report)

BHP Group Limited operates as a resources company in Australia, Europe, China, Japan, India, South Korea, the rest of Asia, North America, South America, and internationally. The company operates through Copper, Iron Ore, and Coal segments. It engages in the mining of copper, uranium, gold, zinc, lead, molybdenum, silver, iron ore, cobalt, and metallurgical and energy coal.

Further Reading

Before you consider BHP Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BHP Group wasn't on the list.

While BHP Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.