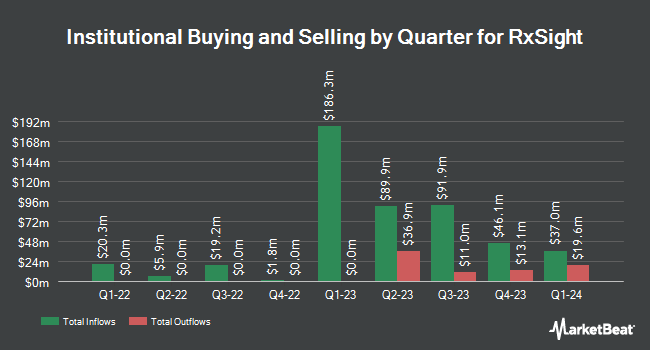

RA Capital Management L.P. boosted its holdings in shares of RxSight, Inc. (NASDAQ:RXST - Free Report) by 6.0% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 3,916,825 shares of the company's stock after buying an additional 222,000 shares during the quarter. RxSight makes up approximately 2.2% of RA Capital Management L.P.'s investment portfolio, making the stock its 12th biggest holding. RA Capital Management L.P. owned about 9.72% of RxSight worth $193,609,000 as of its most recent SEC filing.

A number of other large investors also recently bought and sold shares of RXST. Price T Rowe Associates Inc. MD lifted its position in shares of RxSight by 1.7% during the first quarter. Price T Rowe Associates Inc. MD now owns 60,908 shares of the company's stock valued at $3,143,000 after buying an additional 994 shares during the last quarter. California State Teachers Retirement System grew its stake in shares of RxSight by 6.8% during the first quarter. California State Teachers Retirement System now owns 27,052 shares of the company's stock worth $1,395,000 after acquiring an additional 1,733 shares during the last quarter. CWM LLC increased its holdings in shares of RxSight by 727.5% during the second quarter. CWM LLC now owns 422 shares of the company's stock valued at $25,000 after acquiring an additional 371 shares in the last quarter. SG Americas Securities LLC acquired a new stake in RxSight in the 2nd quarter worth approximately $3,754,000. Finally, M&G Plc grew its position in RxSight by 12.4% during the 2nd quarter. M&G Plc now owns 159,005 shares of the company's stock worth $9,540,000 after purchasing an additional 17,577 shares during the last quarter. Institutional investors own 78.78% of the company's stock.

Insider Buying and Selling at RxSight

In other RxSight news, Director Shweta Maniar sold 3,782 shares of RxSight stock in a transaction on Tuesday, November 26th. The stock was sold at an average price of $45.88, for a total value of $173,518.16. Following the sale, the director now owns 10,902 shares in the company, valued at $500,183.76. The trade was a 25.76 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Ilya Goldshleger sold 3,100 shares of the company's stock in a transaction dated Monday, November 18th. The shares were sold at an average price of $45.00, for a total transaction of $139,500.00. Following the completion of the transaction, the insider now directly owns 42,246 shares in the company, valued at $1,901,070. The trade was a 6.84 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 65,807 shares of company stock valued at $3,202,275 over the last quarter. 9.36% of the stock is currently owned by insiders.

Analyst Upgrades and Downgrades

A number of analysts have commented on RXST shares. Needham & Company LLC reaffirmed a "buy" rating and set a $66.00 price target on shares of RxSight in a research report on Friday, September 13th. Jefferies Financial Group assumed coverage on RxSight in a research report on Tuesday, October 29th. They issued a "buy" rating and a $72.00 target price on the stock. Seven analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, RxSight has a consensus rating of "Buy" and a consensus target price of $65.29.

View Our Latest Report on RxSight

RxSight Price Performance

NASDAQ RXST traded down $0.71 on Thursday, hitting $42.45. The company had a trading volume of 188,531 shares, compared to its average volume of 486,469. The company's fifty day moving average price is $48.25 and its 200-day moving average price is $51.87. The company has a market capitalization of $1.71 billion, a PE ratio of -51.55 and a beta of 1.11. RxSight, Inc. has a 12-month low of $32.88 and a 12-month high of $66.54.

RxSight Profile

(

Free Report)

RxSight, Inc, a commercial-stage medical device company, engages in the research and development, manufacture, and sale of light adjustable intraocular lenses (LAL) used in cataract surgery in the United States and internationally. It offers RxSight system that enables doctors to customize and enhance the visual acuity for patients after cataract surgery.

Read More

Before you consider RxSight, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RxSight wasn't on the list.

While RxSight currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.