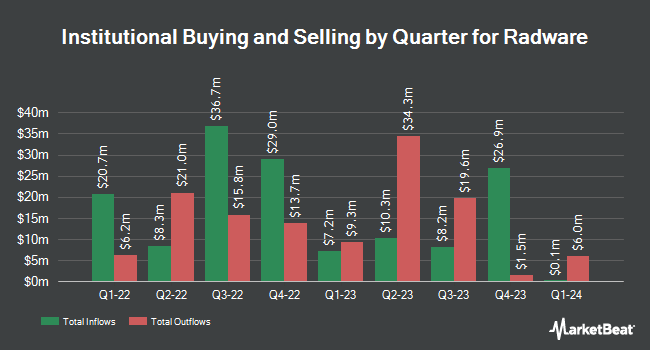

Magnetar Financial LLC reduced its position in shares of Radware Ltd. (NASDAQ:RDWR - Free Report) by 57.4% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 9,628 shares of the information technology services provider's stock after selling 12,998 shares during the period. Magnetar Financial LLC's holdings in Radware were worth $217,000 at the end of the most recent quarter.

Other institutional investors also recently bought and sold shares of the company. Algert Global LLC raised its position in shares of Radware by 15.9% during the 3rd quarter. Algert Global LLC now owns 19,043 shares of the information technology services provider's stock valued at $424,000 after buying an additional 2,610 shares during the period. BNP Paribas Financial Markets raised its position in Radware by 184.7% in the third quarter. BNP Paribas Financial Markets now owns 21,781 shares of the information technology services provider's stock valued at $485,000 after purchasing an additional 14,130 shares during the period. Capstone Investment Advisors LLC acquired a new position in shares of Radware in the 3rd quarter valued at $366,000. Verition Fund Management LLC grew its holdings in shares of Radware by 3.0% during the 3rd quarter. Verition Fund Management LLC now owns 16,084 shares of the information technology services provider's stock worth $358,000 after purchasing an additional 468 shares during the period. Finally, PDT Partners LLC increased its position in shares of Radware by 54.3% during the 3rd quarter. PDT Partners LLC now owns 49,495 shares of the information technology services provider's stock worth $1,103,000 after purchasing an additional 17,409 shares during the last quarter. 73.12% of the stock is owned by hedge funds and other institutional investors.

Radware Stock Performance

Shares of RDWR traded down $0.30 during midday trading on Thursday, hitting $22.53. 49,363 shares of the stock were exchanged, compared to its average volume of 198,799. Radware Ltd. has a 52-week low of $16.12 and a 52-week high of $25.00. The stock has a fifty day simple moving average of $22.51 and a 200 day simple moving average of $22.50. The firm has a market cap of $946.15 million, a P/E ratio of 160.94 and a beta of 0.95.

Radware (NASDAQ:RDWR - Get Free Report) last released its earnings results on Wednesday, February 12th. The information technology services provider reported $0.11 earnings per share for the quarter, missing the consensus estimate of $0.23 by ($0.12). Radware had a net margin of 2.20% and a return on equity of 3.81%. As a group, equities research analysts forecast that Radware Ltd. will post 0.28 EPS for the current fiscal year.

Wall Street Analyst Weigh In

Separately, Needham & Company LLC reaffirmed a "hold" rating on shares of Radware in a research note on Friday, February 14th.

Get Our Latest Research Report on RDWR

Radware Profile

(

Free Report)

Radware Ltd., together with its subsidiaries, develops, manufactures, and markets cyber security and application delivery solutions for cloud, on-premises, and software defined data centers worldwide. The company operates in two segments, Radware's Core Business and The Hawks' Business. It offers DefensePro provides automated DDoS protection; Radware Kubernetes, a web application firewall solution; and Cyber Controller, a unified solution for management, configuration, and attack lifecycle.

Featured Stories

Before you consider Radware, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Radware wasn't on the list.

While Radware currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 best stocks to own in Spring 2025, carefully selected for their growth potential amid market volatility. This exclusive report highlights top companies poised to thrive in uncertain economic conditions—download now to gain an investing edge.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.