Raelipskie Partnership acquired a new stake in Union Pacific Co. (NYSE:UNP - Free Report) in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm acquired 3,845 shares of the railroad operator's stock, valued at approximately $948,000.

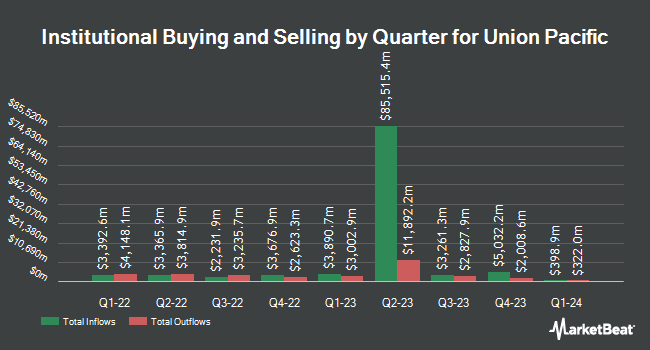

A number of other institutional investors and hedge funds have also made changes to their positions in UNP. RFG Advisory LLC grew its stake in shares of Union Pacific by 0.9% during the second quarter. RFG Advisory LLC now owns 6,601 shares of the railroad operator's stock worth $1,493,000 after purchasing an additional 61 shares in the last quarter. Sequoia Financial Advisors LLC increased its holdings in shares of Union Pacific by 12.9% in the 2nd quarter. Sequoia Financial Advisors LLC now owns 20,137 shares of the railroad operator's stock valued at $4,556,000 after acquiring an additional 2,305 shares during the last quarter. Wedmont Private Capital raised its position in shares of Union Pacific by 23.9% during the 2nd quarter. Wedmont Private Capital now owns 4,281 shares of the railroad operator's stock worth $986,000 after acquiring an additional 827 shares in the last quarter. Gemmer Asset Management LLC purchased a new stake in Union Pacific during the second quarter worth approximately $222,000. Finally, Burke & Herbert Bank & Trust Co. boosted its holdings in Union Pacific by 105.1% in the second quarter. Burke & Herbert Bank & Trust Co. now owns 2,693 shares of the railroad operator's stock valued at $609,000 after purchasing an additional 1,380 shares in the last quarter. 80.38% of the stock is owned by institutional investors and hedge funds.

Union Pacific Price Performance

Union Pacific stock traded down $0.03 during trading hours on Monday, hitting $233.54. The stock had a trading volume of 3,065,255 shares, compared to its average volume of 2,336,226. The company has a debt-to-equity ratio of 1.79, a current ratio of 0.77 and a quick ratio of 0.63. The stock's fifty day moving average is $239.22 and its two-hundred day moving average is $238.29. Union Pacific Co. has a 1-year low of $218.55 and a 1-year high of $258.66. The stock has a market capitalization of $141.59 billion, a price-to-earnings ratio of 21.45, a PEG ratio of 2.31 and a beta of 1.05.

Union Pacific (NYSE:UNP - Get Free Report) last released its quarterly earnings results on Thursday, October 24th. The railroad operator reported $2.75 earnings per share for the quarter, missing analysts' consensus estimates of $2.78 by ($0.03). The company had revenue of $6.09 billion during the quarter, compared to analyst estimates of $6.14 billion. Union Pacific had a return on equity of 41.79% and a net margin of 27.33%. The business's revenue was up 2.5% compared to the same quarter last year. During the same period last year, the firm earned $2.51 earnings per share. As a group, analysts predict that Union Pacific Co. will post 10.94 earnings per share for the current fiscal year.

Union Pacific Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Monday, December 30th. Shareholders of record on Monday, December 9th will be paid a dividend of $1.34 per share. This represents a $5.36 dividend on an annualized basis and a dividend yield of 2.30%. The ex-dividend date is Monday, December 9th. Union Pacific's dividend payout ratio is presently 49.22%.

Analysts Set New Price Targets

Several analysts have recently weighed in on UNP shares. Robert W. Baird reduced their price objective on shares of Union Pacific from $270.00 to $260.00 and set an "outperform" rating for the company in a research report on Friday, October 25th. Citigroup boosted their price target on shares of Union Pacific from $255.00 to $267.00 and gave the company a "neutral" rating in a research report on Tuesday, November 12th. Susquehanna dropped their price objective on Union Pacific from $260.00 to $255.00 and set a "neutral" rating on the stock in a report on Friday, October 25th. Stifel Nicolaus reduced their target price on Union Pacific from $265.00 to $262.00 and set a "buy" rating for the company in a report on Friday, October 25th. Finally, JPMorgan Chase & Co. cut their price target on Union Pacific from $263.00 to $252.00 and set a "neutral" rating on the stock in a research report on Friday, October 25th. Nine investment analysts have rated the stock with a hold rating, eleven have issued a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, Union Pacific has an average rating of "Moderate Buy" and a consensus price target of $259.80.

Read Our Latest Analysis on Union Pacific

About Union Pacific

(

Free Report)

Union Pacific Corporation, through its subsidiary, Union Pacific Railroad Company, operates in the railroad business in the United States. The company offers transportation services for grain and grain products, fertilizers, food and refrigerated products, and coal and renewables to grain processors, animal feeders, ethanol producers, renewable biofuel producers, and other agricultural users; and construction products, industrial chemicals, plastics, forest products, specialized products, metals and ores, petroleum, liquid petroleum gases, soda ash, and sand, as well as finished automobiles, automotive parts, and merchandise in intermodal containers.

Featured Stories

Before you consider Union Pacific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Union Pacific wasn't on the list.

While Union Pacific currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.