Range Resources (NYSE:RRC - Get Free Report) was upgraded by analysts at UBS Group from a "sell" rating to a "neutral" rating in a research note issued to investors on Monday, Marketbeat.com reports. The brokerage presently has a $35.00 target price on the oil and gas exploration company's stock. UBS Group's price objective points to a potential upside of 2.49% from the company's previous close.

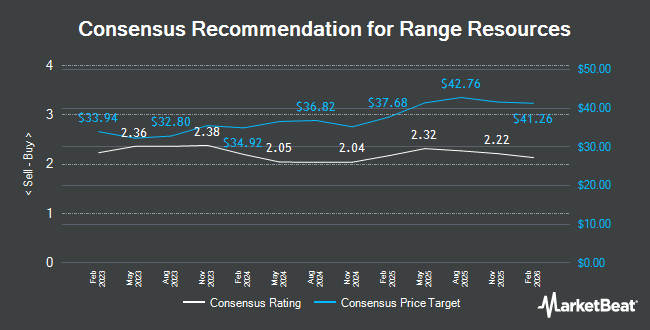

A number of other analysts have also recently weighed in on RRC. Royal Bank of Canada raised their price objective on shares of Range Resources from $35.00 to $40.00 and gave the stock a "sector perform" rating in a report on Monday, November 25th. Piper Sandler cut their price objective on shares of Range Resources from $31.00 to $30.00 and set a "neutral" rating on the stock in a report on Monday, November 18th. Bank of America began coverage on shares of Range Resources in a report on Monday, October 28th. They set a "neutral" rating and a $34.00 price objective on the stock. Benchmark reaffirmed a "hold" rating on shares of Range Resources in a report on Wednesday, October 23rd. Finally, Citigroup lifted their target price on shares of Range Resources from $33.00 to $38.00 and gave the company a "neutral" rating in a report on Friday. Three investment analysts have rated the stock with a sell rating, thirteen have issued a hold rating and five have issued a buy rating to the company. According to MarketBeat.com, Range Resources has an average rating of "Hold" and an average price target of $35.50.

Get Our Latest Stock Report on Range Resources

Range Resources Stock Up 1.2 %

Shares of NYSE RRC traded up $0.40 during midday trading on Monday, hitting $34.15. The company's stock had a trading volume of 2,160,209 shares, compared to its average volume of 2,337,662. The business's fifty day simple moving average is $32.57 and its two-hundred day simple moving average is $32.41. The company has a debt-to-equity ratio of 0.28, a current ratio of 0.54 and a quick ratio of 0.54. Range Resources has a 1 year low of $27.29 and a 1 year high of $39.33. The firm has a market capitalization of $8.24 billion, a price-to-earnings ratio of 17.05 and a beta of 1.85.

Range Resources (NYSE:RRC - Get Free Report) last issued its earnings results on Tuesday, October 22nd. The oil and gas exploration company reported $0.48 earnings per share for the quarter, beating the consensus estimate of $0.32 by $0.16. The firm had revenue of $615.03 million for the quarter, compared to analysts' expectations of $617.90 million. Range Resources had a net margin of 17.63% and a return on equity of 13.69%. The firm's revenue was up .9% compared to the same quarter last year. During the same quarter last year, the company earned $0.43 earnings per share. On average, equities analysts predict that Range Resources will post 1.9 EPS for the current year.

Insider Activity at Range Resources

In other news, Director Charles G. Griffie bought 1,275 shares of the firm's stock in a transaction dated Thursday, October 24th. The stock was acquired at an average price of $31.46 per share, for a total transaction of $40,111.50. Following the acquisition, the director now owns 5,921 shares of the company's stock, valued at $186,274.66. This trade represents a 27.44 % increase in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this link. Also, VP Ashley Kavanaugh sold 12,700 shares of the business's stock in a transaction dated Monday, September 23rd. The stock was sold at an average price of $31.45, for a total value of $399,415.00. Following the sale, the vice president now owns 9,670 shares of the company's stock, valued at $304,121.50. The trade was a 56.77 % decrease in their position. The disclosure for this sale can be found here. 2.50% of the stock is currently owned by corporate insiders.

Institutional Trading of Range Resources

A number of institutional investors have recently modified their holdings of RRC. Brooklyn Investment Group purchased a new position in Range Resources in the 3rd quarter worth approximately $25,000. Blue Trust Inc. boosted its holdings in Range Resources by 107.8% in the 3rd quarter. Blue Trust Inc. now owns 1,359 shares of the oil and gas exploration company's stock worth $46,000 after acquiring an additional 705 shares during the period. Bogart Wealth LLC purchased a new position in Range Resources in the 3rd quarter worth approximately $49,000. Fifth Third Bancorp boosted its holdings in Range Resources by 21.2% in the 2nd quarter. Fifth Third Bancorp now owns 1,709 shares of the oil and gas exploration company's stock worth $57,000 after acquiring an additional 299 shares during the period. Finally, International Assets Investment Management LLC purchased a new position in Range Resources in the 2nd quarter worth approximately $67,000. Hedge funds and other institutional investors own 98.93% of the company's stock.

Range Resources Company Profile

(

Get Free Report)

Range Resources Corporation operates as an independent natural gas, natural gas liquids (NGLs), crude oil, and condensate company in the United States. The company engages in the exploration, development, and acquisition of natural gas and crude oil properties located in the Appalachian region. It sells natural gas to utilities, marketing and midstream companies, and industrial users; NGLs to petrochemical end users, marketers/traders, and natural gas processors; and oil and condensate to crude oil processors, transporters, and refining and marketing companies.

Featured Articles

Before you consider Range Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Range Resources wasn't on the list.

While Range Resources currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.