Range Resources (NYSE:RRC - Get Free Report) was upgraded by investment analysts at Morgan Stanley from an "underweight" rating to an "equal weight" rating in a research report issued to clients and investors on Wednesday, MarketBeat.com reports. The brokerage presently has a $49.00 price objective on the oil and gas exploration company's stock, up from their previous price objective of $40.00. Morgan Stanley's price objective would suggest a potential upside of 25.03% from the stock's previous close.

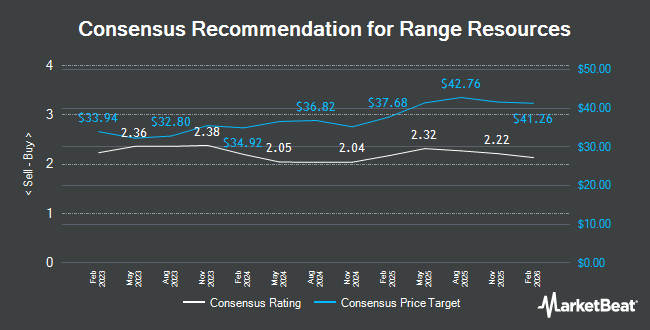

Several other research analysts have also issued reports on RRC. Truist Financial raised their price target on Range Resources from $35.00 to $37.00 and gave the stock a "hold" rating in a research report on Monday, March 17th. Benchmark restated a "hold" rating on shares of Range Resources in a report on Friday, January 17th. Piper Sandler upped their price target on Range Resources from $32.00 to $33.00 and gave the company a "neutral" rating in a research note on Thursday, March 6th. Wells Fargo & Company lifted their price objective on shares of Range Resources from $38.00 to $40.00 and gave the stock an "overweight" rating in a research note on Tuesday, December 17th. Finally, Stephens boosted their price objective on shares of Range Resources from $43.00 to $44.00 and gave the company an "overweight" rating in a report on Wednesday, February 26th. One investment analyst has rated the stock with a sell rating, thirteen have given a hold rating and six have issued a buy rating to the company. According to data from MarketBeat, the stock has an average rating of "Hold" and an average price target of $40.89.

Read Our Latest Research Report on RRC

Range Resources Trading Up 1.0 %

RRC stock traded up $0.40 during midday trading on Wednesday, reaching $39.19. The stock had a trading volume of 1,982,225 shares, compared to its average volume of 2,351,871. The firm has a market cap of $9.46 billion, a price-to-earnings ratio of 19.79, a PEG ratio of 5.11 and a beta of 1.80. Range Resources has a twelve month low of $27.29 and a twelve month high of $41.95. The company has a quick ratio of 0.54, a current ratio of 0.54 and a debt-to-equity ratio of 0.28. The business has a fifty day simple moving average of $38.52 and a two-hundred day simple moving average of $35.17.

Range Resources (NYSE:RRC - Get Free Report) last issued its quarterly earnings results on Tuesday, February 25th. The oil and gas exploration company reported $0.68 EPS for the quarter, topping the consensus estimate of $0.55 by $0.13. Range Resources had a net margin of 17.63% and a return on equity of 13.69%. The company had revenue of $626.42 million during the quarter, compared to analysts' expectations of $676.53 million. During the same quarter in the previous year, the company earned $0.63 EPS. As a group, research analysts expect that Range Resources will post 2.02 EPS for the current fiscal year.

Institutional Trading of Range Resources

A number of institutional investors have recently made changes to their positions in the business. JPMorgan Chase & Co. lifted its position in Range Resources by 61.9% during the 3rd quarter. JPMorgan Chase & Co. now owns 1,579,579 shares of the oil and gas exploration company's stock worth $48,588,000 after buying an additional 604,199 shares in the last quarter. Oppenheimer Asset Management Inc. acquired a new position in shares of Range Resources during the 4th quarter worth approximately $380,000. HITE Hedge Asset Management LLC bought a new stake in shares of Range Resources during the 3rd quarter worth approximately $11,508,000. Calamos Advisors LLC acquired a new stake in shares of Range Resources in the 4th quarter valued at approximately $567,000. Finally, Radnor Capital Management LLC grew its stake in shares of Range Resources by 156.2% in the fourth quarter. Radnor Capital Management LLC now owns 42,993 shares of the oil and gas exploration company's stock valued at $1,547,000 after buying an additional 26,213 shares in the last quarter. Institutional investors own 98.93% of the company's stock.

Range Resources Company Profile

(

Get Free Report)

Range Resources Corporation operates as an independent natural gas, natural gas liquids (NGLs), crude oil, and condensate company in the United States. The company engages in the exploration, development, and acquisition of natural gas and crude oil properties located in the Appalachian region. It sells natural gas to utilities, marketing and midstream companies, and industrial users; NGLs to petrochemical end users, marketers/traders, and natural gas processors; and oil and condensate to crude oil processors, transporters, and refining and marketing companies.

Featured Stories

Before you consider Range Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Range Resources wasn't on the list.

While Range Resources currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.