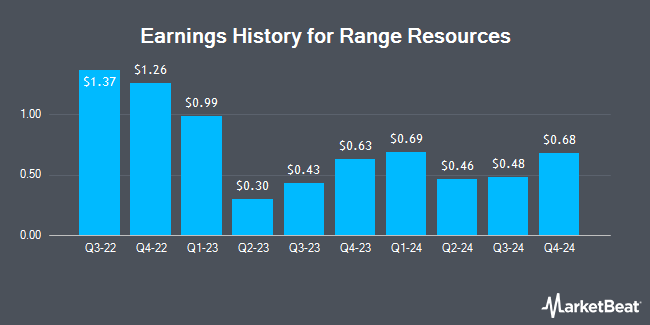

Range Resources (NYSE:RRC - Get Free Report) is anticipated to issue its quarterly earnings data after the market closes on Tuesday, February 25th. Analysts expect the company to announce earnings of $0.55 per share and revenue of $676.53 million for the quarter. Parties interested in listening to the company's conference call can do so using this link.

Range Resources Trading Down 3.0 %

NYSE:RRC traded down $1.20 during mid-day trading on Friday, reaching $38.47. 2,130,683 shares of the company's stock traded hands, compared to its average volume of 2,566,338. Range Resources has a 12-month low of $27.29 and a 12-month high of $41.95. The firm has a market capitalization of $9.28 billion, a price-to-earnings ratio of 19.43, a PEG ratio of 5.14 and a beta of 1.77. The company has a debt-to-equity ratio of 0.28, a current ratio of 0.54 and a quick ratio of 0.54. The company has a 50 day moving average price of $37.52 and a 200-day moving average price of $33.57.

Range Resources Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Friday, December 27th. Investors of record on Friday, December 13th were issued a dividend of $0.08 per share. The ex-dividend date was Friday, December 13th. This represents a $0.32 dividend on an annualized basis and a yield of 0.83%. Range Resources's dividend payout ratio is presently 16.16%.

Analyst Upgrades and Downgrades

RRC has been the topic of a number of research analyst reports. Citigroup boosted their price target on Range Resources from $33.00 to $38.00 and gave the company a "neutral" rating in a report on Friday, December 6th. StockNews.com upgraded Range Resources to a "sell" rating in a report on Wednesday, November 27th. Wolfe Research upgraded Range Resources from a "peer perform" rating to an "outperform" rating and set a $42.00 target price on the stock in a report on Friday, January 3rd. The Goldman Sachs Group upped their target price on Range Resources from $39.00 to $43.00 and gave the stock a "neutral" rating in a report on Wednesday, February 12th. Finally, Wells Fargo & Company upped their target price on Range Resources from $38.00 to $40.00 and gave the stock an "overweight" rating in a report on Tuesday, December 17th. Three equities research analysts have rated the stock with a sell rating, eleven have issued a hold rating and six have given a buy rating to the company. According to MarketBeat.com, the company has a consensus rating of "Hold" and an average target price of $38.78.

View Our Latest Research Report on RRC

Range Resources Company Profile

(

Get Free Report)

Range Resources Corporation operates as an independent natural gas, natural gas liquids (NGLs), crude oil, and condensate company in the United States. The company engages in the exploration, development, and acquisition of natural gas and crude oil properties located in the Appalachian region. It sells natural gas to utilities, marketing and midstream companies, and industrial users; NGLs to petrochemical end users, marketers/traders, and natural gas processors; and oil and condensate to crude oil processors, transporters, and refining and marketing companies.

Featured Stories

Before you consider Range Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Range Resources wasn't on the list.

While Range Resources currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.