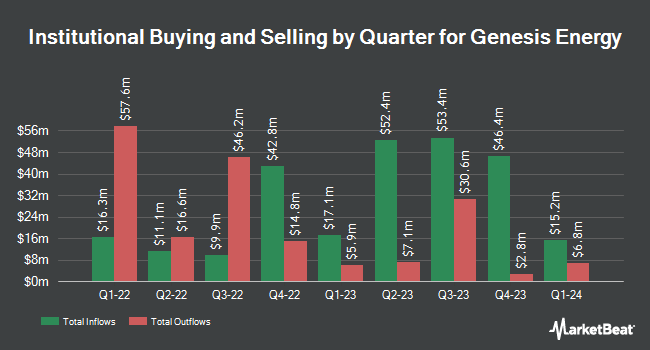

Rangeley Capital LLC acquired a new stake in Genesis Energy, L.P. (NYSE:GEL - Free Report) in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor acquired 211,000 shares of the pipeline company's stock, valued at approximately $2,133,000. Genesis Energy comprises about 1.9% of Rangeley Capital LLC's portfolio, making the stock its 18th largest position. Rangeley Capital LLC owned approximately 0.17% of Genesis Energy at the end of the most recent quarter.

Other institutional investors have also bought and sold shares of the company. JPMorgan Chase & Co. boosted its position in shares of Genesis Energy by 9.9% during the 4th quarter. JPMorgan Chase & Co. now owns 4,665,597 shares of the pipeline company's stock valued at $47,169,000 after acquiring an additional 418,555 shares during the last quarter. Chickasaw Capital Management LLC boosted its holdings in Genesis Energy by 0.4% in the 4th quarter. Chickasaw Capital Management LLC now owns 3,835,449 shares of the pipeline company's stock valued at $38,776,000 after purchasing an additional 15,027 shares during the last quarter. ING Groep NV grew its stake in shares of Genesis Energy by 12.1% in the 4th quarter. ING Groep NV now owns 855,000 shares of the pipeline company's stock valued at $8,644,000 after buying an additional 92,300 shares during the period. Manning & Napier Advisors LLC grew its stake in shares of Genesis Energy by 40.0% in the 4th quarter. Manning & Napier Advisors LLC now owns 350,000 shares of the pipeline company's stock valued at $3,538,000 after buying an additional 100,000 shares during the period. Finally, Tejara Capital Ltd acquired a new stake in shares of Genesis Energy during the 4th quarter worth approximately $3,205,000. 66.82% of the stock is owned by hedge funds and other institutional investors.

Genesis Energy Trading Down 4.0 %

Shares of GEL stock traded down $0.53 during trading hours on Monday, hitting $12.75. The company had a trading volume of 597,134 shares, compared to its average volume of 489,058. The company has a debt-to-equity ratio of 5.13, a current ratio of 1.03 and a quick ratio of 0.91. The stock has a market capitalization of $1.56 billion, a PE ratio of -10.42 and a beta of 1.39. The company's fifty day moving average is $12.90 and its 200 day moving average is $12.09. Genesis Energy, L.P. has a fifty-two week low of $9.86 and a fifty-two week high of $16.44.

Genesis Energy (NYSE:GEL - Get Free Report) last announced its earnings results on Thursday, February 13th. The pipeline company reported ($0.58) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.05) by ($0.53). Genesis Energy had a negative net margin of 2.16% and a negative return on equity of 7.71%. The firm had revenue of $725.55 million during the quarter.

Genesis Energy Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, February 14th. Investors of record on Friday, January 31st were issued a dividend of $0.165 per share. This represents a $0.66 dividend on an annualized basis and a yield of 5.18%. The ex-dividend date was Friday, January 31st. Genesis Energy's dividend payout ratio (DPR) is -53.23%.

Wall Street Analysts Forecast Growth

Several research analysts recently weighed in on the company. Royal Bank of Canada increased their price objective on Genesis Energy from $14.00 to $15.00 and gave the stock an "outperform" rating in a research report on Monday, March 17th. Wells Fargo & Company raised Genesis Energy from an "equal weight" rating to an "overweight" rating and upped their price target for the company from $15.00 to $18.00 in a research note on Monday, March 17th.

Check Out Our Latest Analysis on GEL

Genesis Energy Profile

(

Free Report)

Genesis Energy, L.P. provides integrated suite of midstream services in crude oil and natural gas industry in the United States. It operates through Offshore Pipeline Transportation, Soda and Sulfur Services, Marine Transportation, and Onshore Facilities and Transportation segments. The Offshore Pipeline Transportation segment engages in offshore crude oil and natural gas pipeline transportation and handling operations, as well as deep water pipeline servicing.

Featured Articles

Before you consider Genesis Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genesis Energy wasn't on the list.

While Genesis Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.