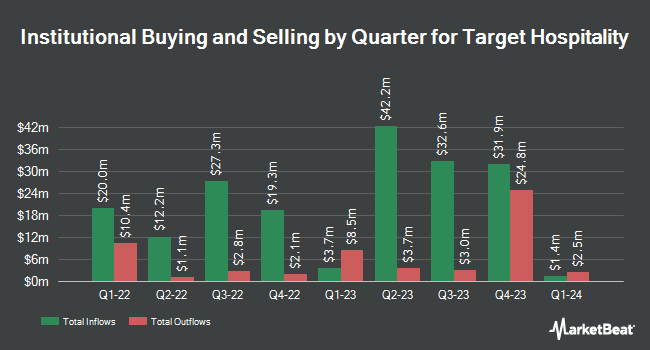

Rangeley Capital LLC acquired a new stake in shares of Target Hospitality Corp. (NASDAQ:TH - Free Report) in the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund acquired 144,300 shares of the company's stock, valued at approximately $1,395,000. Target Hospitality accounts for approximately 1.3% of Rangeley Capital LLC's investment portfolio, making the stock its 22nd biggest position. Rangeley Capital LLC owned 0.15% of Target Hospitality as of its most recent SEC filing.

Several other large investors have also recently bought and sold shares of the company. AlphaQuest LLC raised its stake in shares of Target Hospitality by 275.9% in the 4th quarter. AlphaQuest LLC now owns 4,578 shares of the company's stock valued at $44,000 after purchasing an additional 3,360 shares during the period. Intech Investment Management LLC acquired a new position in Target Hospitality during the third quarter worth $87,000. Maridea Wealth Management LLC bought a new position in Target Hospitality in the fourth quarter valued at $103,000. Fox Run Management L.L.C. increased its stake in Target Hospitality by 17.6% in the 4th quarter. Fox Run Management L.L.C. now owns 14,473 shares of the company's stock valued at $140,000 after buying an additional 2,161 shares during the last quarter. Finally, SG Americas Securities LLC increased its stake in Target Hospitality by 16.3% in the 4th quarter. SG Americas Securities LLC now owns 16,110 shares of the company's stock valued at $156,000 after buying an additional 2,262 shares during the last quarter. Institutional investors own 32.40% of the company's stock.

Analyst Upgrades and Downgrades

TH has been the topic of a number of recent research reports. Stifel Nicolaus lifted their target price on Target Hospitality from $5.00 to $7.50 and gave the company a "hold" rating in a research report on Monday, March 31st. Northland Capmk raised Target Hospitality from a "hold" rating to a "strong-buy" rating in a research report on Wednesday, January 29th. Finally, Northland Securities raised Target Hospitality from a "market perform" rating to an "outperform" rating and increased their price objective for the company from $11.00 to $15.00 in a report on Wednesday, January 29th.

Check Out Our Latest Analysis on TH

Target Hospitality Stock Performance

Shares of NASDAQ TH traded up $0.18 during trading hours on Tuesday, reaching $6.58. 92,686 shares of the stock were exchanged, compared to its average volume of 596,287. The firm has a market capitalization of $651.03 million, a price-to-earnings ratio of 7.56, a P/E/G ratio of 1.81 and a beta of 1.70. The stock's fifty day simple moving average is $7.28 and its 200 day simple moving average is $8.21. Target Hospitality Corp. has a 52 week low of $4.00 and a 52 week high of $11.84.

Target Hospitality (NASDAQ:TH - Get Free Report) last posted its quarterly earnings data on Wednesday, March 26th. The company reported $0.12 earnings per share for the quarter, topping the consensus estimate of $0.06 by $0.06. The firm had revenue of $83.70 million for the quarter, compared to analysts' expectations of $80.10 million. Target Hospitality had a return on equity of 22.80% and a net margin of 20.84%. The company's quarterly revenue was down 33.7% compared to the same quarter last year. During the same quarter last year, the business earned $0.29 EPS. Research analysts predict that Target Hospitality Corp. will post 0.65 EPS for the current fiscal year.

Target Hospitality Profile

(

Free Report)

Target Hospitality Corp. operates as a specialty rental and hospitality services company in North America. The company operates through two segments, Hospitality & Facilities Services - South and Government. It owns a network of specialty rental accommodation units. In addition, the company provides catering and food, maintenance, housekeeping, grounds-keeping, security, health and recreation facilities, workforce community management, concierge, and laundry services.

Recommended Stories

Before you consider Target Hospitality, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Target Hospitality wasn't on the list.

While Target Hospitality currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.