Rangeley Capital LLC purchased a new stake in shares of Ponce Financial Group, Inc. (NASDAQ:PDLB - Free Report) in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm purchased 46,000 shares of the company's stock, valued at approximately $598,000. Rangeley Capital LLC owned about 0.19% of Ponce Financial Group as of its most recent SEC filing.

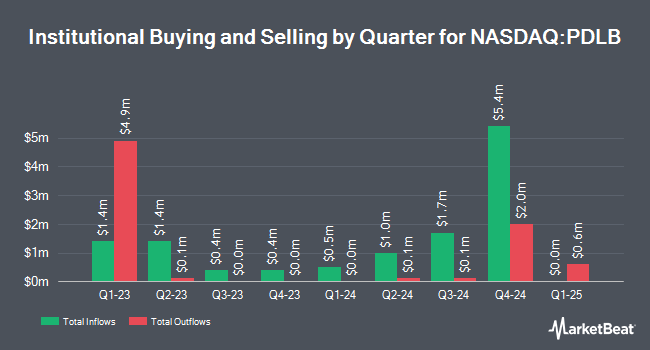

A number of other institutional investors also recently modified their holdings of the company. American Capital Advisory LLC grew its stake in shares of Ponce Financial Group by 150.0% during the fourth quarter. American Capital Advisory LLC now owns 2,500 shares of the company's stock worth $32,000 after purchasing an additional 1,500 shares during the period. SG Americas Securities LLC bought a new stake in Ponce Financial Group in the fourth quarter valued at approximately $115,000. American Century Companies Inc. lifted its holdings in Ponce Financial Group by 8.2% during the 4th quarter. American Century Companies Inc. now owns 14,419 shares of the company's stock valued at $187,000 after purchasing an additional 1,096 shares during the last quarter. Trexquant Investment LP grew its stake in Ponce Financial Group by 82.4% in the 4th quarter. Trexquant Investment LP now owns 19,272 shares of the company's stock valued at $251,000 after buying an additional 8,707 shares during the last quarter. Finally, Barclays PLC increased its stake in shares of Ponce Financial Group by 267.8% during the third quarter. Barclays PLC now owns 25,370 shares of the company's stock worth $297,000 after purchasing an additional 18,472 shares during the period. Institutional investors own 64.35% of the company's stock.

Ponce Financial Group Price Performance

Shares of PDLB stock traded up $0.18 during trading on Tuesday, hitting $11.53. The company had a trading volume of 24,650 shares, compared to its average volume of 48,198. The stock's 50-day moving average price is $12.99 and its 200 day moving average price is $12.61. Ponce Financial Group, Inc. has a one year low of $7.89 and a one year high of $13.97. The company has a debt-to-equity ratio of 2.08, a quick ratio of 1.26 and a current ratio of 1.26. The firm has a market capitalization of $276.21 million, a P/E ratio of 24.66 and a beta of 0.50.

Ponce Financial Group (NASDAQ:PDLB - Get Free Report) last issued its quarterly earnings results on Tuesday, February 4th. The company reported $0.12 EPS for the quarter, beating analysts' consensus estimates of $0.09 by $0.03. Ponce Financial Group had a net margin of 6.46% and a return on equity of 4.01%. Equities analysts expect that Ponce Financial Group, Inc. will post 0.39 EPS for the current fiscal year.

Ponce Financial Group Company Profile

(

Free Report)

Ponce Financial Group, Inc operates as the bank holding company for Ponce Bank that provides various banking products and services. It offers various deposit products, including demand accounts, NOW/IOLA, money market, reciprocal deposits, savings accounts, and certificates of deposit to individuals, business entities, and non-profit organizations, as well as individual retirement accounts.

Featured Articles

Before you consider Ponce Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ponce Financial Group wasn't on the list.

While Ponce Financial Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.