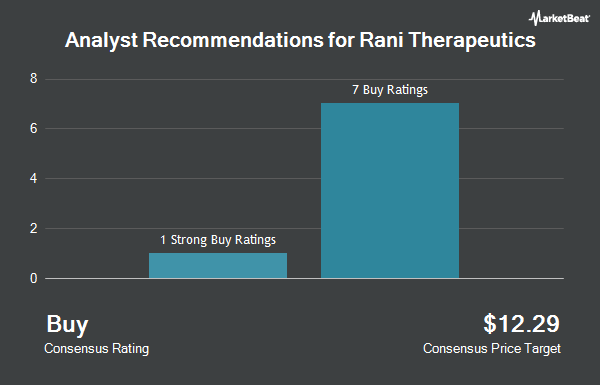

Rani Therapeutics Holdings, Inc. (NASDAQ:RANI - Get Free Report) has received a consensus recommendation of "Buy" from the six analysts that are presently covering the firm, MarketBeat reports. Five research analysts have rated the stock with a buy recommendation and one has assigned a strong buy recommendation to the company. The average 12-month price objective among brokerages that have covered the stock in the last year is $12.33.

Separately, HC Wainwright restated a "buy" rating and issued a $9.00 price objective on shares of Rani Therapeutics in a research report on Friday.

View Our Latest Stock Analysis on Rani Therapeutics

Insider Buying and Selling at Rani Therapeutics

In other Rani Therapeutics news, insider Kate Mckinley acquired 17,960 shares of the stock in a transaction dated Friday, December 13th. The stock was purchased at an average cost of $1.67 per share, for a total transaction of $29,993.20. Following the acquisition, the insider now owns 17,960 shares in the company, valued at $29,993.20. The trade was a ∞ increase in their position. The acquisition was disclosed in a legal filing with the SEC, which is available at this link. 53.30% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On Rani Therapeutics

Hedge funds have recently made changes to their positions in the business. Marshall Wace LLP bought a new stake in shares of Rani Therapeutics in the 2nd quarter worth approximately $81,000. Janney Montgomery Scott LLC purchased a new position in shares of Rani Therapeutics in the fourth quarter worth $37,000. Virtu Financial LLC purchased a new position in shares of Rani Therapeutics in the fourth quarter worth $62,000. King Luther Capital Management Corp increased its stake in shares of Rani Therapeutics by 44.5% in the third quarter. King Luther Capital Management Corp now owns 81,129 shares of the company's stock worth $175,000 after buying an additional 25,000 shares during the period. Finally, Geode Capital Management LLC increased its stake in shares of Rani Therapeutics by 14.3% in the third quarter. Geode Capital Management LLC now owns 172,261 shares of the company's stock worth $372,000 after buying an additional 21,527 shares during the period. 30.19% of the stock is currently owned by institutional investors.

Rani Therapeutics Price Performance

Shares of RANI stock traded down $0.01 during trading hours on Friday, reaching $1.41. The stock had a trading volume of 692,358 shares, compared to its average volume of 1,641,430. The stock's fifty day simple moving average is $1.49 and its 200 day simple moving average is $2.13. The company has a current ratio of 1.60, a quick ratio of 1.60 and a debt-to-equity ratio of 2.34. Rani Therapeutics has a 12 month low of $1.24 and a 12 month high of $8.75. The firm has a market capitalization of $80.78 million, a PE ratio of -1.33 and a beta of 0.16.

About Rani Therapeutics

(

Get Free ReportRani Therapeutics Holdings, Inc operates as a clinical stage biotherapeutics company that develops orally administered biologics for patients, physicians, and healthcare systems in the United States. The company develops the RaniPill capsule, a drug-agnostic oral delivery platform to deliver a variety of drug substances, including oligonucleotides, peptides, proteins, and antibodies.

Recommended Stories

Before you consider Rani Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rani Therapeutics wasn't on the list.

While Rani Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.